Still up, near important resistance levels. If SPX 2580 can be taken out on a daily close basis then the markets can rally to 2640 and even as high as 2700. However, it is more likely that there will be a pullback this week.

Here are comments & key levels from GMM

S&P500 Key Levels by macromon

Stocks have seized the bullish narrative of a dovish Fed and an imminent trade deal with China, which should continue to drive the S&P up to its 50-day at 2639.61. Note the vicious sell-off in bonds since hitting the recent low of 2.55 percent on January 3rd. You know our suspicions that bonds have become the instrument of choice for the big global macro equity bears.

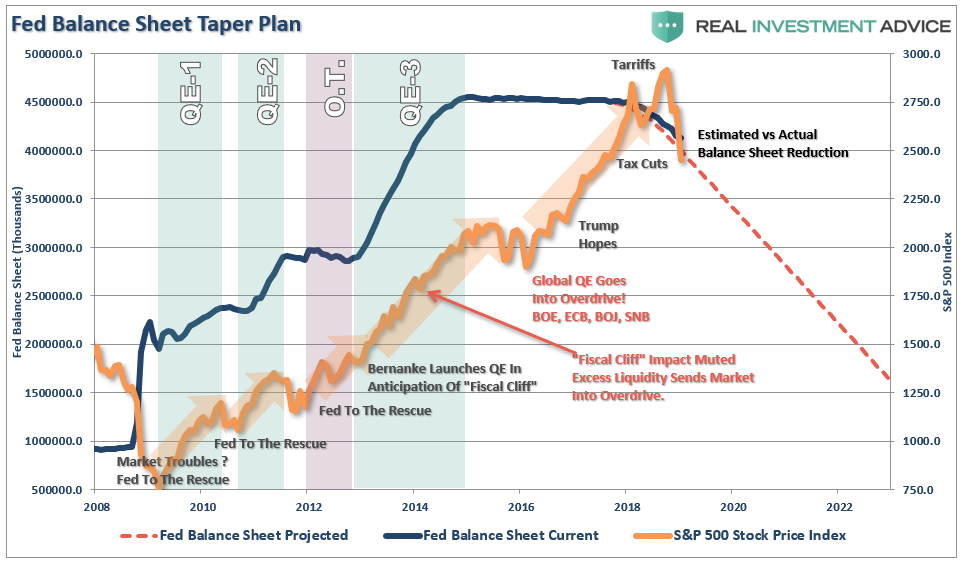

The current rally is based on an unstable narrative, in our opinion. What happens if the terrific trio -- Sean, Rush, and Ann -- don't like and the trade deal and criticize the president for selling out the base for stock investors? We don't see the Fed cutting rates or suspending its balance sheet reduction, which we project at $442 billion in 2019 until stocks are much lower. The bulls, who are driving stocks higher, are thus cannibalizing their own narrative.

President Donald Trump is increasingly eager to strike a deal with China soon in an effort to perk up financial markets that have slumped on concerns over the trade war, according to people familiar with internal White House deliberations. - Bloomberg, Jan 8th

Key Levels

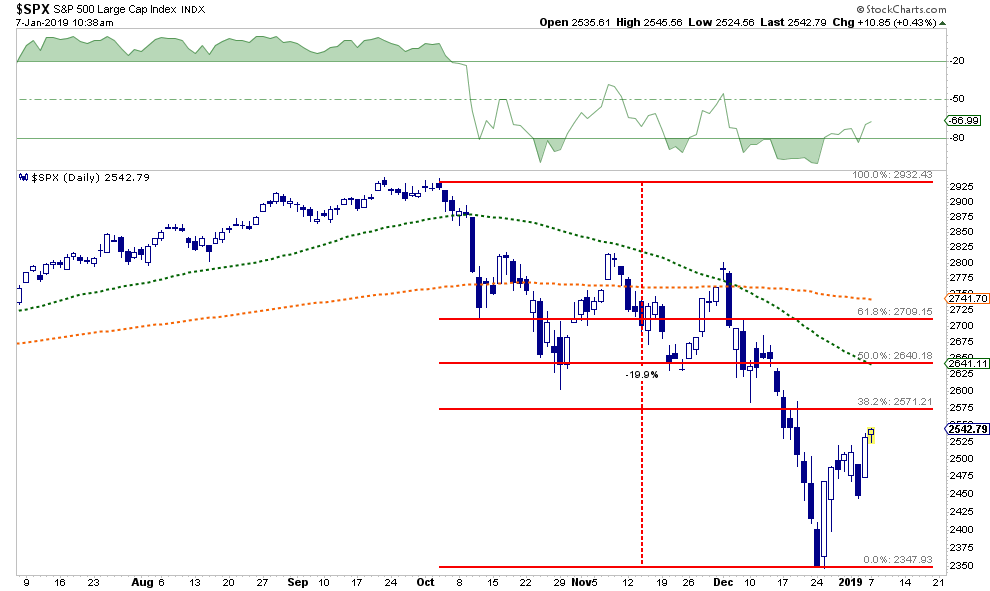

The S&P closed just above the key .382 Fibo of the recent sell-off at 2573.61, which opens the way to the next critical range of resistance at 2639 to 2643, the 50-day and .50 Fibo, respectively. We may see some consolidation before the move there, however.

To the downside, it is now critical for the 20-day to hold at 2528.77, which, keep in mind changes daily. Also, the index needs to stay above 2593.61, the Fibo retracement mentioned above.

Upshot

We believe stocks are still in a bear market, experiencing a classic nutcracker of a bounce, but reserve the right to change or mind.

Stocks have seized the bullish narrative of a dovish Fed and an imminent trade deal with China, which should continue to drive the S&P up to its 50-day at 2639.61. Note the vicious sell-off in bonds since hitting the recent low of 2.55 percent on January 3rd. You know our suspicions that bonds have become the instrument of choice for the big global macro equity bears.

President Donald Trump is increasingly eager to strike a deal with China soon in an effort to perk up financial markets that have slumped on concerns over the trade war, according to people familiar with internal White House deliberations. - Bloomberg, Jan 8th

The current rally is based on an unstable narrative, in our opinion. What happens if the terrific trio -- Sean, Rush, and Ann -- don't like and the trade deal and criticize the president for selling out the base for stock investors? We don't see the Fed cutting rates or suspending its balance sheet reduction, which we project at $442 billion in 2019 until stocks are much lower. The bulls, who are driving stocks higher, are thus cannibalizing their own narrative.

Key Levels

The S&P closed just above the key .382 Fibo of the recent sell-off at 2573.61, which opens the way to the next critical range of resistance at 2639 to 2643, the 50-day and .50 Fibo, respectively. We may see some consolidation before the move there, however.

To the downside, it is now critical for the 20-day to hold at 2528.77, which, keep in mind changes daily. Also, the index needs to stay above 2593.61, the Fibo retracement mentioned above.

Upshot

We believe stocks are still in a bear market, experiencing a classic nutcracker of a bounce, but reserve the right to change or mind.