Tom thinks we test the 50ma

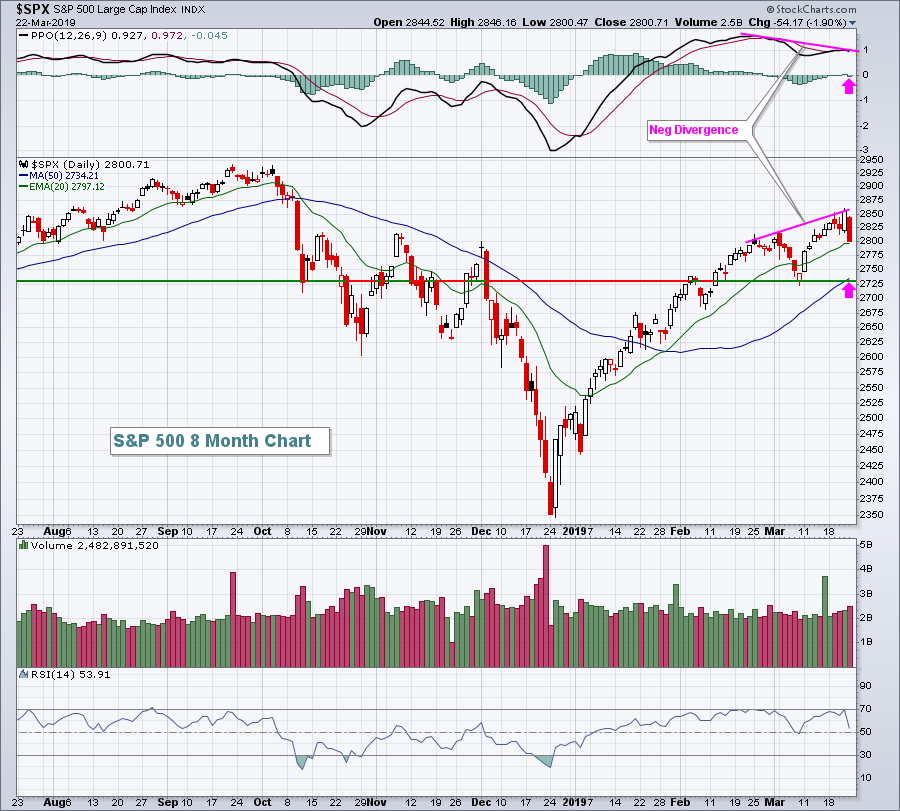

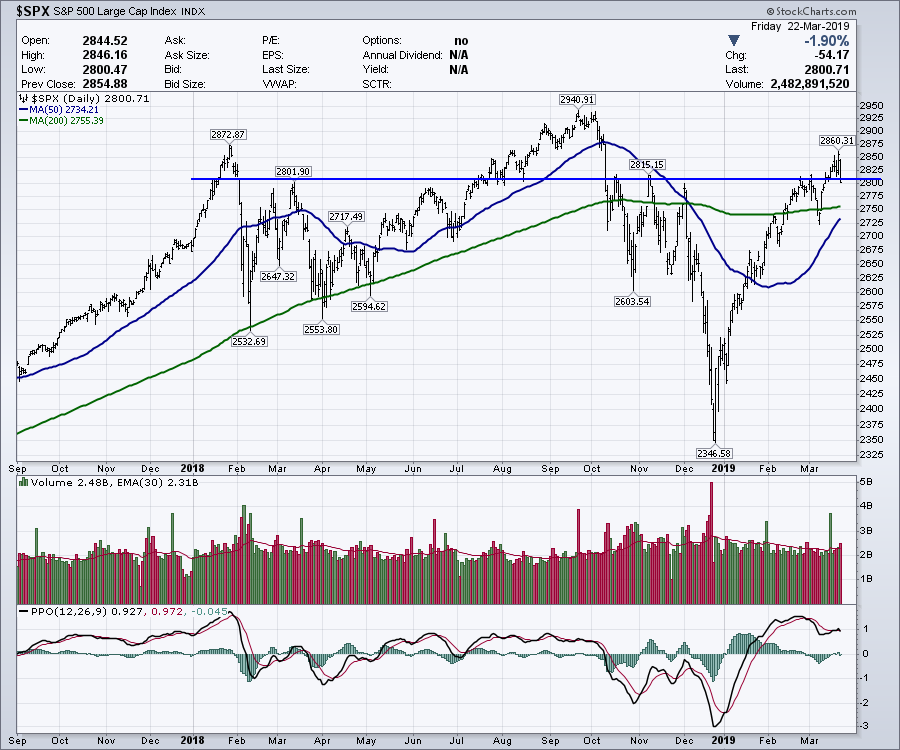

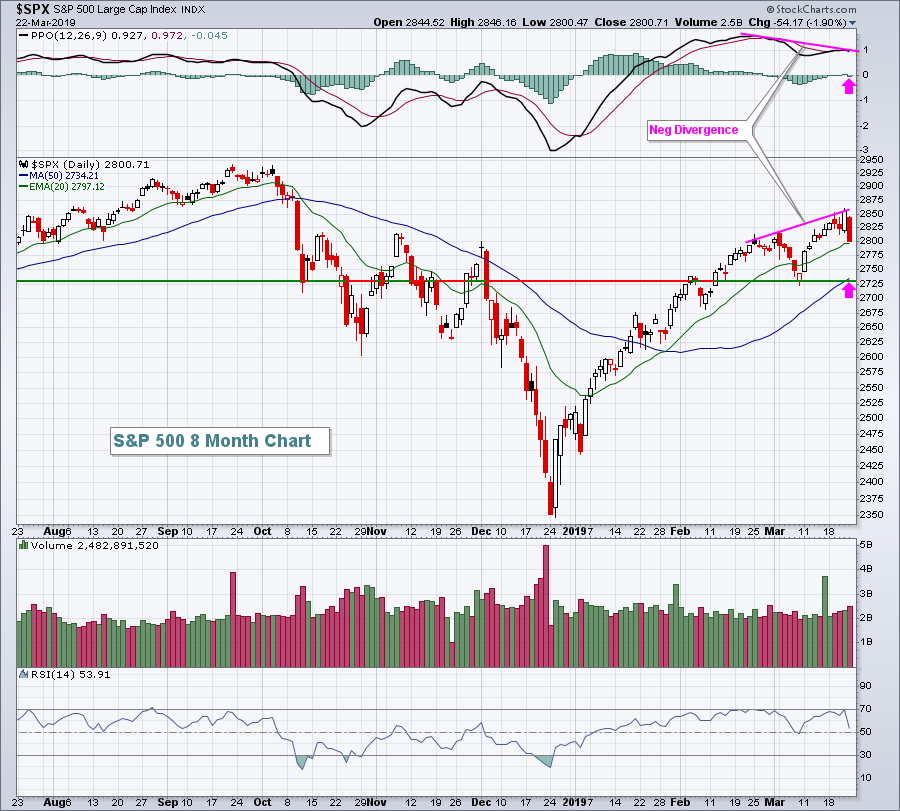

Investors were worried on Friday and it was reflected in the Volatility Index ($VIX), which rose more than 20%, and sharply lower U.S. equity prices. The small cap Russell 2000 was hit hardest, dropping 3.62%. The weakness, however, was felt just about everywhere. The NASDAQ, S&P 500 and Dow Jones fell 2.50%, 1.90%, and 1.77%, respectively, as negative divergences kicked in. I wrote last week about moving to cash as warning signs were mounting. My blog article last Tuesday, "Negative Divergences Could Wreak Havoc On U.S. Stocks", discussed slowing momentum signals and a possible trip to test the rising 50 day SMA. We're on our way as you can see from this S&P 500 chart:

