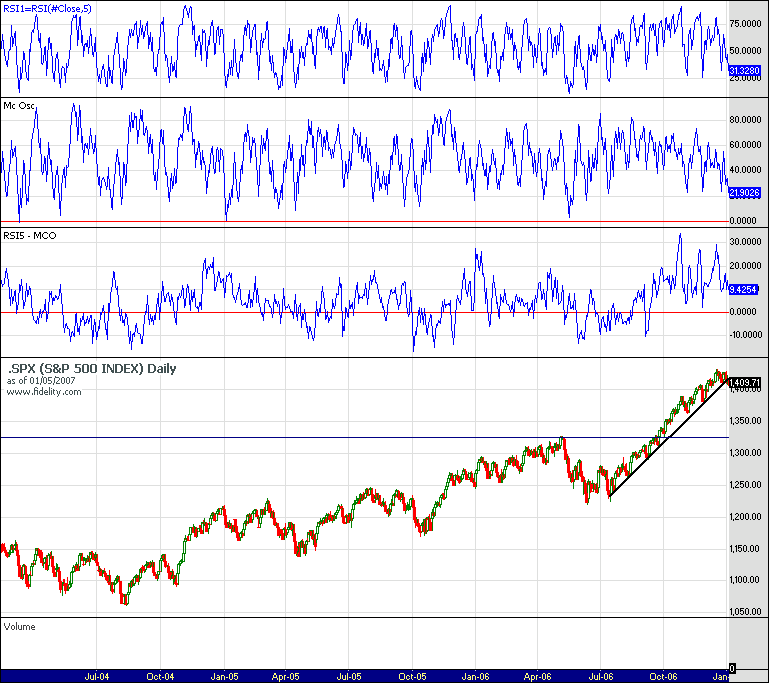

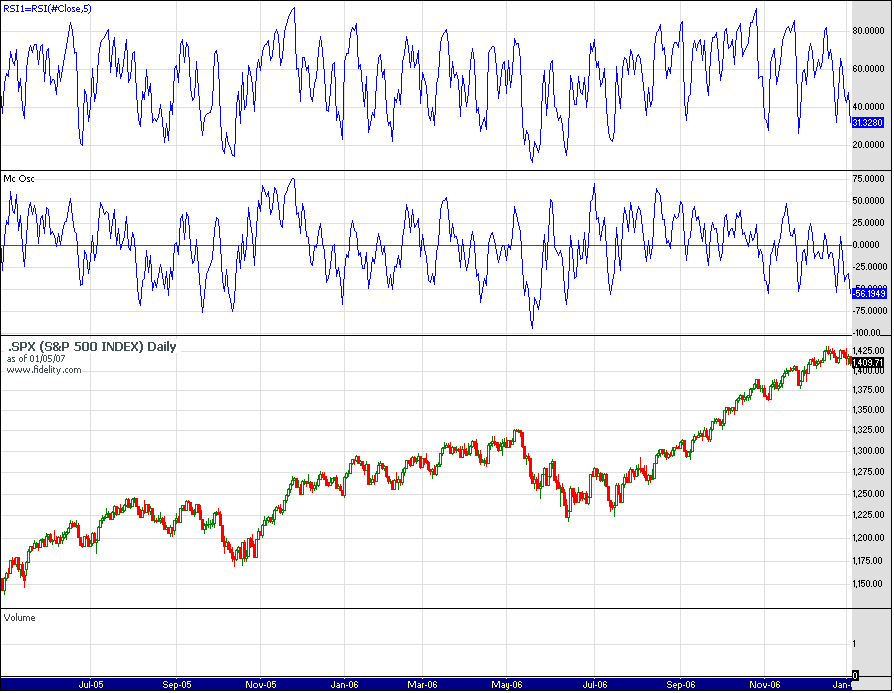

Realize one is constructed simply from the RSI formula off the index price only, while the other is constructed from the A-D line of the SPX 500 components using the MCO formula..

Whats just as interesting is if I take RSI20 of the price, I get a shape thats similar to the McSum... though its not as tight fitting.

Look here, seems to work for everything...

I must investigate the reason for this relationship... will report on it later.

http://stockcharts.com/c-sc/sc?s=$NAAD&p=D&yr=3&mn=0&dy=0&i=p32054617033&a=94068090&r=7983.png

http://stockcharts.com/c-sc/sc?s=$NYAD&p=D&yr=3&mn=0&dy=0&i=p29635362203&a=91163974&r=3237.png

Edited by dcengr, 05 January 2007 - 11:08 PM.