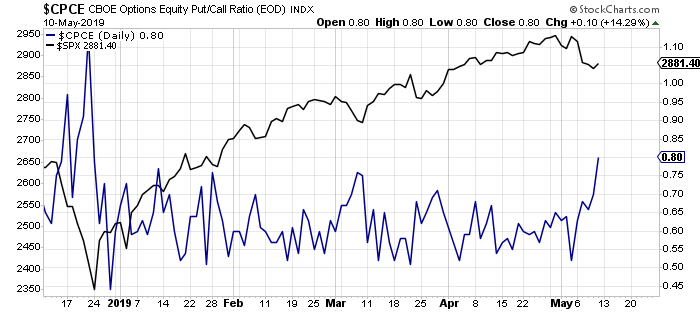

Equity put/call ratio (blue) which was 80% Friday with SPX (black)

Posted 11 May 2019 - 09:54 AM

Equity put/call ratio (blue) which was 80% Friday with SPX (black)

Posted 11 May 2019 - 10:32 AM

Posted 11 May 2019 - 05:17 PM

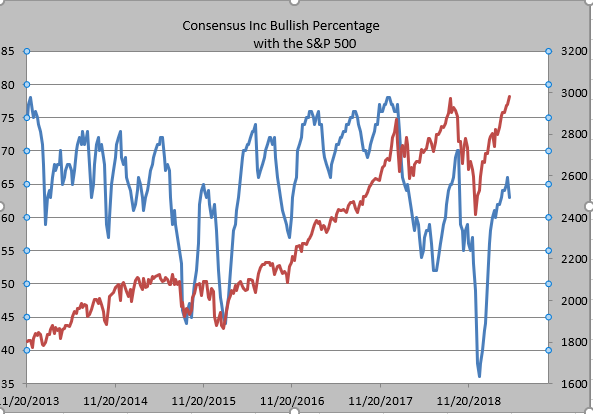

Consensus pulled back to 63. First downtick since March when it downticked by 1 (this time by 3)

Posted 12 May 2019 - 06:41 AM

War of trash talk continues....the US election ticking clock is the biggest advantage the Chinese have; also control of the YUAN....they can weaponize it quite quickly; ditto for their US Bonds holding...

Trump tells China to ‘act now’ on trade or face a ‘far worse’ deal in his second term

https://www.cnbc.com...econd-term.html

Posted 12 May 2019 - 06:44 AM

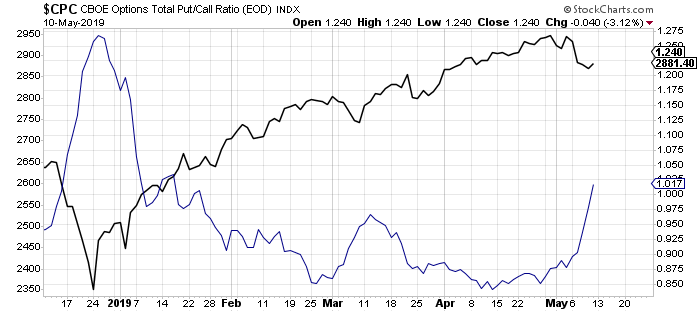

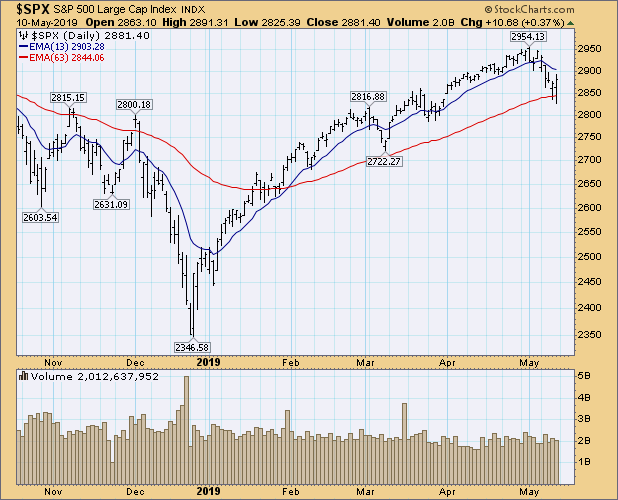

Big outside day Friday. Does low need to be tested?

