You got to give it to the bulls: they have come back from numerous bear raids during the past week and still hold the edge.

But, it has been choppy, nervy, and indecisive as both bears & bulls maneuver for the decisive move in their direction.

Bears have to go for it now or else the bulls can move this very quickly above SPX 2800.

Long weekend ahead, I will be leaving quite early tomorrow, going SHORT into the weekend.

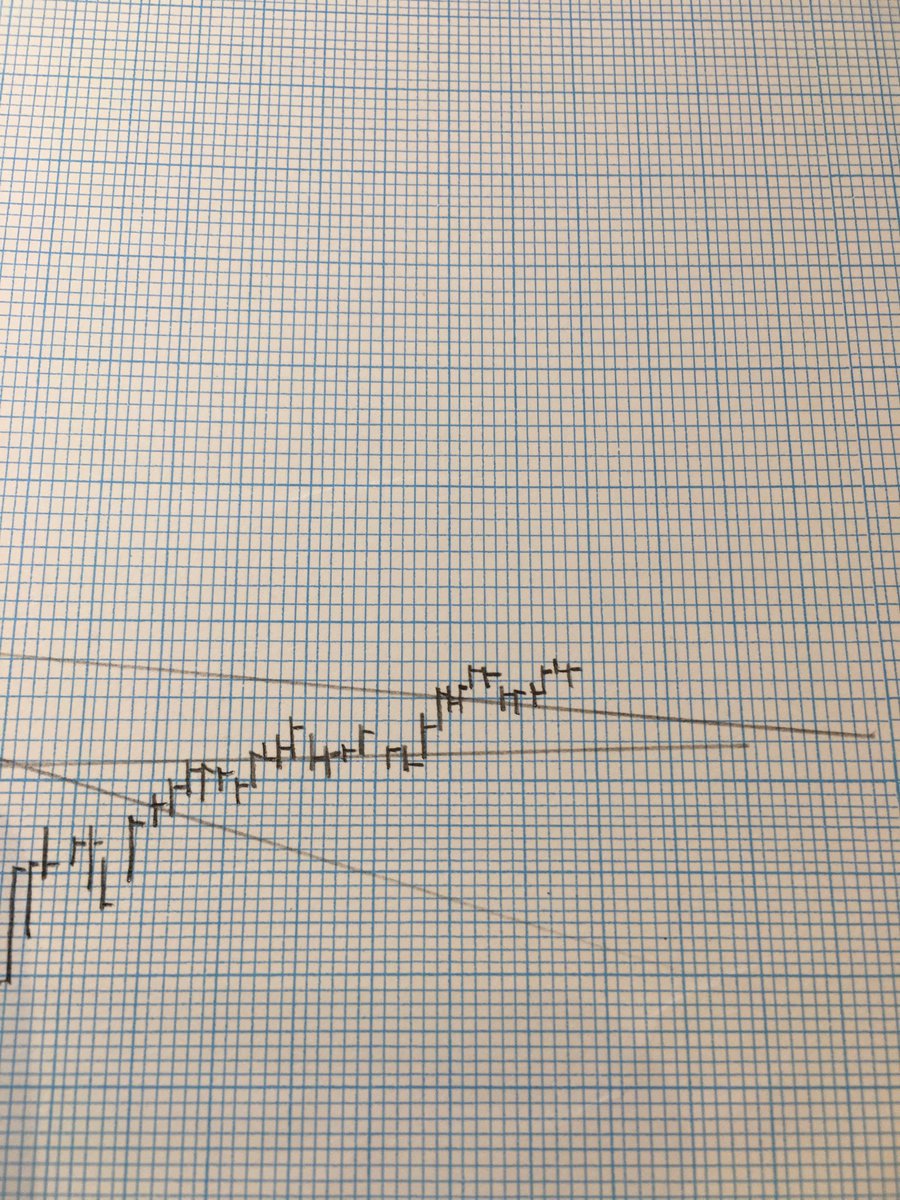

Doji City At The 200-day

Total indecision in the S&P 500 price action at the 200-day moving average.

Very similar to past short-term peaks but if it were that easy, we’d all be eating caviar on our yachts.

Impressive that market doesn’t break. No sellers.

Nevertheless, better seller before everyone else starts selling.

Source: Using Japanese Slang