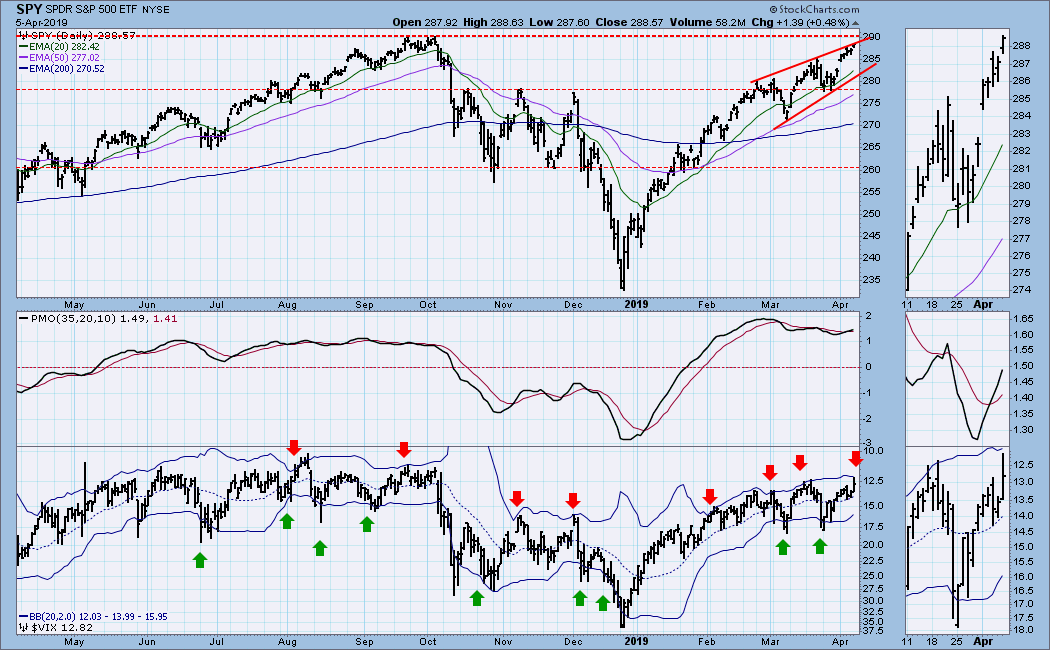

With NEW HIGHS around the bend, there is the odor of irrational exuberance and it could also be another potential BULL TRAP waiting to spring on the careless trader.

Technically, the market is still very strong as it grinds higher and those who still characterize this as a Bear Market rally will have to throw away that if there is a new SPX record high.

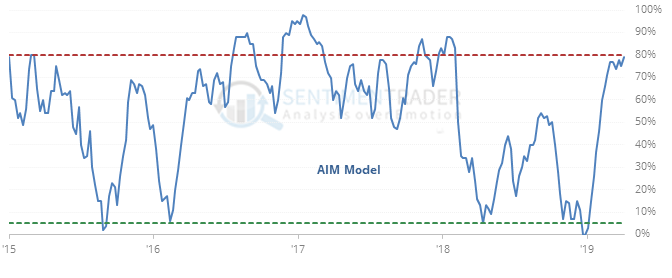

In terms of Sentiment, it feels and look as it is at en extreme level but the market can still spike up another 2 or 3 %; actually, any market can do that but what is needed to take this to the magic SPX 3000 level is a catalyst or two. Maybe great earnings are coming up for Q 2019; maybe finally there is a definite Trade Deal or even a minor one that can satisfy everyone, even temporarily, or something out there that can give some more oomph to the rally.

I don't expect that because during the past 2 to 3 weeks this market has been behaving as one nearing a top rather than one in the middle to later stages that is running on all cylinders.

I am about 90% cash in my LT Portfolio with few hundred total shares in MICROSOFT (since long ago!), MERCK, and NESTLE.

Very tempted to close MSFT & MERCK now but that might be after SPX 2900; will not close NESTLE, had it since 2009 on a recommendation from a friend and it just keeps rising, even if slowly.

My QQQ PUT holding is down 39% but I have made much more profit in NQ so not surrendering as yet. And, I am trading 10-lot NQ longs, just feels much better doing that with lots of QQQ puts in the basket.

It's Friday. It's $SPX. It's a 7 day win streak. And 67% of the time since electronic trading began in 1983, that meant the next week was green too.

By the way, weekly initial jobless claims were 202,000 yesterday; the lowest they've been since the first week of December, 1969... ...the week a recession began. [source: Federal Reserve/NBER]