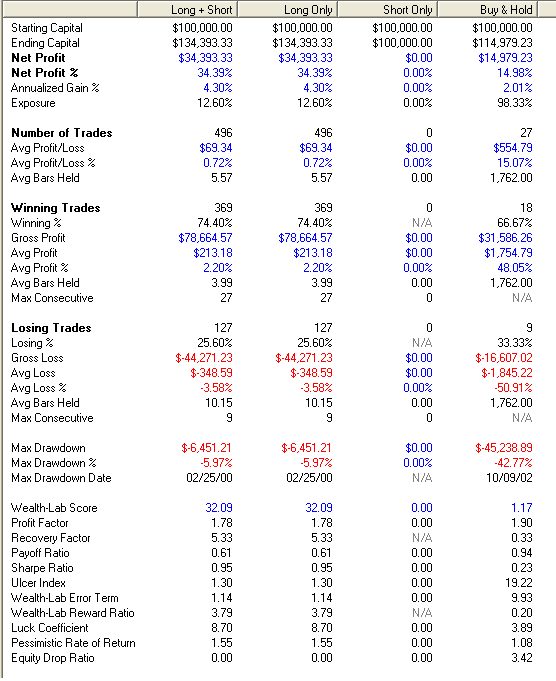

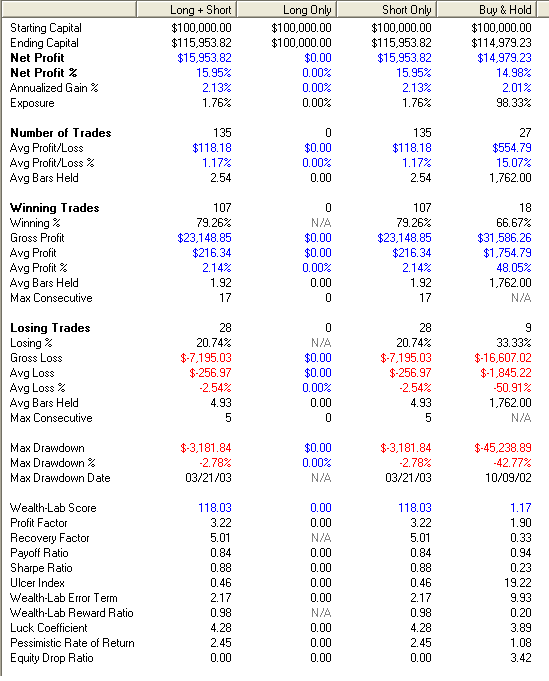

Used my RSI5 system (buy when RSI5 < 30 and price > 50MA, sell when RSI5 > 50) on a basket of ETFs.

The ETFs chosen were well known sector SPDR and others.

BBH BDH DIA HHH IWM MDY NYC OIH PPH QQQQ RKH RTH SMH SPY SWH TLT TTH XBD XLB XLE XLF XLI XLK XLP XLU XLV XLY

Applied the rules starting at 2000 (or whenever ETF started trading).

The rules state that I put $10,000 for each trade, maximum of 10 positions open at a time ($100k account). Stop loss is 10%, and time based exit is 30 trading days (ie get out no matter what).

Results are tabulated below. The results beat buy and hold, ofcourse. But whats interesting is the maximum drawdown, including the bear market, is -5.97%. Which is darn nice.