Best Q1 in 21 years ends with the market still grinding up higher but with reduced momentum, and

low participation:

"The NYSE had its lowest trading volume day of 2019 for the second time this week, after first setting the benchmark on Tuesday."

All good things come to an end and so shall it be for this great V-shape rally, one for the history books.

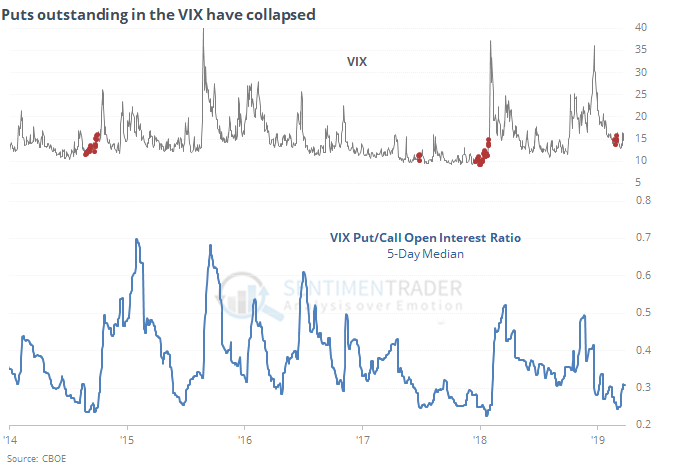

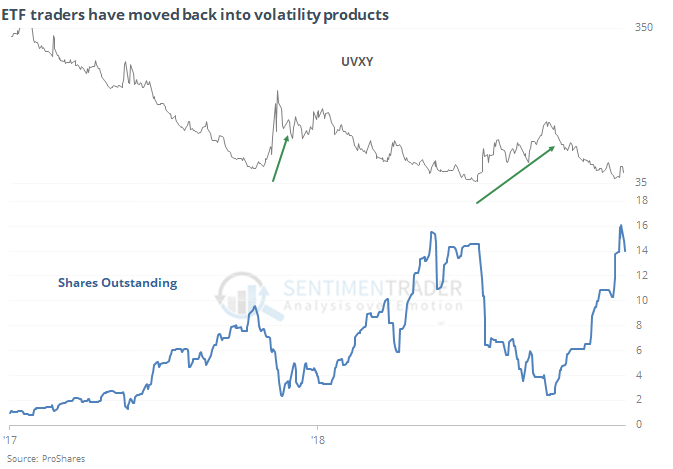

I expect a big DOWN Q2 as well as much more volatility.

But, the best strategy is to trade WITH the markets even if it goes against all that is logical !

FROM WSJ:

The Federal Reserve's abrupt shift from hawkish to dovish over the past six months has been a mixed blessing for investors. On one hand, lower interest rates tend to be supportive of stock prices. On the other, the very fact that the Fed needs to loosen its monetary policy stance because of weakening economic conditions is obviously not a good sign.

This morning's revised-down fourth quarter GDP figure confirmed that U.S. economic growth has been sharply decelerating since last spring, when growth peaked at a 4.2% annualized rate in the second quarter. It also confirmed that the Fed continued raising interest rates several months into an economic growth slowdown, having most recently hiked in December.

Perhaps if monetary policy officials had known that the economy had only expanded at a 2.2% rate in the fourth quarter they wouldn't have been so eager to do so. But that's the problem with the "data-dependent" path the Fed was on – that it relies on figures describing conditions that are in the past once they have been collected. Markets tumbled in the fourth quarter on concerns of slowing economic growth (among other things) so it's not as if no one saw it coming.

As Matthew Klein wrote in Barron's over the weekend:

The question is why so many at the Fed were blindsided by a turn of events that was clearly anticipated by the financial markets. Commodities, stocks, exchange rates, credit spreads, and the yield curve were all warning policy makers of the risk of excessive interest-rate increases as early as October, yet those signals were mostly ignored by Fed officials until after their meeting in mid-December. Even the macroeconomic concerns cited by Fed Chairman Jerome Powell at the most recent press conference—weak growth in China and Europe, as well as a faltering U.S. housing market—were all evident months ago.

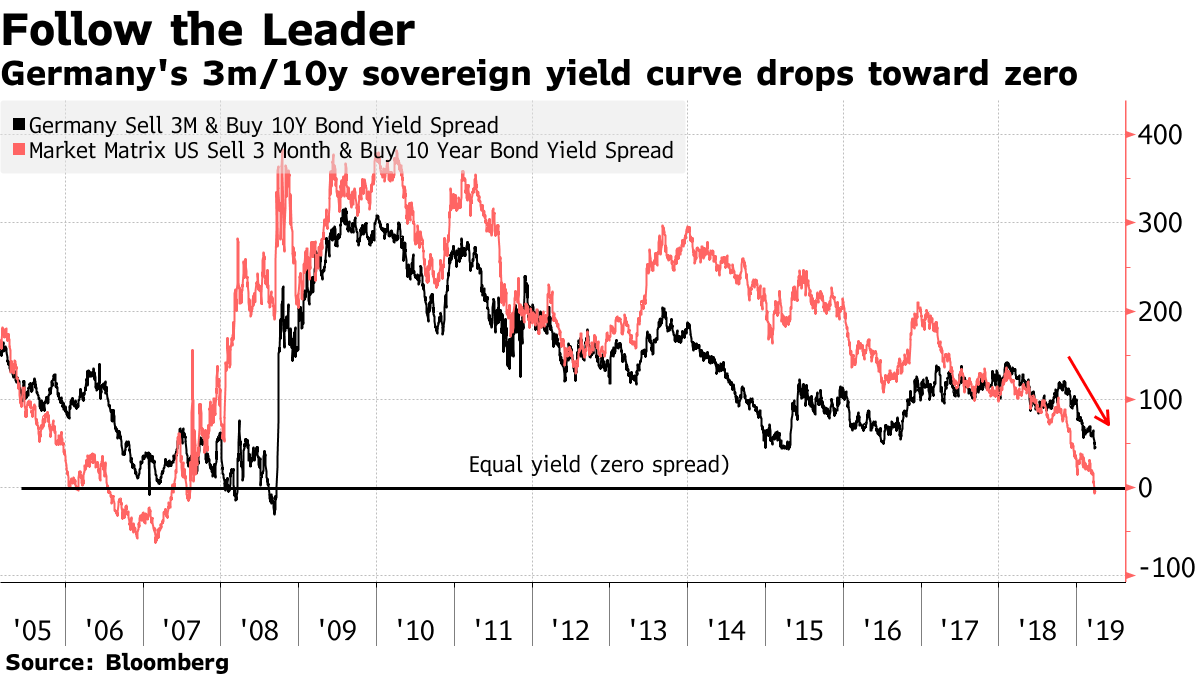

Now that Fed officials' economic outlook has caught up with that of investors, the question becomes whether it's too late to fix their mistake. The yield curve has inverted; manufacturing, housing, and retail data have all been soft; and economic conditions abroad are even weaker than in the U.S.

The Fed now expects to keep interests rates more-or-less steady through at least the end of 2021, but markets remain unconvinced. "Stocks are up, but credit spreads are still elevated, especially for the riskiest borrowers, and commodity prices are still down," Matt wrote.

Read the rest of Matt's economy column here.