He seems to be neutral to short, closing a LONG position.

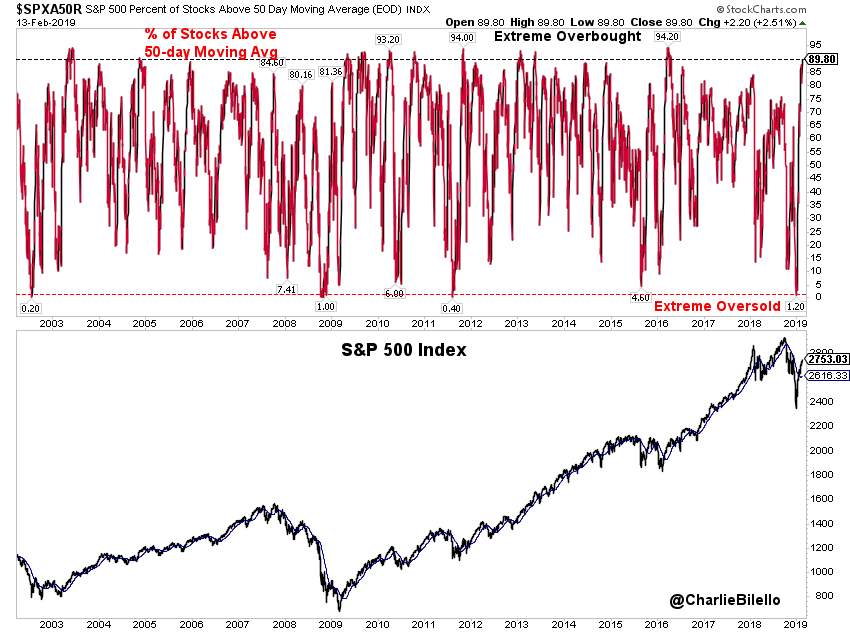

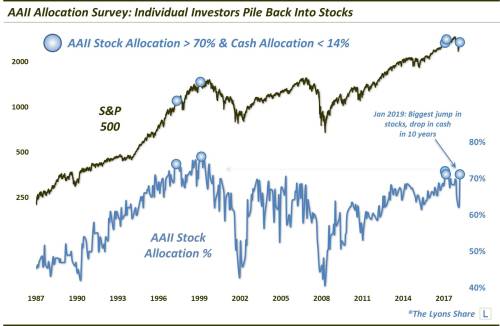

I am also thinking the same, a bit more bearish. My CM indicator says the rally is running on fumes but

I know that such rallies can run for a while, in this case, to SPX 2800 or just above it. But, this looks like another case where my CM (Common Sense) indicator is right.

SPX Monitoring purposes; Sold SPX on 2/12/19 at 2744.73 gain 1.36%; long 2707.89 on 2-8-19.

Monitoring purposes GOLD: Long GDX on 1/29/19 at 21.96.

Long Term Trend SPX monitor purposes; Long SPX on 10-19-18 at 2767.78

Yesterday we said, “First upside resistance is last Tuesday’s high of 2739 and next higher resistance is 2800 SPX, which is November and December high.” We where thinking that we'd get to the 2800 level, and we may still, but in the very short term, a pullback is likely. SPX closed the day at 2744.73, just above the previous high of 2738.98. The chart above is the Total Put/Call ratio (CPC) going back nearly a year, showing the times when this ratio reached .78 or lower (today’s close was .77). As you can see from the chart, all were at a high for at least a day; some marked highs that lasted a week or more. The top window is the NYSE McClellan Summation index, which has reached +900 - previous times it has reached +900, a consolidation appeared that lasted two weeks, and something like that may be developing here. We sold our long position for a gain of 1.36%. We will wait for the next setup.

Yesterday we said, “First upside resistance is last Tuesday’s high of 2739 and next higher resistance is 2800 SPX, which is November and December high.” We where thinking that we'd get to the 2800 level, and we may still, but in the very short term, a pullback is likely. SPX closed the day at 2744.73, just above the previous high of 2738.98. The chart above is the Total Put/Call ratio (CPC) going back nearly a year, showing the times when this ratio reached .78 or lower (today’s close was .77). As you can see from the chart, all were at a high for at least a day; some marked highs that lasted a week or more. The top window is the NYSE McClellan Summation index, which has reached +900 - previous times it has reached +900, a consolidation appeared that lasted two weeks, and something like that may be developing here. We sold our long position for a gain of 1.36%. We will wait for the next setup.

