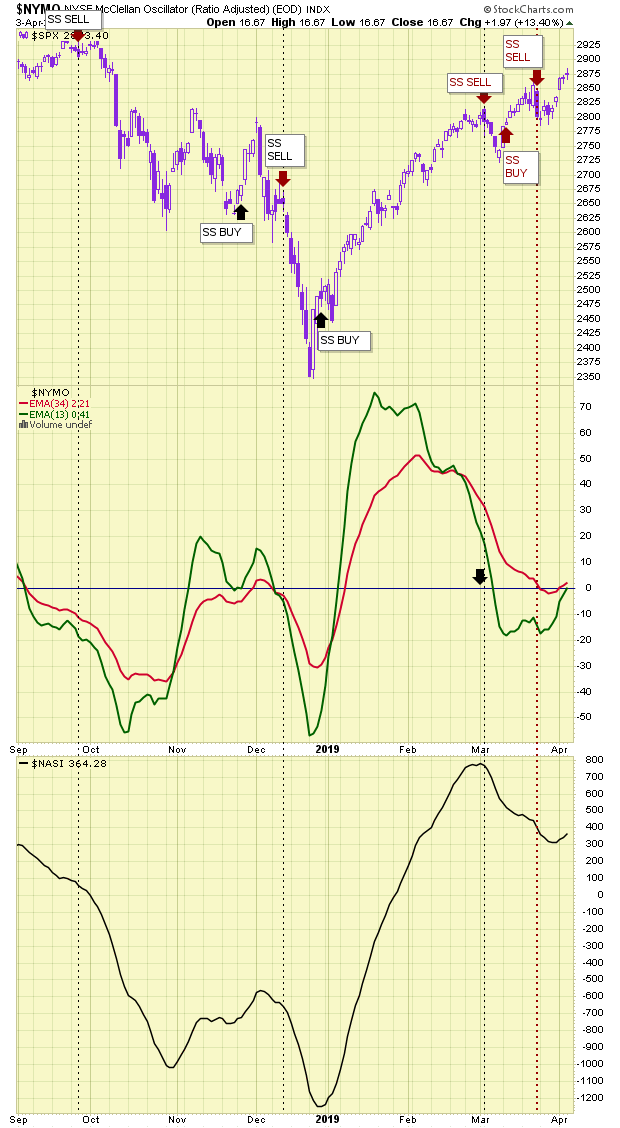

Much more energy today as the markets struggled and labored to eke out minor gains.

As I wrote yesterday, I am looking for a ST top today (was it made already?) or tomorrow.

Note NASDAQ achieved its Golden Cross today.

You must also note that the 50ma above the 200ma does not guarantee markets will be UP all the time, LOL!

In fact, SP can decline to as low as 2800 and the 50ma will still be above the 200ma

Ditto for NASDQ

The markets took off last night after another bit of GOOD TRADE NEWS (this is the # 1051 report of good trade news) but

were soon disappointed when even Larry backtracked:

I told you the Chinese and North Koreans are playing for time; they can wait but the US electoral calendar cannot.

China now has a strong market and even stronger economy than a few months back.

They will stall and stall as much as possible as they try to put the squeeze on the US and will come out with a wimpish deal

that means zilch.

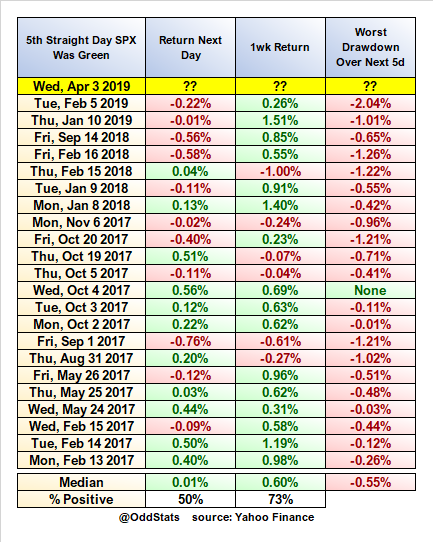

If there is not a ST top this week, then I am forecasting a move above SPX 2900 but I don't see any sustained rally until at least AFTER Q1 earnings.