Anyone long here ?

#1

Posted 29 January 2007 - 07:59 PM

#2

Posted 29 January 2007 - 08:03 PM

....or looking to go long here ?. If so, please raise your hand

this market is going to crash tomorrow or at the latest wednesday. Qs are going to 20, and SPX to 850. A major depression is looming.

I am fully short in futures with max leverage

It's the illiquidity, stupid !

#3

Posted 29 January 2007 - 08:04 PM

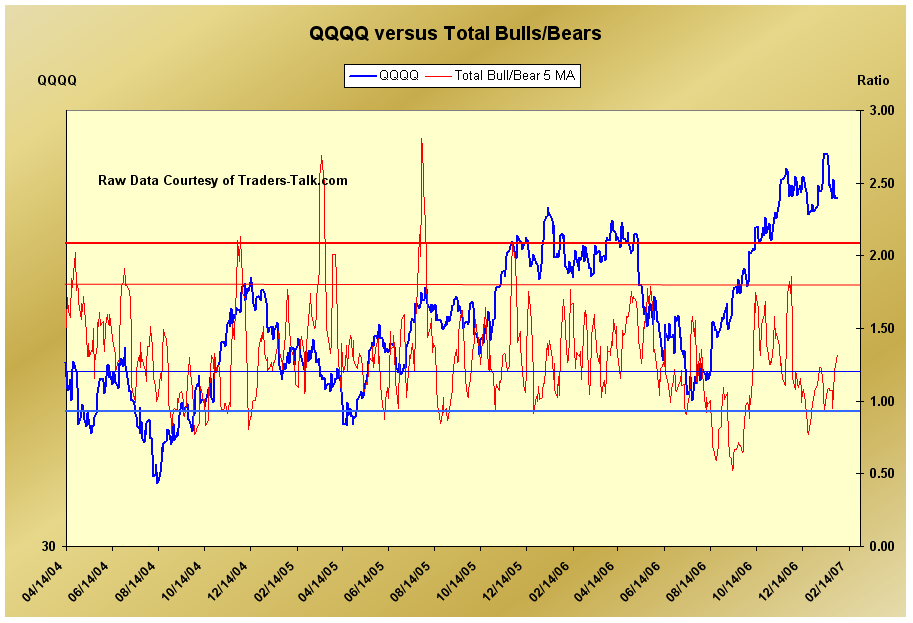

Came clear out of the "bear trap" zone..

To answer your question, it would appear theres more longs.. or less shorts as of late.

#4

Posted 29 January 2007 - 08:10 PM

....or looking to go long here ?. If so, please raise your hand

this market is going to crash tomorrow or at the latest wednesday. Qs are going to 20, and SPX to 850. A major depression is looming.

I know you truly believe in that.

But my question was, if anyone saw any reason or setup, to go long here.

#5

Posted 29 January 2007 - 08:18 PM

Edited by CLK, 29 January 2007 - 08:23 PM.

#6

Posted 29 January 2007 - 08:32 PM

NAV,

I added back a small position, should have just took

half off to start with but some new info appeared.

I think the market can breakout to new highs here,

something that most probably are not expecting

with the topping action.

The NDX looks ready to start at least a B wave towards the highs.

Btw, I went back fully long in my 401K today from cash.

Just like IndexTrader pointed out at the bottom, the inverse H&S

are back in place again, we might get alot higher prices in the event

of a breakout.

#7

Posted 29 January 2007 - 08:50 PM

....or looking to go long here ?. If so, please raise your hand :D

Tuffy88 among a few others here are always long in bull markets. I've added to existing positions in office REITs, select tech, and telecom the past three trading days. My worry, and it's a big worry, are rising interest because I believe the economy is hotter than many believe. If rates keep rising the whole merger and acquisitions game could come to a screeching halt as junk bonds and bank loan debts used to fund takeovers could get socked with hedge fund blowups becoming front page financial news. In the meantime I will trade like a bull and think like a bear which is pretty much what I do all the time anyway.

Edited by Gary Smith, 29 January 2007 - 08:51 PM.

#8

Posted 29 January 2007 - 09:39 PM

....or looking to go long here ?. If so, please raise your hand

Feeling lonely? Me too.

100% long the SPY in the trading account looking for the "last" blast up but I am not married to the position.

The retirement account is 75% cash and 25% long and looking to close that position.

60 minute charts drive my trades. I am considering a broadening top pattern, oversold technicals, and some older and current fractal patterns as justification for the long. For certain, it will be very obvious tomorrow if the pattern and fractals are not working. If the longs do work, I would expect a top at the end of the week into early the following week.

KC

#9

Posted 29 January 2007 - 10:03 PM

#10

Posted 29 January 2007 - 10:34 PM

....or looking to go long here ?. If so, please raise your hand

which ones are you looking at ?

Hank

thanks

just curious

....or looking to go long here ?. If so, please raise your hand

Feeling lonely? Me too.

100% long the SPY in the trading account looking for the "last" blast up but I am not married to the position.

The retirement account is 75% cash and 25% long and looking to close that position.

60 minute charts drive my trades. I am considering a broadening top pattern, oversold technicals, and some older and current fractal patterns as justification for the long. For certain, it will be very obvious tomorrow if the pattern and fractals are not working. If the longs do work, I would expect a top at the end of the week into early the following week.

KC