SLV finally got bopped.

#1

Posted 15 December 2006 - 02:19 PM

#2

Posted 15 December 2006 - 11:33 PM

#3

Posted 16 December 2006 - 04:04 PM

Silver is one of my favorite investment themes. I accumulated a lot of silver bullion in 2004 (buying in a range $6.5-7.5) and currently hold a large quantity of 1 kg silver bullion bars at a jeweler in Birmingham (UK). I also bought a bunch of 1 kg Kookaburra silver coins.

Silver Coins

See my Avatar? Guess where it comes from.

Here's a good overview on silver investments.

Buy Silver

I plan to buy an initial swing position in SLV next week. The short plays are sweet when silver corrects, but I am a bull and would rather buy the corrections.

cheers,

john

#4

Posted 16 December 2006 - 09:58 PM

#5

Posted 17 December 2006 - 06:01 AM

Thank you for the comments. I am also a bullion bull. I continue to hold my 100 ounce JM bars purchased $3-5 per ounce. I thought about selling on the recent spike, but think it is prudent to wait.

I have been a silver and gold futures and bullion trader since 1969...you ever hear of JR Simplot the potato king who invented the machinery and process that resulted in the US military and fast food servers using dehydrated spuds? He and his friends included me in a weekend presentation in that time period that spoke to the dynamics related to precious metals...I was thankful to be prepared with trading and fundamental knowledge when the Hunt brothers action heated up the gold and silver market.

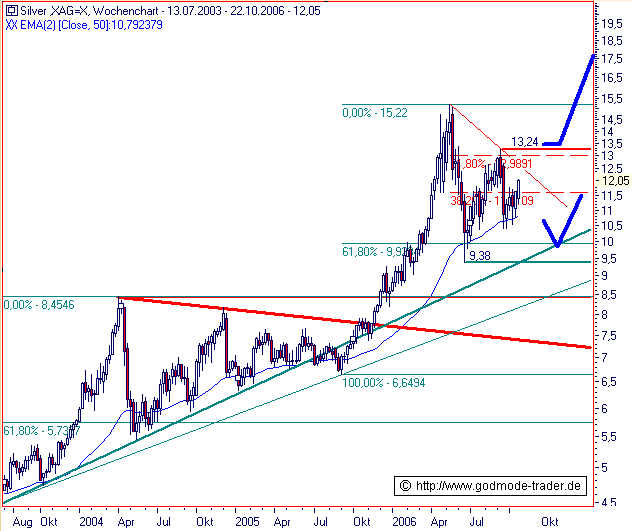

this is a link to one of Fib's charts showing the partial silver history ...the peak period prior is not shown on this chart -

Edited by hiker, 17 December 2006 - 06:05 AM.

#6

Posted 17 December 2006 - 06:43 AM

SLV>>>>>>>>>>>>>>110? or may follow FXE

I doubt we would break $12 here. I'm a buyer on Monday on any further weakness from Friday's close (1/2 swing position trade) and will pick up the remainder later in the week.

2007 will be a good year for precious metals IMO.

Timing for a high and a major top to sell into is Dec. 2007. My silver target is +$20. The first major wave high for this silver bull is probably ~$35. I don't when that might happen though. But +$20 in the coming year seems very possible.

cheers,

john

PS. Godmode is an excellent site for its TA take. I like to reference it because they always give two possibilities. Their charts and lines are very clean. I used to follow Mathias and his ewave before he went to subscription.

#7

Posted 17 December 2006 - 07:12 AM

Thank you for the comments. I am also a bullion bull. I continue to hold my 100 ounce JM bars purchased $3-5 per ounce. I thought about selling on the recent spike, but think it is prudent to wait.

Ah, the gold and silver bugs come out of the closet!

I have been a silver and gold futures and bullion trader since 1969...you ever hear of JR Simplot the potato king who invented the machinery and process that resulted in the US military and fast food servers using dehydrated spuds? He and his friends included me in a weekend presentation in that time period that spoke to the dynamics related to precious metals...I was thankful to be prepared with trading and fundamental knowledge when the Hunt brothers action heated up the gold and silver market.

So you had some help from the Illuminati? Geez, I had to figure this stuff out on my own using the internet!

I was too young to appreciate the 70s PM bull, but I caught the bug in early 2001, it all started with that chad count if I remember ...

cheers,

john

Illuminati

#8

Posted 18 December 2006 - 07:30 AM

Edited by hiker, 18 December 2006 - 07:39 AM.

#9

Posted 02 January 2007 - 08:15 AM

I plan to buy an initial swing position in SLV next week.

I went long the week of the 18th. Entered SLV about 12.5.

Next key level to watch is ~ $13. Once above there, it should become future support.

cheers,

john

Edited by SilentOne, 02 January 2007 - 08:16 AM.

#10

Posted 17 January 2007 - 04:08 PM

cheers,

john