Let’s start with the ugly:

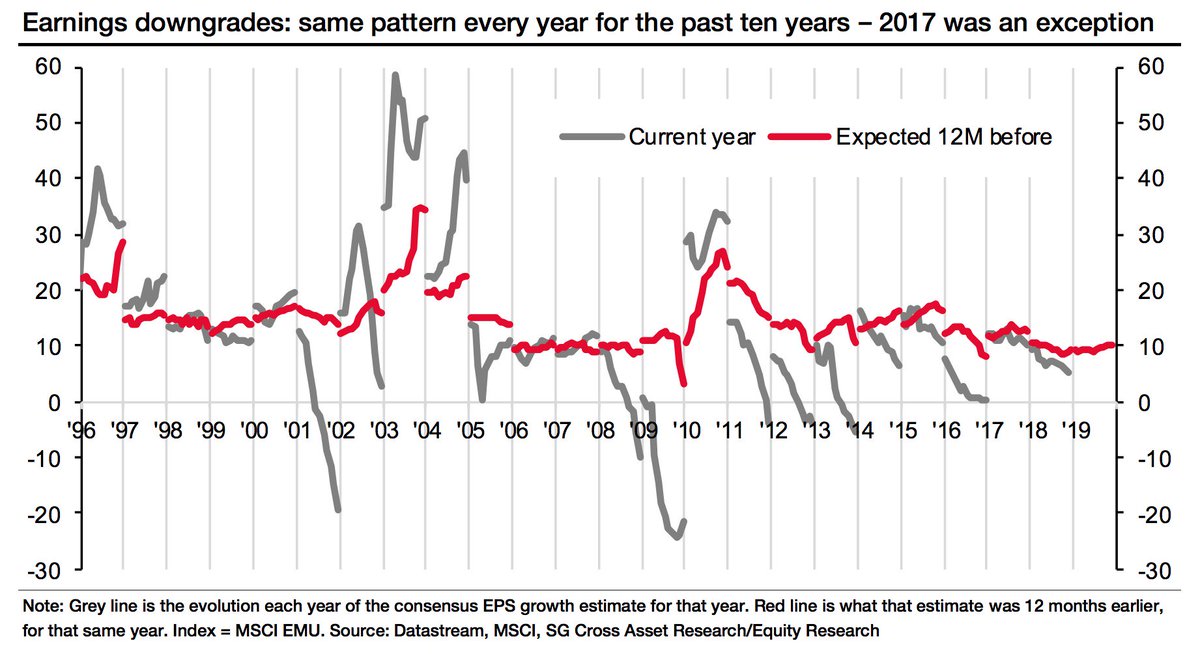

The biggest risk for investors: That it’s different this time and not in a good way. Why different? Because we are facing the prospect of a major market top in place and a coming recession, but this time central bankers have a lot less ammunition at their disposal compared to the end of previous economic cycles while debt is higher than ever by far. Here we are 10 years into an expansion and global growth has been slowing dramatically and markets are highly stressed.

The ECB is still on negative interest rates, the BOJ is still printing and the US Fed, instead of taking advantage of the opportunity during the growth recovery, embarked on its slowest rate hike cycle in history. During Janet Yellen’s tenure the Fed tinkered much too cautiously missing their opportunity to build a larger buffer to deal with the next downturn. Only 3 months after confidently projecting a 4 rate hike schedule for 2019 recent market turmoil already caused Fed Chair Jerome Powell to cave and send dovish jawboning signals to markets last Friday, the timing of which is following the historic script I outlined in The Ugly Truth.

In my December warning I outlined 6 specific signs to watch out for, one of which was the bull market trend line. That trend line broke in December along with numerous others I highlighted in Shattered Trends:

The reversal in yields and the breaking of the bull market trend in context of an unemployment cycle reaching its historic cycle limit overtly raises the possibility that this bull market is over and may repeat the cycle of previous market tops.

If this is so and a recession indeed unfolds into 2019/2020 much lower risk ranges must be considered in the months and years ahead:

The 2000 top saw a recession following into 2001 with markets bottoming in 2002. The total retrace from the lows of the 1990 recession to the 2000 top ended at the .618fib. An equivalent technical move now would imply an eventual move back toward the 2000 and 2007 highs with the .618 fib sitting at 1535. For reference: The 2008 financial crisis reversed more than 100% of the advance from the 2002 lows to the 2007 highs. So if anyone thinks such a move is impossible, it indeed is the historic reversal record of the last 2 bubbles.

Except this time central banks have much less ammunition .

And be clear: Wall Street is not publicly forecasting this technical scenario. But let me also point out that Wall Street did not forecast the 2002 and 2009 lows either.

https://northmantrad...market-outlook/