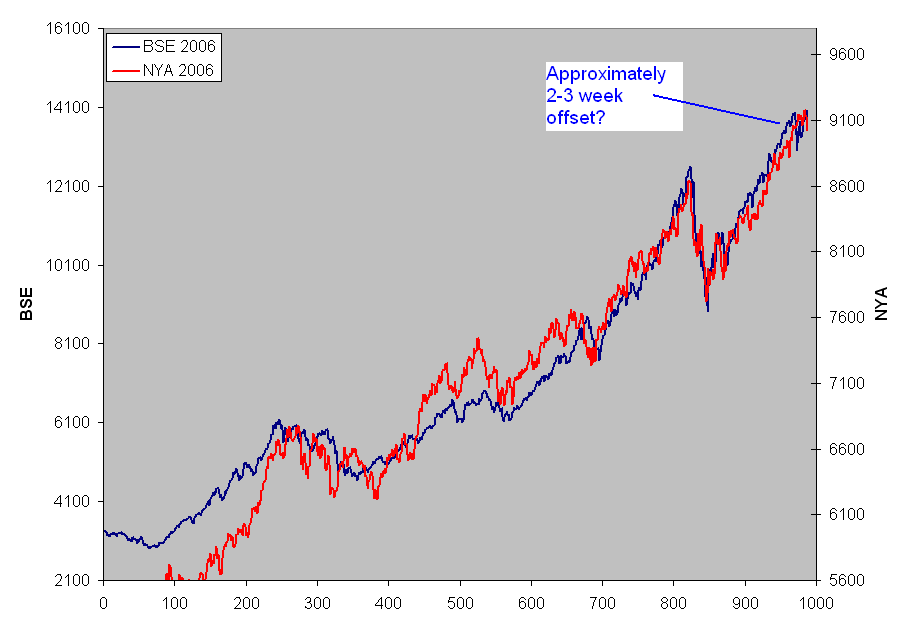

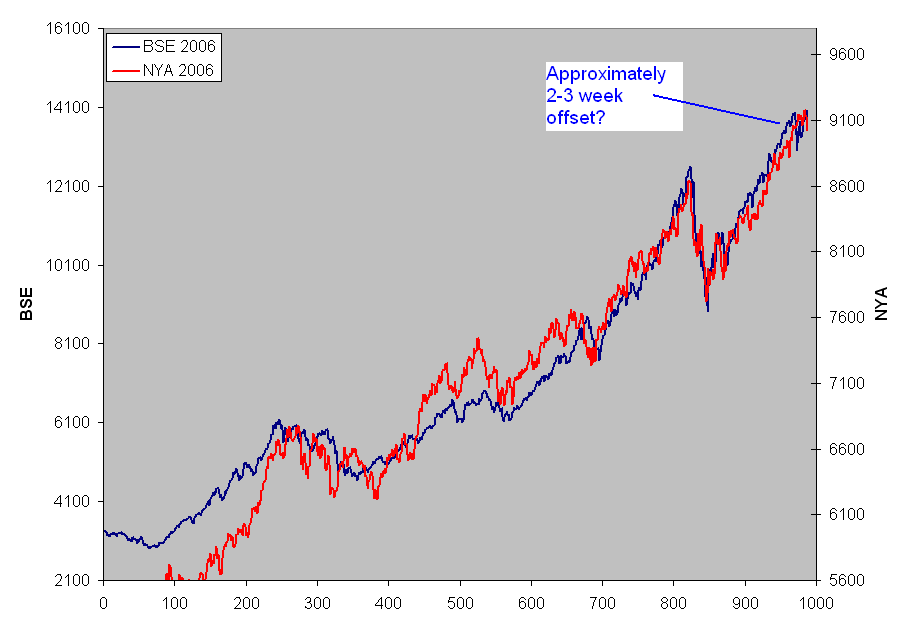

I imagine its due to the x-mas light holiday trading. But if the NYA is to "catch-up" pattern wise, we should see it hit NYA around 8700 to 8800 shortly.

Posted 05 January 2007 - 07:38 PM

Posted 05 January 2007 - 07:42 PM

Posted 05 January 2007 - 07:48 PM

Edited by CLK, 05 January 2007 - 07:50 PM.

Posted 05 January 2007 - 07:56 PM

Dcengr,

I just don't get the huge ramp in the NDX generals and the CME's.

I'm aware that the leaders top first then the market, but to run

back against the indices this much ?

Can you plot a chart of a custom mix of those against the market

compared to previous tops ?

RIMM acts like it wants to run to 160.

Posted 05 January 2007 - 08:17 PM