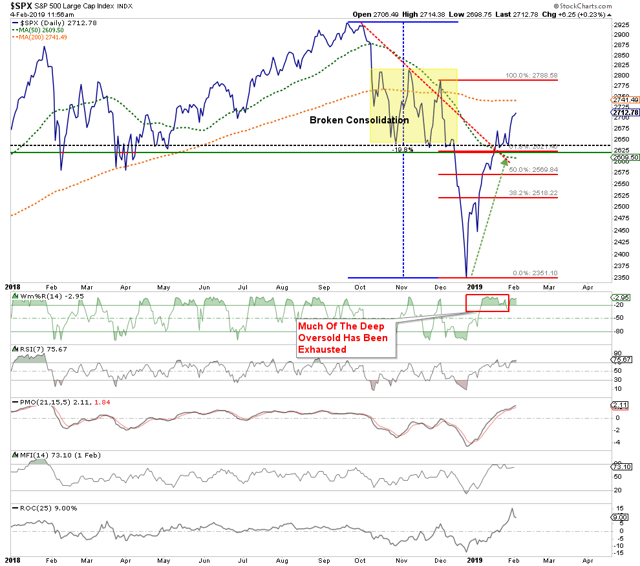

The charts don't lie, they are for real, and it does show the bulls have come back from the brink on 2 successive days to take the SPX back above the 2700 level. Candle experts say those are two bullish candles and the hourly candle chart is also quite bullishly impressive.

But, for now, the bears are still holding the edge once SPX daily does not close above the 200ma level. Essentially, this has been a pitched battle for control of the SPX 2700 to 2740 zone and who wins it will control the market for at least a 5% move

BTW, this was actually still an UP week for SPX! OPEX week can be quite volatile (bring it on!) and it can get really wild with trade war negotiations, shutdown threat (again!), and assorted political gyrations. But, who is complaining, this is what we dream of!

Magic

This week markets reached the key resistance confluence zone I’ve been outlining and rejected from there. Still $SPX managed to close the week positively by 1 handle making it the 7th consecutive week of uninterrupted gains. Whether this rejection is meaningful remains unproven at this stage. From my perch price discovery remains engaged in a battle for control between 2600 and 2730-2760 on $SPX. This aggressive rally has achieved what it was technically meant to: Reconnect with moving averages and achieve balance.

This week markets reached the key resistance confluence zone I’ve been outlining and rejected from there. Still $SPX managed to close the week positively by 1 handle making it the 7th consecutive week of uninterrupted gains. Whether this rejection is meaningful remains unproven at this stage. From my perch price discovery remains engaged in a battle for control between 2600 and 2730-2760 on $SPX. This aggressive rally has achieved what it was technically meant to: Reconnect with moving averages and achieve balance.

