I haven't seen any mention here about junk bonds, but they are on a relentless trend up - a good economy in the future seems baked into the price since they are so sensitive to any real weakness. Junk has been mentioned in some business rags as being too frothy and yet another "bubble" - I take that as a contrarian signal that they could continue to perform well. Price is the final judge, so we will see what happens....

Junk is on Fire

Started by

wyocowboy

, Jan 25 2007 12:50 AM

4 replies to this topic

#1

Posted 25 January 2007 - 12:50 AM

Good luck is with the man who doesn't include it in his plan.

- Graffitti

- Graffitti

#2

Posted 25 January 2007 - 01:08 AM

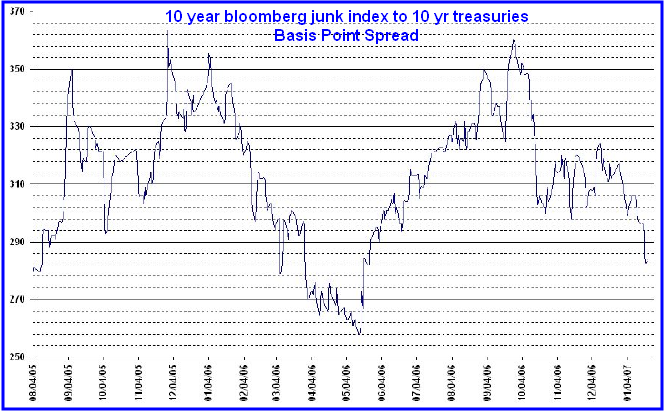

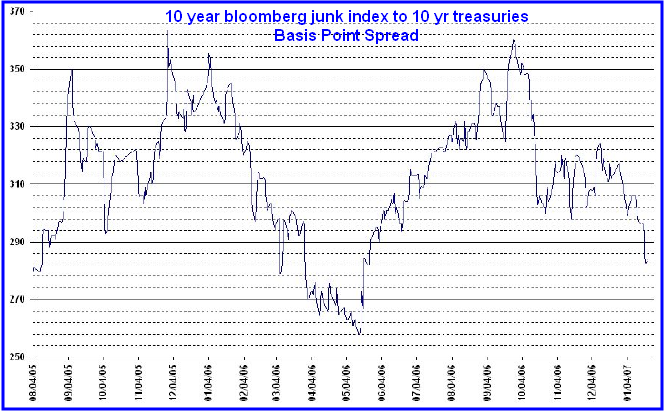

Still got a ways to go before reaching the May "tights." Real men love tights, don't they, cowboy?

Da nile is more than a river in Egypt.

#3

Posted 25 January 2007 - 01:22 AM

I've seen several posts here indicating that Junk has been bullish. I think it was Gary Smith.

In the end we retain from our studies only that which we practically apply.

~ Johann Wolfgang Von Goethe ~

~ Johann Wolfgang Von Goethe ~

#4

Posted 25 January 2007 - 02:31 AM

just like most of the other stuff, it is probably advertised right at the top ...

by the way this doesn't look like it leads or lags anything to me although the reason it should is quite logical

by the way this doesn't look like it leads or lags anything to me although the reason it should is quite logical

#5

Posted 25 January 2007 - 12:14 PM

Junk is on fire because the default rate in 2006 was a record low of 0.8% according to Fitch. That's down from 3.1% in 2005 and well below the long term average of 5%. There also seems to be shortage of junk bonds as the syndicated bank loan market has supplanted junk as the instrument of choice in takeovers and funding debt. In 2006 the loan market saw nearly 500 billion in issuance vs. only 127 billion for junk.

Lastly, and as mentioned 1001 times here, a chart of junk bonds is meaningless unless dividends (which have accounted for over 100% of the historical returns of junk) are taken into consideration. You would not know by looking at the meaningless charts that junk has been making historical highs nearly everyday for the past five months. In the real world of real money investing, junk bond holders are seeing those historical highs in their in their actual accounts. I've also said junk is an accident waiting to happen but in the meantime to enjoy the ride because no one knows how long the ride will last, least of all the the experts who have been saying to stay out of junk for over a year now and counting. One thing that can derail the junk rally is if the 10 year Treasuries continue their current rise up in yield. The spread between junk and Treasuries is already at a historical low.