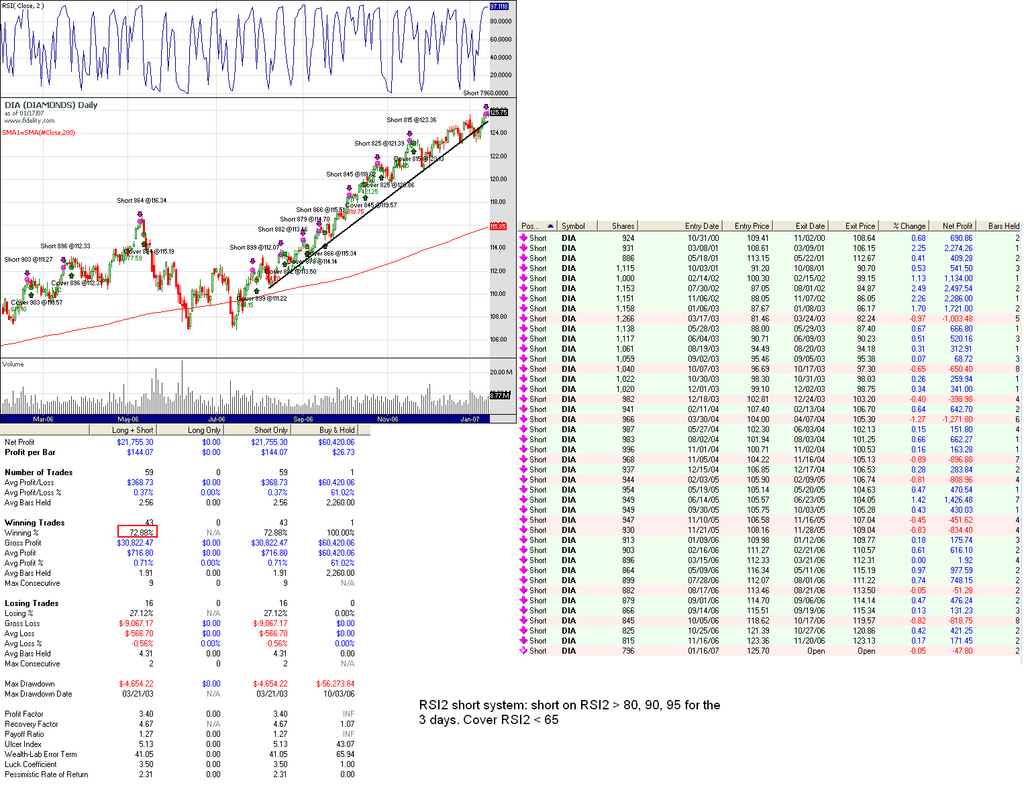

I'm not trading the Dow any more for a good while, not enough

volatility. I like choppy sideways trends.

I think we get a good bounce here but the Dow may not do much since it is still near the highs.

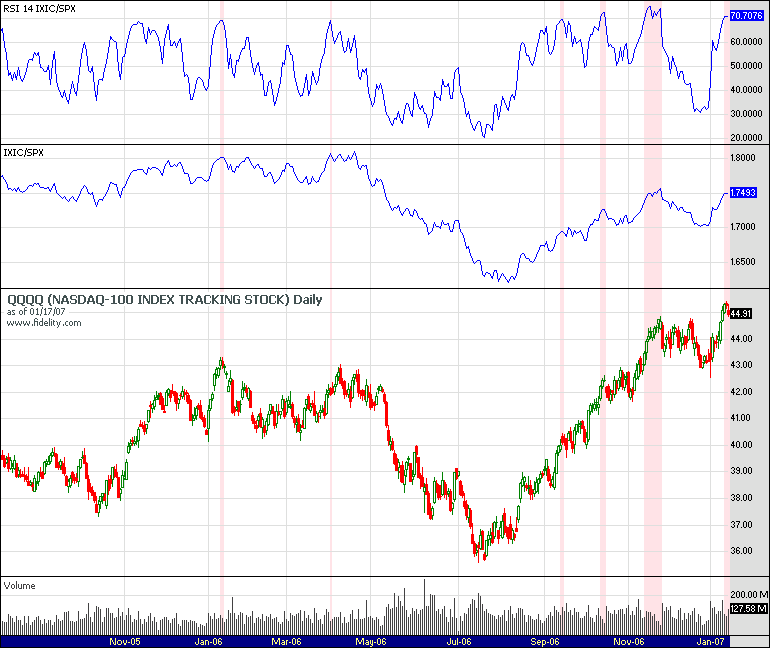

This system also applies to Qs, and it has met the requirement to cover at the close today.

But if you look at the RSI14 of IXIC/SPX ratio, you will note that it is still sky high, and that means IXIC sorta ran away from SPX a bit too much. Hence one way to equalize it is for the SPX (and Dow) to come down, but Nasdaq to come down even harder. Ofcourse, it can go the other way around.. for the Nasdaq to lag while the Dow and SPX go higher.

But since the RSI2 signal says Dow has gone up quite a bit, the odds favor that Dow must now go down, and IXIC must come down harder.

Edited by dcengr, 17 January 2007 - 10:22 PM.