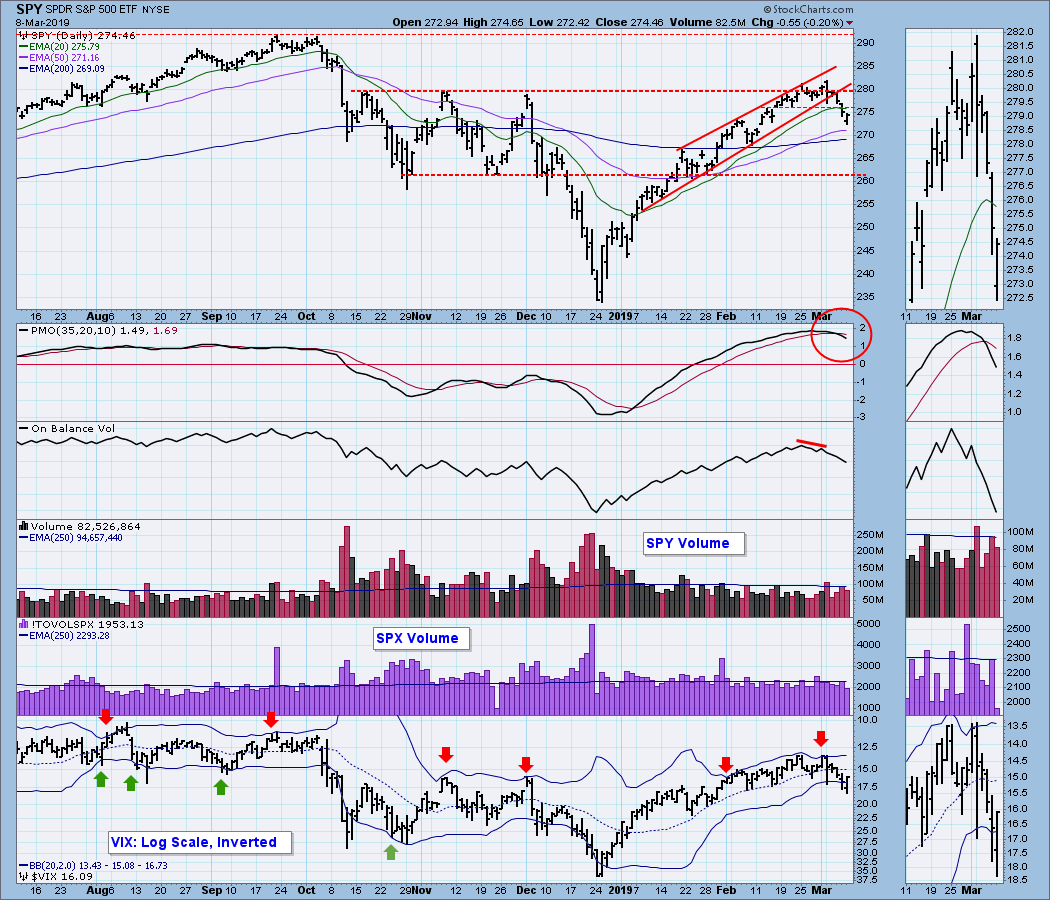

Basically, the market is now in ST & IT mode.

Why will invalidate this?

For ST SELL, stop @ SPX 2784

For IT SELL, stop @ SPX 2815 (this changes at the close every day)

Bulls pulled back from the lows to finish almost flat of the fake pop up that will be SOLD really hard at the slightest sign of bearishness.

Still waiting on TRADE DEAL etc

POWELL us now a TV star on main street TV....nothing new from him, not a surprise since he can hardly go more dovish!

OPEX week could follow the conventional trend - UP - but there are exceptions and I think this is the case.

But, one has to be ready to ditch your plan and follow the market if does not match your strategies.