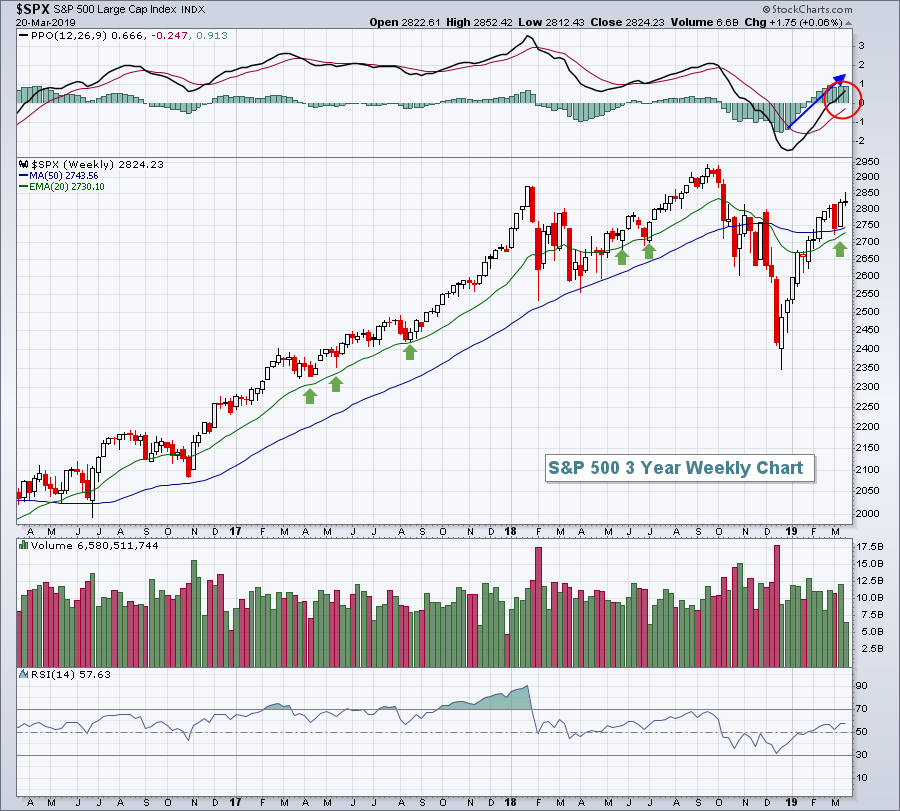

Seriously, with today's breakout, SPX could easily surpass the historic high in a weeks and proceed to Summer to remember, all the way to 4000!

Well, no, people also thought NASDAQ would have reached 10K in 2K (2000) but it all collapsed like the proverbial house of cards because you can levitate nothingness and fluff for only so long.

With the VIX stubbornly staying above 13, VXXB down slightly, and many anxious to get into the action that they had missed in 2019, I expect a market that will soon fizzle out.

How soon is SOON? not more than 2 weeks.

How high will it go? Possible new highs but only marginally so.

But, one has to trade WITH the markets, at least on a ST basis, so ride it upwards until it reverses.

This from WSJ:

By Alex Eule | Thursday, March 21

Tech to the Rescue. So much for the Federal Reserve's anxiety over the economy. A day after interest-rate policy makers unnerved investors with a surprise dovish turn, the market chose to see the silver lining instead. With no rate hikes on the horizon, high-growth tech stocks look particularly appealing again. The Nasdaq Composite jumped 1.4%, powered by new excitement over Apple, as well as Micron Technology's better-than-expected earnings report.

Investors are eagerly awaiting Apple's TV streaming announcement scheduled for Monday. One analyst upgraded the stock today in anticipation of the event.

"On Monday, Apple will announce a new content service that, IF adopted by its users should lower churn and drive higher lifetime value for each of Apple's 900 million unique ecosystem users," Needham analyst Laura Martin wrote in her upgrade to Strong Buy. Apple shares closed up 3.7% today.

Time will tell if Apple's latest strategy justifies the excitement, but there's reason to think that investors are getting ahead of themselves. Tech site Recode reported today that Apple's offering won't be the Netflix clone some are expecting.

The tech sentiment outweighed the big news in health care. Biogenplunged 29% after the pharmaceutical company said it was ending trials of its much-heralded Alzheimer's drug. Biogen said the latest trials of the drug had failed. It's the latest in a string of industry disappointments around Alzheimer's treatment.

“This disappointing news confirms the complexity of treating Alzheimer’s disease and the need to further advance knowledge in neuroscience," the company's CEO said in a statement.

DJIA: +0.84% to 25,962.51

S&P 500: +1.09% to 2,854.88

Nasdaq: +1.42% to 7,838.96

The Hot Stock: Conagra Brands +12.8%

The Biggest Loser: Biogen -29.2%

Best Sector: Technology +2.5%

Worst Sector: Financials -0.3%