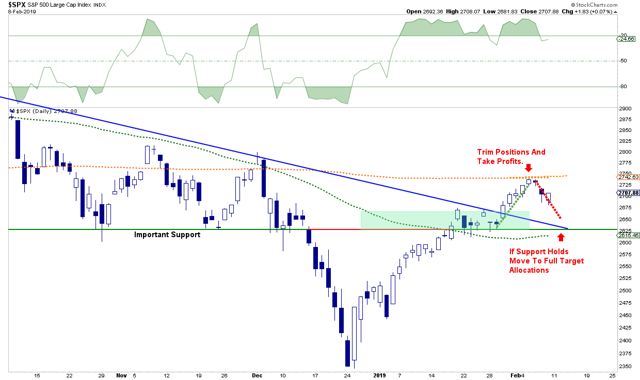

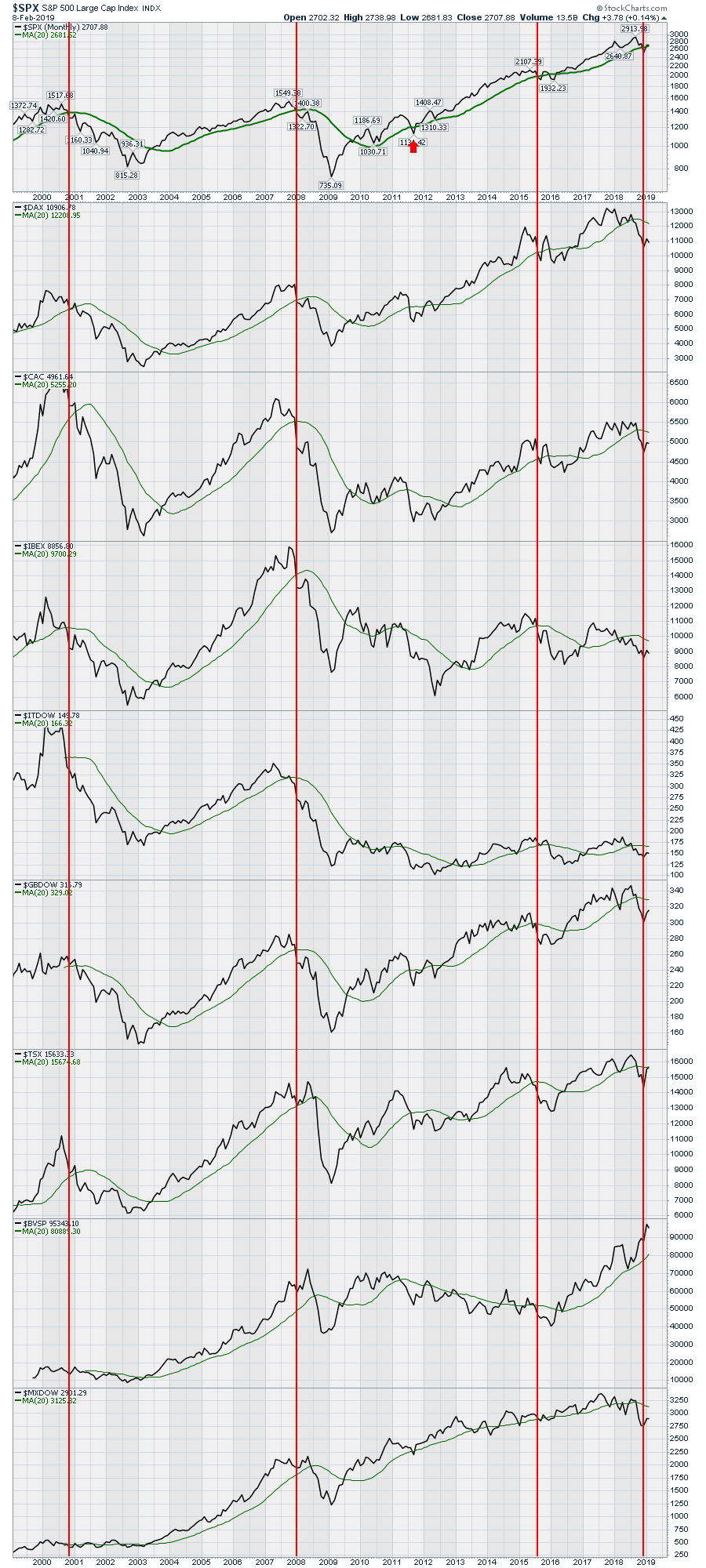

But for now it remains a rally below the 200 daily moving average:

It remains a rally below the weekly 50MA:

And it remains a rally below the monthly 15MA:

