"They" say the FED's usage of the word "Transitory" to describe low inflation is the main reason for the decline that started during

Powell's press conference. Loads of feces, BS, utter crap!

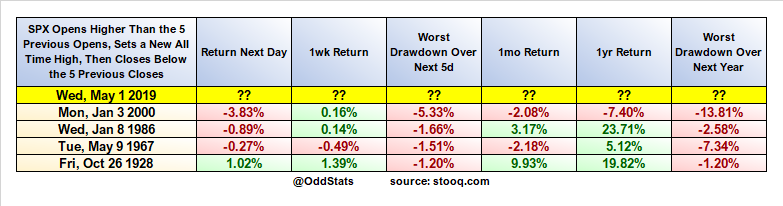

This is a pull-back from extreme sentiment levels but I still think the final leg up will start soon and then the market top will be formed.

BUT, you got to go with the markets, not fight it, so we will see if the market decides it has had it with the historic rally since December 24th 2018 or it wants to make a higher record high before the inevitable drop of at least 10%.

"Transitory" inflation! Poppycock!

- Fed Chairman Jerome Powell described low inflation as likely “transitory,′ not ’persistent.”

- Powell, speaking after the Fed’s meeting, said the central bank would consider policy moves if inflation was persistently low.

- The markets have been pricing in a Fed rate cut, and Powell’s comments suggest the Fed is not considering a cut at this point.

- https://www.cnbc.com...r-eyebrows.html

Edited by dTraderB, 01 May 2019 - 07:41 PM.