Tariffs this time around are not significant relative to GDP levels, at this rate it can't start to matter. The previous excitement was the steel tariffs after the 2001 recession, during 2002 and 2003. That included more Fed rate cuts to get down to the 1 percent level by mid 2003. And from what I've read, Trump is a dreamer if he expects to get rid of the trade deficit when the US has the world's reserve currency. Wishful wasteful thinking.....

Top? Not Today...

#11

Posted 20 February 2019 - 07:55 PM

#12

Posted 20 February 2019 - 11:02 PM

Further upside (in the short term) targets 2808. Downside targets 2640 (at the extreme). Most likely is a pullback along the lines of 3% followed by new highs.

Yep... that's my take on things.

Edited by tsharp, 20 February 2019 - 11:03 PM.

#13

Posted 21 February 2019 - 08:49 AM

Interesting there are no comments on this overnight reversal, likely wont stick anyhow lol!!

#14

Posted 21 February 2019 - 09:41 AM

I've got a VIX P/C Buy for Thursday.

M

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#15

Posted 21 February 2019 - 09:50 AM

I've got a VIX P/C Buy for Thursday.

M

Didn't you just say there is no way of a top today though?

#16

Posted 21 February 2019 - 10:13 AM

I've got a VIX P/C Buy for Thursday.

M

Didn't you just say there is no way of a top today though?

Nothing to worry about Brother......

LOL..... The dumb money loves stocks again and the FOMO is still in play. The Banks also have our backs.... Watch the sky, but I'm just glad Bulls and Bears can't fly!

Good Trading....

I see the world is fearless again. The higher we go the more bullish people become. The same people that were bullish (and wrong) last year are bullish again and as prices rise relentlessly everybody is a genius again. Central banks don’t filter into the analysis otherwise one would have to admit that that’s what it’s all about. Bad data doesn’t matter because stocks go up. A China deal will be positive and a catalyst to buy stocks. If there is no real China deal a cosmetic one is good enough. Since bad data doesn’t matter any good data is bullish too. In short bad news is good news and good news is good news. It’s blind faith in a system that never has to face any consequences as the central bank put reigns supreme.

Risk happens fast - Complacency may be rampant right now 9 weeks into this rally, but the charts and patterns suggest a larger volatility spike is yet to come in the weeks ahead.

Edited by robo, 21 February 2019 - 10:17 AM.

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

#17

Posted 21 February 2019 - 10:26 AM

I've got a VIX P/C Buy for Thursday.

M

Didn't you just say there is no way of a top today though?

Nothing to worry about Brother......

LOL..... The dumb money loves stocks again and the FOMO is still in play. The Banks also have our backs.... Watch the sky, but I'm just glad Bulls and Bears can't fly!

Good Trading....

I see the world is fearless again. The higher we go the more bullish people become. The same people that were bullish (and wrong) last year are bullish again and as prices rise relentlessly everybody is a genius again. Central banks don’t filter into the analysis otherwise one would have to admit that that’s what it’s all about. Bad data doesn’t matter because stocks go up. A China deal will be positive and a catalyst to buy stocks. If there is no real China deal a cosmetic one is good enough. Since bad data doesn’t matter any good data is bullish too. In short bad news is good news and good news is good news. It’s blind faith in a system that never has to face any consequences as the central bank put reigns supreme.

Risk happens fast - Complacency may be rampant right now 9 weeks into this rally, but the charts and patterns suggest a larger volatility spike is yet to come in the weeks ahead.

Basically agree we could still see new highs but I also think the market is starting to smell that maybe the reason the Fed did the sudden shift overnight was because maybe there is a hard slowdown coming!! With the news out of the trade meeting we should have been hitting 2800 this morning but the markets hesitating! Nonetheless all I really care about is that I just want some more volatility again lol!!

#18

Posted 21 February 2019 - 12:31 PM

Yes Sir..... I would love to start trading TVIX again....

Long TZA - Beer Money trade....

