Good commentary here on previous corrections & reversals

The Big Test

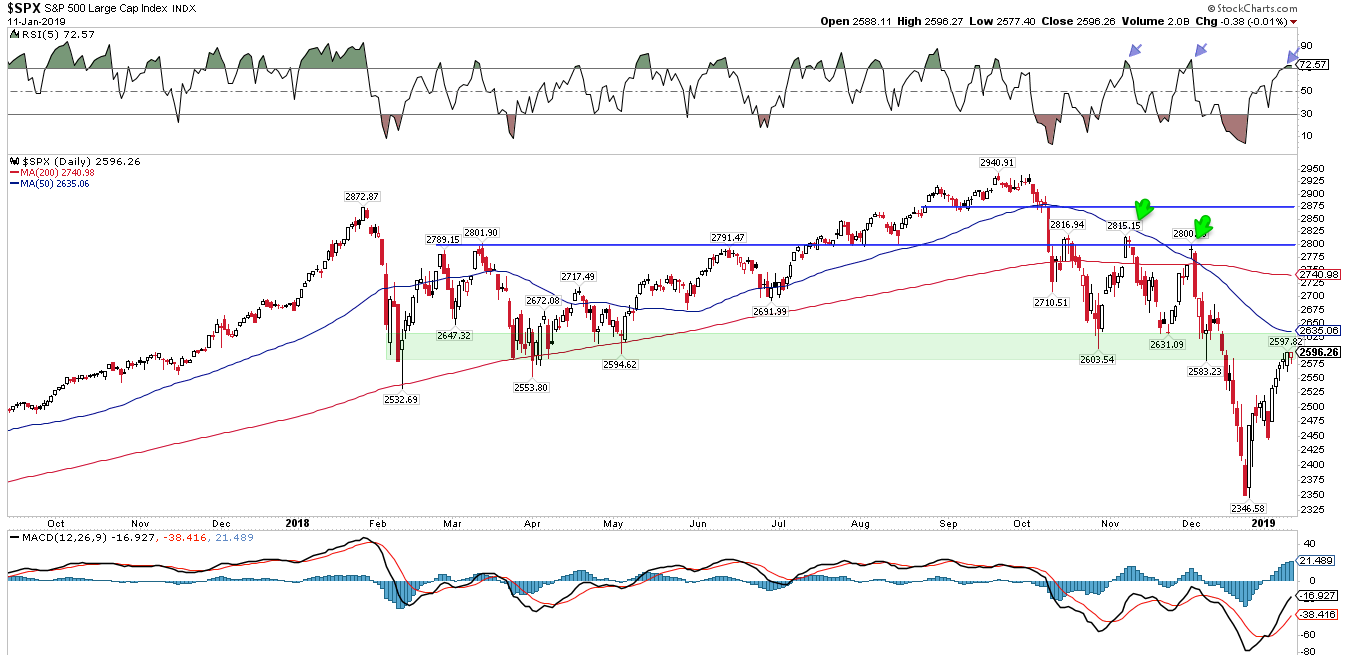

Over the next couple of weeks, the market is going to face the “test” that has defined the “bear markets” of the past.

With the markets already back to very overbought conditions, multiple moving averages just overhead, and previously broken support; the market is going to have its work cut out for it.

However, if the bulls can regain control and push prices back above the November highs, then the “bear market correction of 2018” will officially be dead.

But such is only one possibility out of many others which pose a far greater risk to capital currently.

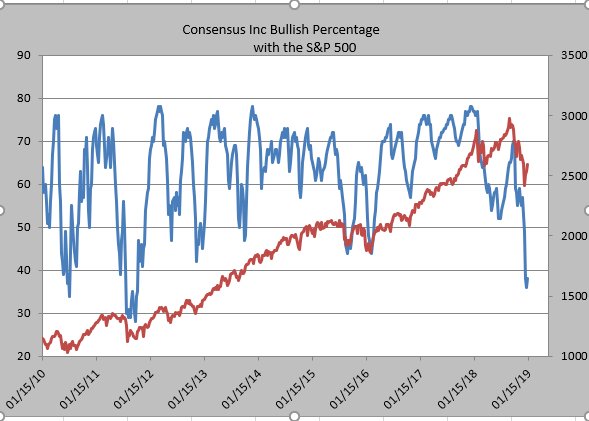

With the Fed continuing to extract liquidity, economic data slowing, and earnings likely to be weaker than expected, the current bounce is likely to be just that.

As we have continuously repeated, if you didn’t like the November-December decline, it is simply a function that you have built up more uncontrolled risk in your portfolio than you previously realized.

Use this rally to rebalance risk, sell losers and laggards, and add to fixed income and cash.

Conclusion

We noted previously that we remain long many of our core holdings and in November and late December added positions in companies which had been discounted due to the market’s downdraft.

This past week, we did reduce our equity exposure by 6% to remove some positions which have not been performing as well as expected.

The risk to the market remains high, but that doesn’t mean we can’t make money along the way.

Until the bullish trend is returned, we will continue to run our portfolios with a bit higher level of cash, fixed income, and tighter stops on our current long-equity exposure.

We are excited about the opportunity to finally be able to add a “short book” to our portfolios for the first time since 2008. It is too early in the market transition process to implement such a strategy, but the opportunity is clearly forming.

https://realinvestme...-tops-01-11-19/