Because you have identified that worry, it must happen. Gap up Monday, then put in a call to your expert friend Phil. Wednesday he may respond.

Posted 12 May 2019 - 10:41 AM

Forecasts galore, from one extreme to the other; here is another:

"I will simply say that the market remains in an immediate bearish posture for as long as we remain below 2925SPX. If the bulls are able to take us back over the 2925SPX region, then they can open the door back up towards the 3000 region before the major top is struck.

Yet, whichever path the market takes over the coming week or two, I can assure you that the whipsaw will not cease, so please expect it and prepare for it during this topping process. And, should we see a sustained break down below 2785SPX, that can open the trap door for a waterfall event of several hundred points, based upon the structure with which we break that level.

Stay tuned, as the last half of 2019 looks to be shaping up for a wild market event, with a major buying opportunity to be seen. In fact, this will likely be your last buying opportunity before the market rallies to the 3500-4000 region I expect to see as we look towards the 2022/23 time frame."

https://seekingalpha...rning-listening

Posted 12 May 2019 - 10:49 AM

Tons of analysis on TRADE TALKS; here is a good one:

"What went wrong? Clearly, all the positive talk from both the U.S. and China painted a much too rosy picture of trade negotiation progress. From the Wall Street Journal (Lingling Wei and Bob Davis): "The new hard line taken by China in trade talks - surprising the White House and threatening to derail negotiations - came after Beijing interpreted recent statements and actions by President Trump as a sign the U.S. was ready to make concessions, said people familiar with the thinking of the Chinese side."

"…The U.S. thought China agreed to detail the laws it would change to implement the trade deal under negotiation. Beijing said it had no intention of doing so…" "The hardened battle lines were prompted by Beijing's decision to take a more aggressive stance in negotiations… They said Beijing was emboldened by the perception that the U.S. was ready to compromise. In particular…, Mr. Trump's hectoring of… Chairman Jerome Powell to cut interest rates was seen in Beijing as evidence that the president thought the U.S. economy was more fragile than he claimed."

In the most comprehensive and insightful article on the subject I've read so far, a Reuters article (David Lawder, Jeff Masson, Michael Martin, Chris Prentice, Dan Burns, Jing Xu and Ben Blanchard) presented compelling analysis:

"The diplomatic cable from Beijing arrived in Washington late on Friday night, with systematic edits to a nearly 150-page draft trade agreement that would blow up months of negotiations between the world's two largest economies, according to three U.S. government sources and three private sector sources briefed on the talks. The document was riddled with reversals by China that undermined core U.S. demands, the sources told Reuters. In each of the seven chapters of the draft trade deal, China had deleted its commitments to change laws to resolve core complaints that caused the United States to launch a trade war: Theft of U.S. intellectual property and trade secrets; forced technology transfers; competition policy; access to financial services; and currency manipulation."

Why would Beijing return a 150-page draft with "systematic edits" that it surely knew would risk blowing up months of negotiations? "Liu last week told Lighthizer and Mnuchin that they needed to trust China to fulfill its pledges through administrative and regulatory changes… Both Mnuchin and Lighthizer considered that unacceptable, given China's history of failing to fulfill reform pledges."

The U.S. was demanding that China change existing laws to incorporate trade concessions along with agreeing to "an enforcement regime more like those used for punitive economic sanctions - such as those imposed on North Korea or Iran - than a typical trade deal."

