Ok, let's be real: this market is a sick puppy, and will be so for most of 2019, unless there is a vast improvement in the political environment & conduct of negotiations etc.

Fundamentals are still fairly strong, the FED will back off the hike plan with dovish cooing today from Powell, and the Shutdown & Trade Talks are all artificial problems that can be solved in a day or two or three.

However, the market has been spooked with fear and panic permeating almost every market in the world.

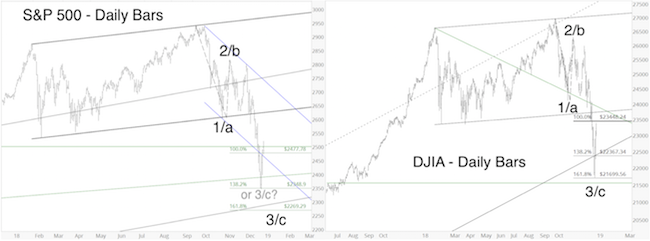

There has been a complex bottoming process since the December low. In terms of my TA analysis, the market will go up unless that low is taken out. Also, the bad news & instability have already been priced into the markets.

Either the market now bounces 10% or more now or only up to the previous swing hi at SPX 2520 and then back down again to retest that critical December low.

My opinion: EPIC bounce to SPX 2700 or higher

If that fails, SPX 2250/60 will be the next major target if SPX 2350 is taken out.

Lower than expected Q4 earnings or warnings will kill this wannabe bounce!

https://macromon.wor...0-key-levels-5/