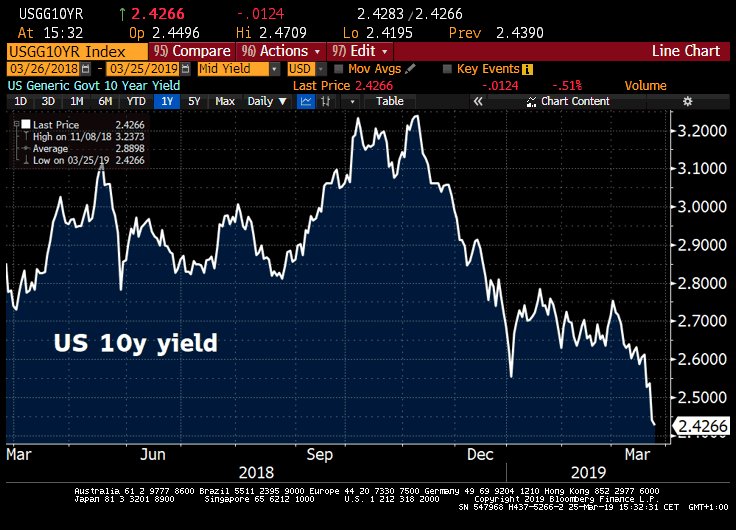

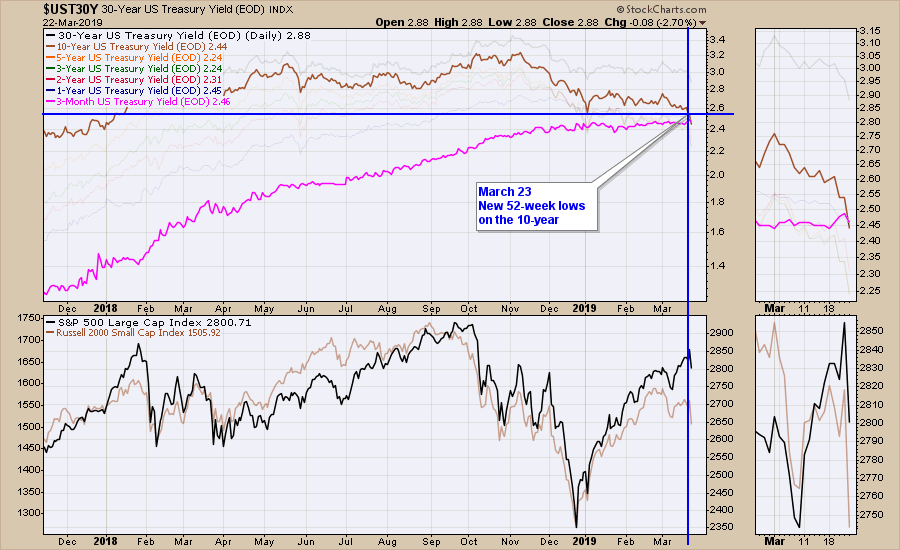

Also, market action the week after monthly options expire is generally not very good. Throw in the tumbling treasury yields, which I also warned about last Thursday in my article, "The Bond Market Is Sending Us The Most Bearish Signal", and it's clear we need to be cautious in the very near-term. Technical analysis never provides us a guarantee that anything will occur, but it does tell us a story. The plot of the current story says to be very, very careful. For me, the most important consideration, bar none, is the combination of price support/resistance and volume. The recent price low on the S&P 500 is close to 2730. The rising 50 day SMA is currently at 2734. During an uptrend, the rising 20 week EMA also provides excellent support and it currently resides at 2728. Clearly, this is an important area to watch on further selling. We know that impulsive selling tends to occur with a VIX above 20 and price support lost. Therefore, I'd grow even more cautious if you see the VIX spiking further and the S&P 500 moving (and closing) beneath the 2725 level.

Also, market action the week after monthly options expire is generally not very good. Throw in the tumbling treasury yields, which I also warned about last Thursday in my article, "The Bond Market Is Sending Us The Most Bearish Signal", and it's clear we need to be cautious in the very near-term. Technical analysis never provides us a guarantee that anything will occur, but it does tell us a story. The plot of the current story says to be very, very careful. For me, the most important consideration, bar none, is the combination of price support/resistance and volume. The recent price low on the S&P 500 is close to 2730. The rising 50 day SMA is currently at 2734. During an uptrend, the rising 20 week EMA also provides excellent support and it currently resides at 2728. Clearly, this is an important area to watch on further selling. We know that impulsive selling tends to occur with a VIX above 20 and price support lost. Therefore, I'd grow even more cautious if you see the VIX spiking further and the S&P 500 moving (and closing) beneath the 2725 level.

Economic weakness abroad has become very clear. The European Central Bank (ECB) was slower to act than the Federal Reserve, but it is on a program of quantitative easing (QE) to help spur economic activity in Europe. On Friday, the German PMI manufacturing number fell to 44.7, well below the 50 threshold that suggests economic contraction. One big concern in the U.S. is that economic weakness in Asia and Europe will lead to a recession here and the inversion of the yield curve last week increased the odds of that. However, the rate of change (ROC) in U.S. jobs is generally a very good economic indication and, despite the February job slowdown, the ROC remains quite strong. I'd be very patient at this time before making any longer-term prediction about the direction of U.S. equity prices. I believe we remain in a secular bull market with higher prices ahead. Could we see weakness and/or consolidation in the foreseeable future? Absolutely. In fact, the bond market is arguing for exactly that.

10 of 11 sectors fell on Friday, with only the defensive utilities group (XLU, +0.72%) gaining ground. The combination of a strengthening U.S. Dollar Index ($USD, +0.17%) and growing worldwide economic fears resulted in underperformance by materials (XLB, -2.98%) and energy (XLE, -2.70%). These two sectors, especially materials, will likely remain under tremendous pressure on a relative basis. The strong dollar almost guarantees it. Financials (XLF, -2.76%) also performed very poorly as the inversion of the yield curve creates tremendous headwinds for areas like banks ($DJUSBK, -3.74%) and life insurance companies ($DJUSIL, -3.32%).

https://stockcharts....idays-drop.html