from one of my top 5 Twitter Accounts:

Barrons would like us to keep calm. Of course maybe that's cuz a month ago they told us the bull market was unstoppable?

Edited by dTraderB, 18 May 2019 - 07:38 AM.

Posted 18 May 2019 - 07:35 AM

from one of my top 5 Twitter Accounts:

Barrons would like us to keep calm. Of course maybe that's cuz a month ago they told us the bull market was unstoppable?

Edited by dTraderB, 18 May 2019 - 07:38 AM.

Posted 18 May 2019 - 07:41 AM

Did not realize SPX closed below the 50ma

So, Monday will close up on the day?

Another favorite:

This is the first time $SPX has finished a week under its own 50d moving average after closing above it the week before since....

October 12, 2018

[data @YahooFinance]

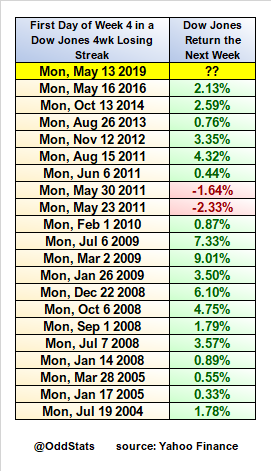

This is the 1st time since Trump was elected that the Dow Jones has closed lower than the week before for four straight weeks. Here's how the Dow did the week after each of the last 20 losing streaks of four weeks or more. [data @YahooFinance]

Posted 18 May 2019 - 07:45 AM

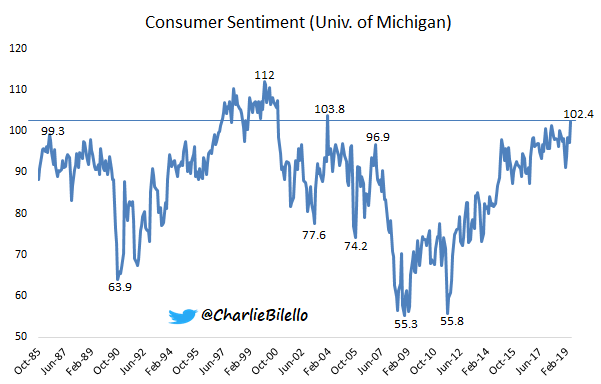

NOTE from me: As is the case with overbought and oversold that can continue for days & weeks, Consumer sentiment and market sentiment can be at extreme levels for days & weeks & months....e.g. 2000, 2007, 2018/19

Verified account @charliebilello 21h21 hours ago

US Consumers have not been this optimistic since January 2004.

Last 3 Economic Cycles... 1) 2001-07: Consumer Sentiment peaked at 103.8 in Jan '04. Recession started Dec '07. 2) 1991-01: Consumer Sentiment peaked at 112 in Jan '00. Recession started Mar '01. 3) 1982-90: Consumer Sentiment peaked at 101 in Mar '84. Recession started Jul '90.

Edited by dTraderB, 18 May 2019 - 07:46 AM.

Posted 18 May 2019 - 07:53 AM

Lots of trash talk from both sides; this may not necessarily lead to a long trade war but it could be they are nearer to a deal as the situation deteriorates since.... as it becomes more painful for both sides there is more motivation to get a deal, especially for President Trump with an election clock ticking.

So, warning again to shorts: do not be caught with a trade deal surprise! Markets will zoom 5% on any deal or semblance of a deal, even a fakish deal.

Here is one of the few unofficial official Twitter sources:

Trump delays EU, Japan auto tariffs for 6 months since there's little chance of reaching a China-US trade deal in 6 months. The two sides have serious differences with worsening political atmosphere. Negotiation terms have been laid bare to the public, making compromise difficult

China will certainly retaliate for barbaric suppression Huawei received. It's a unanimous attitude of officials and ordinary people. I believe Beijing is selecting retaliation targets and approaches, minimizing damage to itself and not weakening confidence in China's opening up.

Shanghai stock exchange index dropped 2.48% Friday due to worry of an overall escalation of trade war, but Huawei related stocks soared. This is vote of confidence of the market on Huawei's long prepared back-up plan. Huawei's US supplies will become real victims.