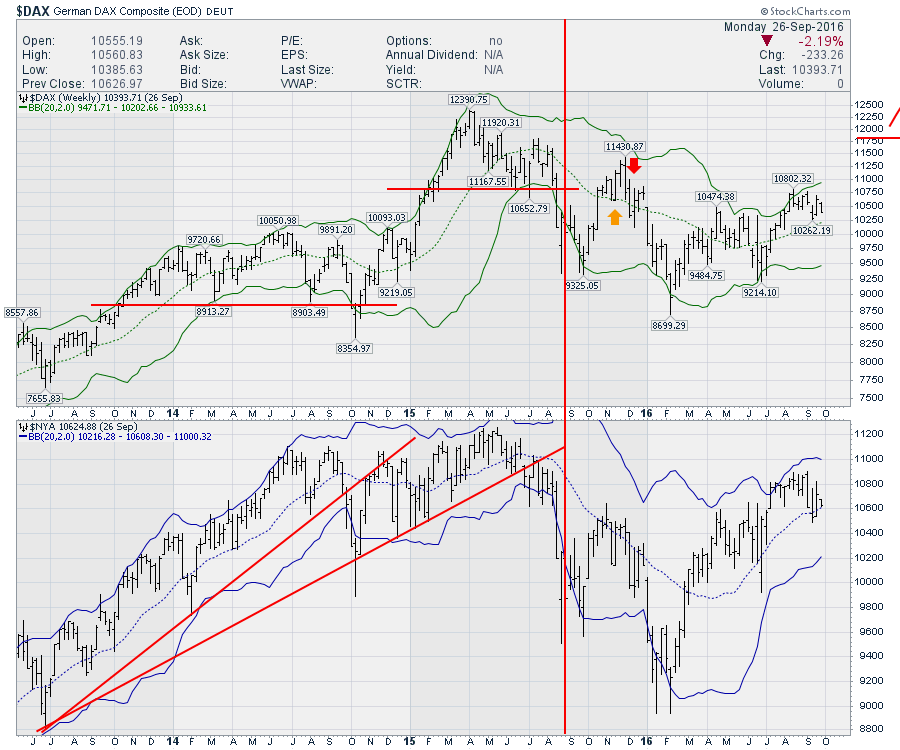

And hence the larger potential bull trap structure remains in play for now:

$DJIA failed to recapture its broken 2016 trend line:

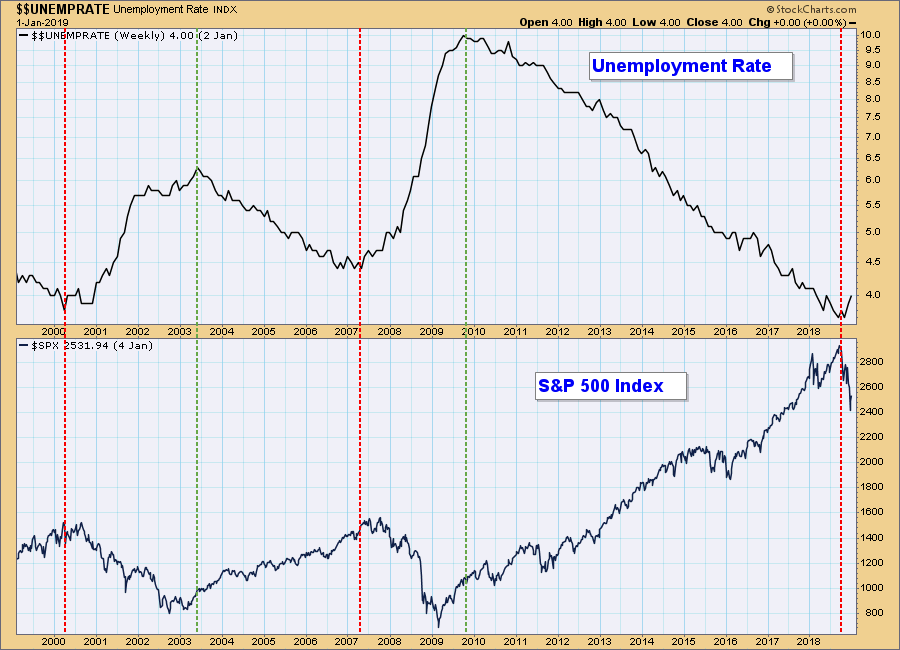

Yet fact remains that ever since the big central bank capitulation of 2019 markets have not had a single down week. It’s almost magical.

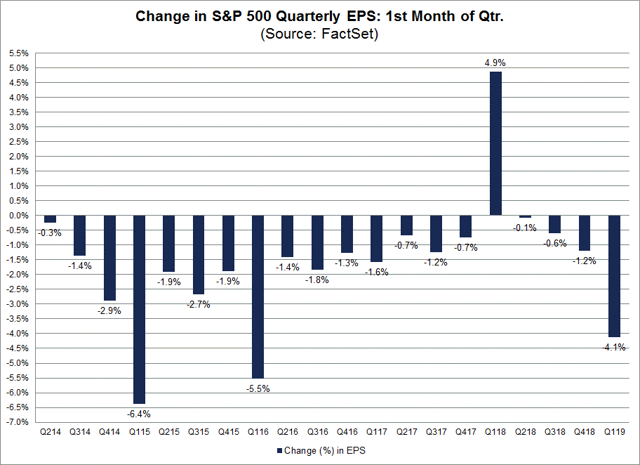

Indeed markets keep rising as earnings estimates keep coming down. Per Factset: “$SPX is projected to report a year-over-year decline (-1.7%) in earnings for Q119, with 7 of 11 sectors expected to report a decrease in earnings. $SPX EPS estimate for Q119 has declined by 4.8% over the past 12 months and by 5.4% since Dec. 31.”