I don't know, but the Risk/Reward sure has changed.

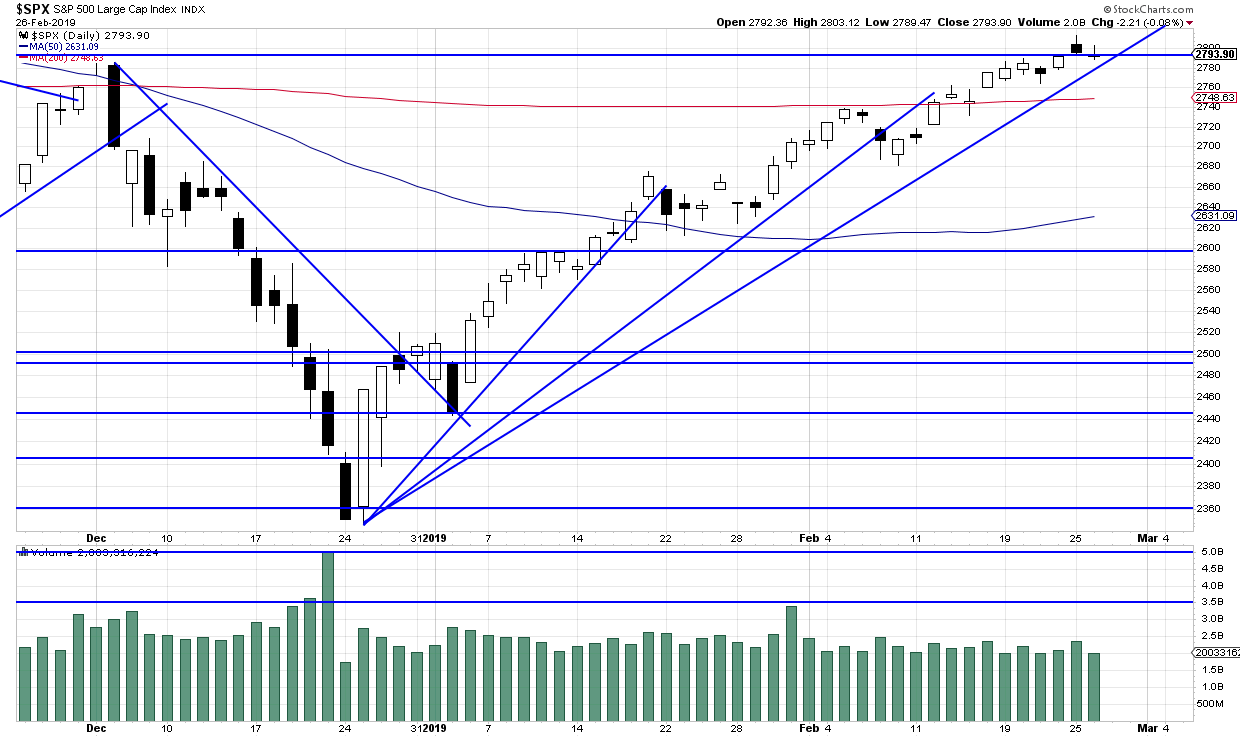

Tuesday was day 41, placing stocks in their timing band for a DCL. The swing high was accompanied by a close below the 2800.18 resistance level that signals the start of the daily cycle decline. A close below the 10 day MA will confirm the daily cycle decline.

Stocks are in a daily uptrend. If a swing low forms above the lower daily cycle band they will remain in their daily uptrend.

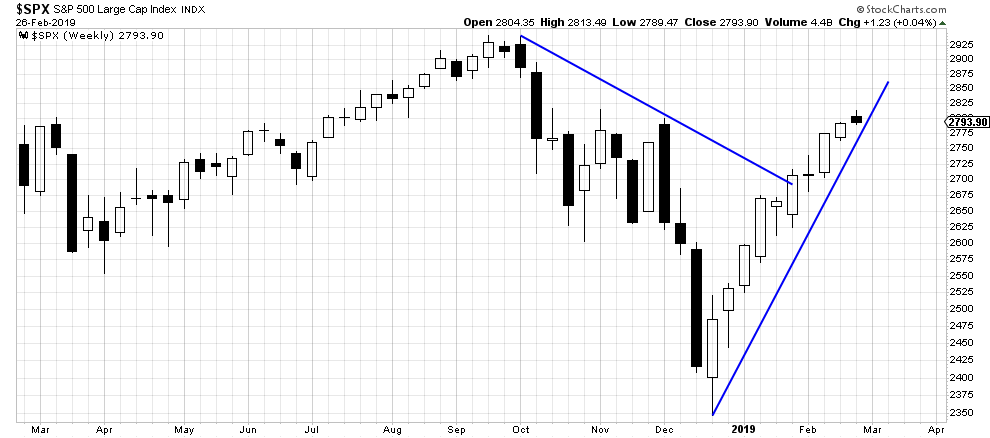

This week’s stock market action has likely signaled a short-term turning point from bullish to bearish.

The S&P 500 gapped above the 2800 resistance level early on Monday. The index ran as high as 2813 before a last-hour decline pushed the index back down below 2800.

The S&P 500 still closed in positive territory on Monday. So, we can’t really call it a reversal day. But the action was weak. And, that sort of weakness, following a long, nearly-one-way move higher often marks at least a short-term top.