Edited by dTraderB, 18 May 2019 - 07:54 AM.

Posted 18 May 2019 - 07:57 AM

You see why I warn BEARS to be careful!

Even a one-line suggestion of consideration of lifting tariffs, even partially, even consideration, will lead to a massive rally:

Pence advised Trump to ditch the tariffs after his recent swing to Midwestern states -- Lighthizer wanted them lifted to clear the decks for China fight, per two people familiar w/ the situation. Everybody else was taken by surprise -- especially Peter Navarro, they said.

Posted 18 May 2019 - 10:24 AM

Still one of the best:

Weekly Sector Rankings Show a Defensive Market

The table in Chart 1 plots the relative performance of the eleven market sectors for the week. And they show a generally defensive market. That can be seen by the fact that REITs, utilities, and consumer staples are the three top sectors for the week. At the same time, the weakest sectors are financials, industrials, cyclicals, technology, and materials.

https://stockcharts....ive-market.html

Posted 18 May 2019 - 10:30 AM

One reason why are I not getting too bearish, unless SPX 2800 is taken out, is that one has to be realistic: if the market is finding support at SPX 2800 in a Trade Wart then why would it go even lower when this issue is resolved, even partially?

If the market goes down because of economy, earnings, etc then one would have to factor in these influences but until that happens one has to be realistic and sum it up as: market wants to go up, with minor pull-backs. Having said all that over the weekend, S&P Futures could drop by 50 points on Sunday evening as the Trade War repercussions finally hit home.

DP WEEKLY WRAP: Double Top Scenario Still Fits

May 17, 2019 at 05:40 PM

BROAD MARKET INDEXES SECTORS

https://stockcharts....still-fits.html

Posted 18 May 2019 - 10:32 AM

This Permabull still bullish:

S&P 500 Weekly Update: Selling Stocks Due To The Tariff Issues May Be Repeating The Same Mistake Made In 2018

https://seekingalpha...stake-made-2018

Posted 18 May 2019 - 10:34 AM

Time running out for the SPRING crash, here comes Memorial Day, soon!

Spring Crash Potential Not About China

https://seekingalpha...potential-china

Posted 18 May 2019 - 10:38 AM

ST thinks there is weakening of sentiment:

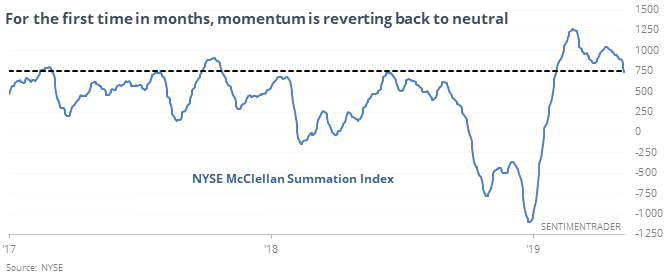

Summation finally weakens

We’ve discussed the McClellan Oscillator and Summation Indexes a lot in recent months, because they have been showing notable readings of momentum. That’s starting to ease with the long-term Summation Index, which dropped below 750 for the first time in months, ending its 2nd-longest streak above that level in 57 years.

Like most other displays of extreme momentum, these didn’t roll over often, and when they did, the losses tended to be muted.

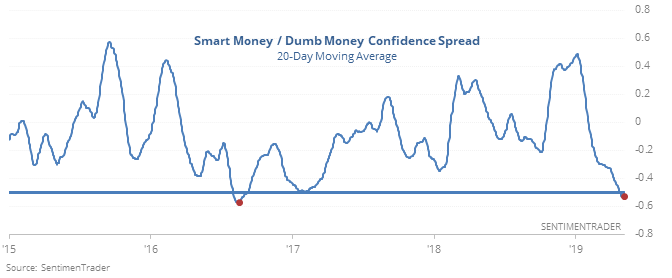

Sentiment is curling

The spread between Smart and Dumb Money Confidence reached an extreme months ago and has stayed there. Only now it is beginning to curl back in the other direction, with the 20-day average moving up from an extreme level.

That has preceded weak short-term returns when it triggered in the past.

https://www.sentimen...ment-is-curling