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

#19

Posted 21 February 2019 - 03:56 PM

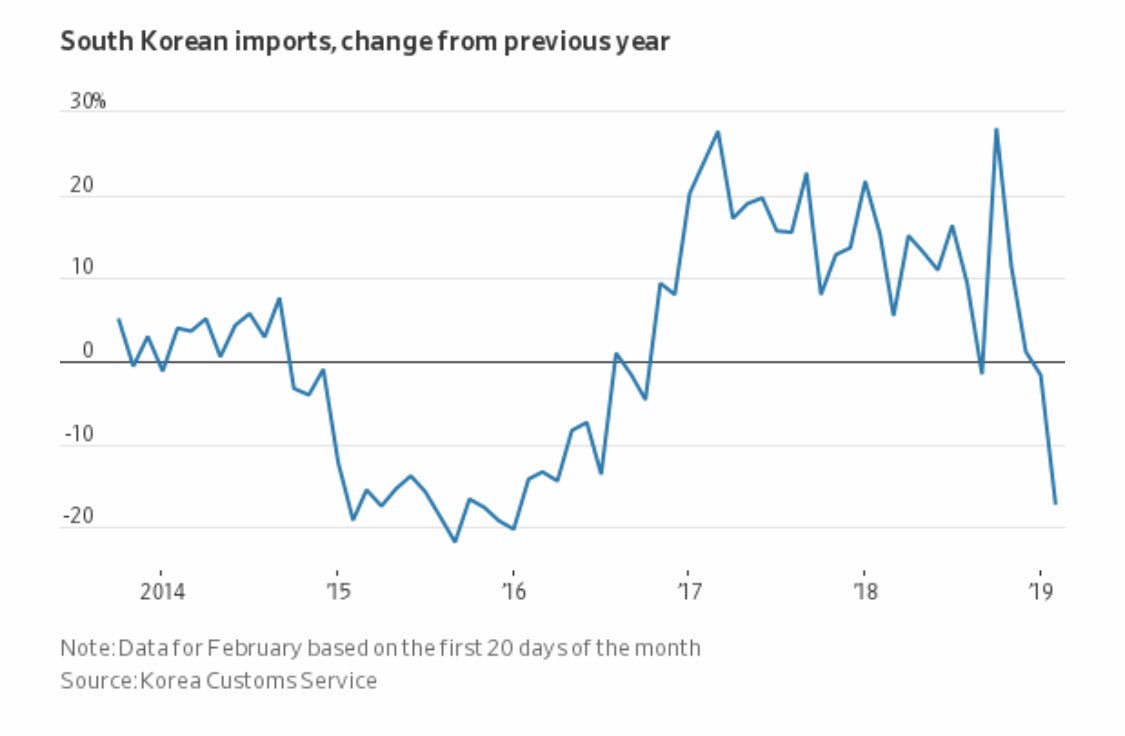

This chart — from the @wsj — is yet another indication of slowing global #trade and #growth. #economy #markets

The Banks have our Backs.... Just BTFD!

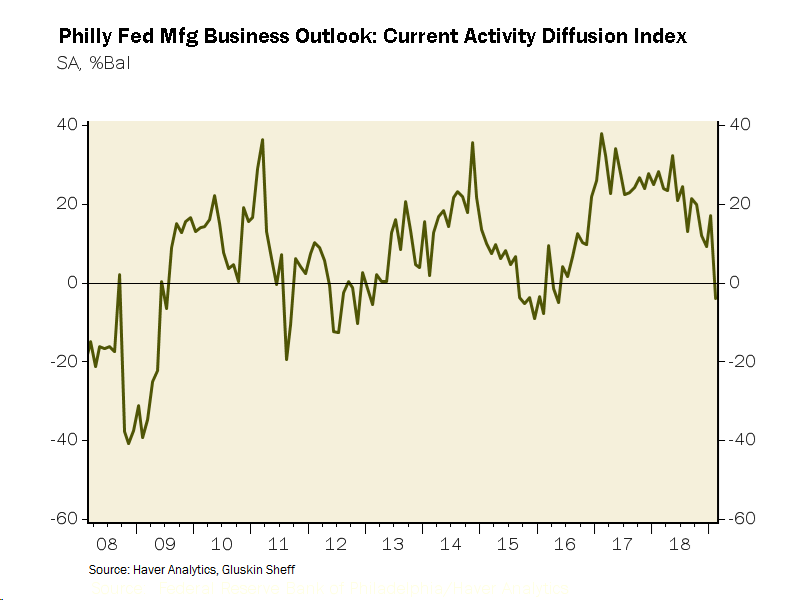

Worst Philly Fed headline since May 2016. Biggest one-month decline in new orders (-23.7pts) since October 2008.

https://twitter.com/...uyRosie?lang=en

Edited by robo, 21 February 2019 - 03:56 PM.

" “There is only one side to the stock market; and it is not the bull side or the bear side, but the right side” Jesse L. Livermore

#20

Posted 22 February 2019 - 04:11 PM

The way they handled their promises so far, their negotiation skills, this never ending story of "deal is done". You remember the deal was done still in Oct 2018? But he had to leave for the funeral and there was a strong promise of an announcement afterwards, etc. This is not the way you handle the negotiations. If they really wanted a deal - they would conclude it in silence. But what they want - is hope. Hope eternal, lol..Why there wont be a deal? I'm thinking small deal tariffs remain the same for now. Not sure how the market will react to that.

And selling this hope.

In fact agricultural commodities are smelling it. You sell first what is less liquid. Check wheat, corn and soybeans.

Lol, no deal. Told you so. But it's bullish of course