WSJ also thinks there will be fresh highs in April:

Calendar Flipping to April Bodes Well for Stocks

Before some investors ‘sell in May and go away,’ stocks typically rise in April

History bodes well for stocks in April, a bullish sign for investors as major averages inch toward record highs.

The S&P 500, which is off to its best start to a year since 1987 through Monday, has shaken off recent market jitters over a looming U.S. recessionand slowing global growth. A cautious Federal Reserve and thawing U.S.-China trade relations have helped propel stocks in 2019 following a rocky fourth-quarter selloff, putting both the broad index and the Dow Jones Industrial Average back within 2.2% and 2.1%, respectively, of their all-time highs.

As investors continue to plow more money into U.S. stocks, the optimism comes just in time for the start of a new month that typically delivers robust returns.

The S&P 500, which has averaged a gain of 2.2% in April since 2006, has only declined once since then in 2012, according to Dow Jones Market Data. Meanwhile, the Dow industrials have advanced every April since 2006, averaging a gain of 2.3% for the month in that span, the data showed.

Some analysts attribute typical April gains to the old adage of "sell in May and go away," which refers to a six-month period that historically has been a weaker time to own stocks amid the summer doldrums. April is the final month of a sixth-month period from November to April when investors tend to hold more cyclical stocks linked to the domestic economy that are more sensitive to changing conditions, some analysts said.

Cyclical sectors have powered the S&P 500 higher in April over the past three decades. Energy, materials, industrials and financials are four of the top five best-performing sectors in April and have each posted average monthly gains of at least 1.9% going back to 1990, according to data from CFRA Research.

Some of April’s gains are also driven by capital inflows from Americans filing during tax season. Another reason why April outperforms: Portfolio managers rebalancing at the end of the first quarter often sell poor-performing stocks, which sets up more buying opportunities in April, some analysts said.

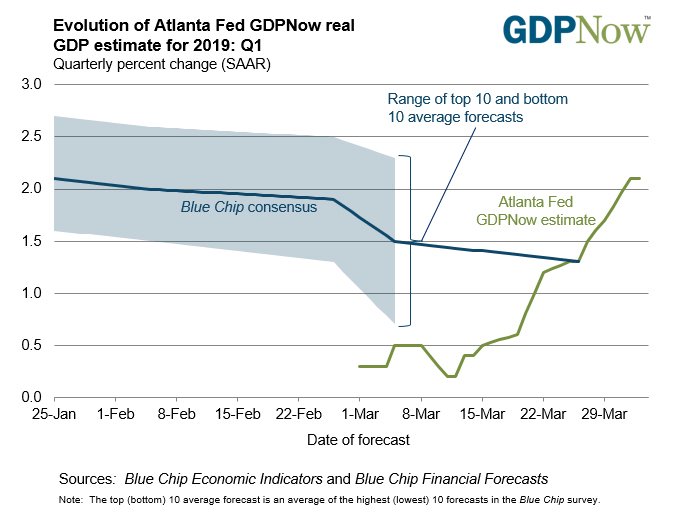

A batch of potential catalysts could help propel indexes to new highs, or leave room for pause after the stock market’s strong first-quarter rally. Investors will be watching Friday’s monthly jobs report for any signs of a further slowdown in job creation after last month’s data showed a sharp downturn in hiring in February. Meanwhile, stocks face a rare projected contraction in first-quarter corporate earnings.

Even so, some analysts are still optimistic. Since 1950, April has tallied gains 15 of 19 years when January, February, and March were all positive, and the average gain in April for those 15 years was 2.6%, according to LPL Financial.