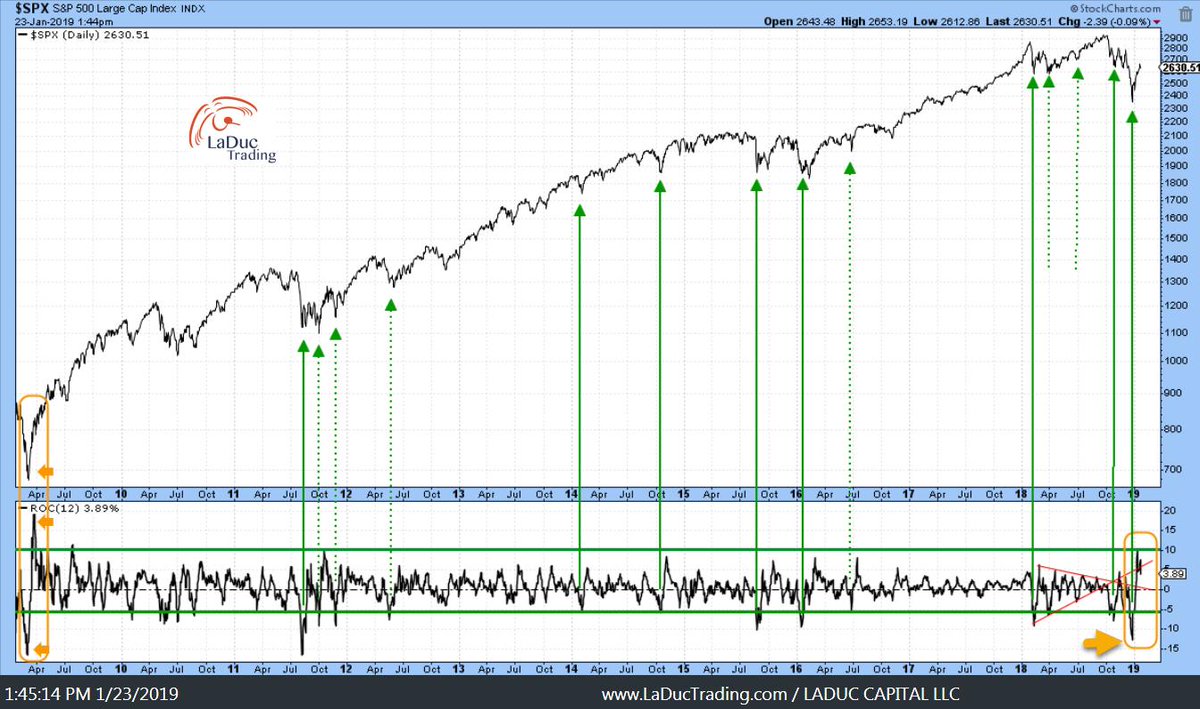

Last Thursday we said, “Since mid January, the SPX has pushed modestly higher and the Cumulative TICK flipped sideways, indicating upside momentum is weakening. Market has been up five days in a row going into this Tuesday and 97% of the time it will hit a higher high within five days.” Today is day number 5 and the market has hit a higher high, keeping its promise that market should be higher within five days. The cumulative TICK (second window up form the bottom) has made a higher high, suggesting the SPX rally may continue. However, the steepness of the uptrend has weakened over the last couple of weeks, which is a negative in the intermediate-term. The top window is the 30-period moving average of the TICK, which has made a lower high as the SPX made a higher high and a short-term divergence. With this divergence and CPC reaching bearish levels, we elected to sell our long SPX position. President's Day is next Monday and markets are closed. It common for markets to reverse around holiday periods. Volume usually lessens as a holiday nears as traders take off early for the extended weekend and volume decreases. Volume decrease on a rally phase is usually a bearish sign and a declining phase is a bullish sign. Not sure what the next three days will bring, so back to neutral for now.

https://stockcharts....ry-12-2019.html