Interesting FF Sentiment Chart

#1

Posted 12 January 2007 - 10:25 AM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#2

Posted 12 January 2007 - 10:28 AM

#3

Posted 12 January 2007 - 10:58 AM

Be Sure to Perform Your Own Due Diligence

#4

Posted 12 January 2007 - 01:07 PM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#5

Posted 12 January 2007 - 04:56 PM

Are you sure it was "originally" posted by dcengr?Originally posted by dcengr

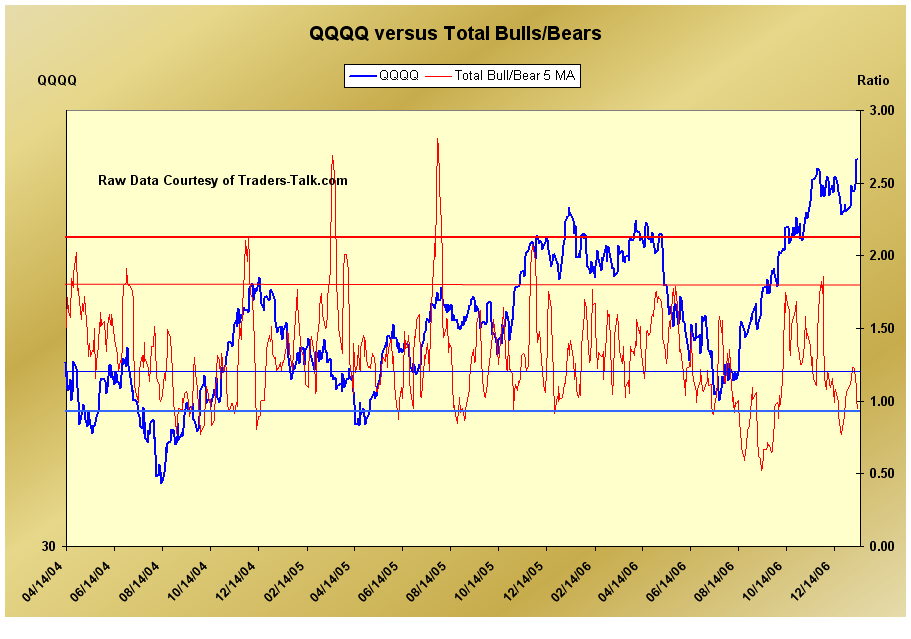

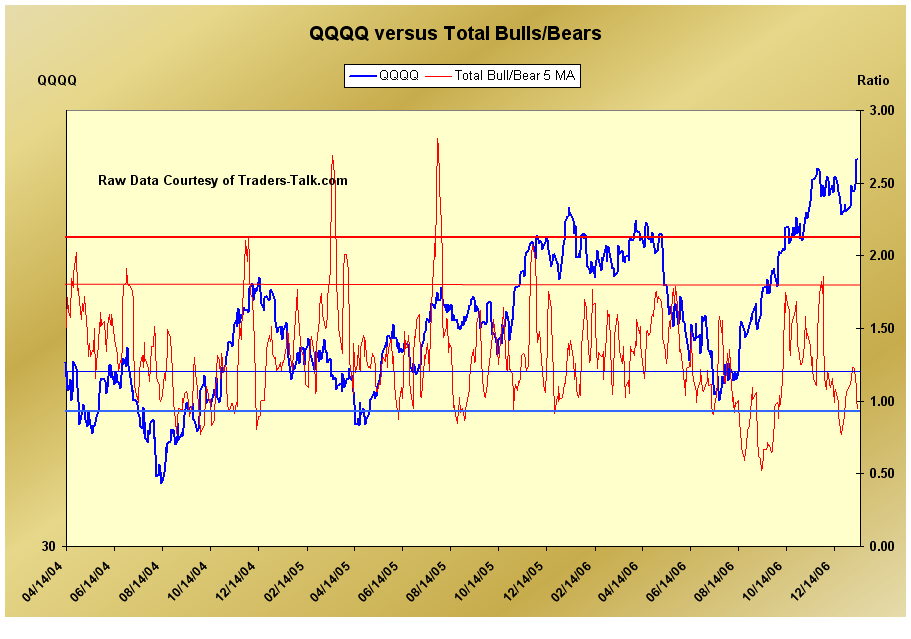

Are you sure that you constructed the data in its current form? Seems to me that the only difference is that you decided to use the QQQQ as a proxy instead of the originators used comparison of the SPX?You know how I construct that? I basically add the bull% from opinion polls and position polls. Then divide that with similar from bears. Then I take the 5MA of it.

Maybe a clarification is warranted on the difference?

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#6

Posted 12 January 2007 - 05:01 PM

Are you sure it was "originally" posted by dcengr?Originally posted by dcengr

Are you sure that you constructed the data in its current form? Seems to me that the only difference is that you decided to use the QQQQ as a proxy instead of the originators used comparison of the SPX?You know how I construct that? I basically add the bull% from opinion polls and position polls. Then divide that with similar from bears. Then I take the 5MA of it.

Maybe a clarification is warranted on the difference?

Fib

I believe that's my original construct. The chart looks familiar because the original data was provided by Mortiz. But he did not construct the data the way I did (since I have his original excel file, I should know!).

So yes, thanks to Randy for providing me the data

To further clarify, if you will read how I constructed the data, it should be clear. As far as I know, Randy's work was separated into opinion and position polls (thats what I saw anyways).

I also noticed that sentiment is much more geared towards Qs than SPX.

Edited by dcengr, 12 January 2007 - 05:07 PM.

#7

Posted 13 January 2007 - 11:02 AM

Edited by Rich, 13 January 2007 - 11:07 AM.

#8

Posted 13 January 2007 - 11:54 AM

Mark,

It's a little hard to see the correlation between the price and ratio.

Can you plot the 5-day forward slope of the qqqq price vs the bull/bear ratio? This would be just points corresponding to the day values. If you can't do the slope, the difference between two EMAs of the price might work. I would try 5- and 10-day EMAs.

Thanks,

Rich

I've been meaning to look at the polls like MCO/MSUM... What would be nice is if in that file library that Mark may make, we can contribute excel files of data such as this.

#9

Posted 13 January 2007 - 06:16 PM

Mark S Young

Wall Street Sentiment

Get a free trial here:

http://wallstreetsen...t.com/trial.htm

You can now follow me on twitter

#10

Posted 15 January 2007 - 10:03 PM

~Benjamin Franklin~