China views U.S. demands to change laws as an infringement of national sovereignty. And I can imagine Chinese officials have utter disdain for a U.S.-dictated "enforcement regime." Xi and Putin's private talks - and close personal relationship - surely coalesce around their mutual revulsion to U.S. hegemony including its aggressive command of international organizations and authority over punitive economic sanctions. The U.S. was pushing vehemently for concessions the Chinese likely considered red line issues. Beijing made the calculated decision to push back. Have increasingly contentious U.S. military excursions in the Taiwan Strait and South China Sea been a factor? Less than a trust-building exercise. Huawei? How much is Maduro on the hook to the Chinese? Kim Jong Un (aka "Rocketman") up to his old tricks mere coincidence?"

https://seekingalpha...ntary-deal-deal

Posted 12 May 2019 - 11:03 AM

I don't believe CHINA can bear a full-scale trade war onslaught from the US & EUROPE; however, the Chinese have time on their side as the election season begins in full earnest in the US. Of course, the Chinese are playing for time, they don't have that election pressure, hence they are trying to run down the clock for at least the next 3 to 4 months. Here is another opinion:

Game Of Thrones

Just as Jon Snow faced the "White Walkers" in the battle to save civilization, Trump has squared off with China again over trade.

Most of the comments I have read about the ongoing "trade deal" negotiations are, in my opinion, wrong. The general belief is that China "wants" a deal with the U.S. and Trump has the upper hand in this matter. To wit a recent comment by Kevin Giddis via Raymond James:

I believe this to be incorrect and I laid out my reasoning Tuesday in "Trade War In May, Go Away:"

"It doesn't help when the Chinese reportedly backed away from issues important to the U.S. just days before they are set to meet to negotiate a deal. Could this be as simple as a 'clash of culture,' or the way each side has postured themselves to get a deal done?"

"The problem is that China knows time is short for the President and subsequently there is 'no rush' to conclude a 'trade deal' for several reasons:

China is playing a very long game. Short-term economic pain can be met with ever-increasing levels of government stimulus. The U.S. has no such mechanism currently, but explains why both Trump and Vice-President Pence have been suggesting the Fed restarts QE and cuts rates by 1%.

The pressure is on the Trump Administration to conclude a "deal," not on China. Trump needs a deal done before the 2020 election cycle AND he needs the markets and economy to be strong. If the markets and economy weaken because of tariffs, which are a tax on domestic consumers and corporate profits, as they did in 2018, the risk off electoral losses rise. China knows this and are willing to "wait it out" to get a better deal.

As I have stated before, China is not going to jeopardize its 50- to 100-year economic growth plan on a current President who will be out of office within the next 5 years at most. It is unlikely, the next President will take the same hard-line approach on China that President Trump has, so agreeing to something that is unlikely to be supported in the future is unlikely. It is also why many parts of the trade deal already negotiated don't take effect until after Trump is out of office when those agreements are unlikely to be enforced.

Even with that said, the markets rallied from the opening lows on Monday in 'hopes' that this is just part of Trump's 'Art of the Deal' and China will quickly acquiesce to demands. I wouldn't be so sure that is case."

Doug Kass agreed with my views yesterday:

"It was never likely that tariff pressures were ever going to force China to succumb and altar deep rooted policy and the country's 'evolution' and planned economic growth strategies.

Trump's approach failed to comprehend the magnitude of the tough structural issues (that were never going to be resolved with China) and, instead, leaned on a focus of the bilateral trade deficit. Technology transfer, state-sponsored industrial policy, cyber issues and intellectual property theft were likely never on the table of serious negotiation from China's standpoint and despite Trump's protestations that discussions were going well.

As I have suggested for months, the unilateral imposition of tariffs will cause more economic disruption than the Administration recognizes (in our flat and interconnected economic world):

China's role in world trade is important - the country is the third largest exporter in the world.

Specifically, China is a prime source of cheap, imported goods for American consumers.

China is the largest owner of U.S. debt.

Last night at a political rally in the Panhandle of Florida the president said that "we don't have to do business" with China. That statement is short-sighted.

https://seekingalpha...s-winter-coming