REAL ESTATE CRISIS

#1

Posted 30 January 2007 - 03:29 AM

#2

Posted 30 January 2007 - 06:22 AM

..not to mention the hgx I've posted numerous times..

http://stockcharts.c...6097&r=2442.png

#3

Posted 30 January 2007 - 08:38 AM

#4

Posted 30 January 2007 - 09:35 AM

Exhibit A is the purchase of Equity Office Properties, the country's biggest owner of office buildings, by the real-estate arm of the Blackstone Group, a private equity firm. What you need to know about this $36 billion deal is that 80 percent of the purchase price will be financed with debt, and that the "cap rate" -- the rate of return from next year's rental income -- is an estimated 5.5 percent.

What, exactly, does that mean?

First of all, it means that the lessons of the past five real estate crashes have, once again, been forgotten, and real estate has once again become a highly leveraged investment class. So, when the inevitable downturn finally happens and the price falls by more than 20 percent, there's a pretty good chance the value of the collateral will fall below the value of the loans, which in financial circles is considered a no-no. To make things even worse, it's a good probability that these are interest-only loans, which means that even in good times, the borrower is not paying down principal. -- Washington Post

Blackstone bid has since been raised to $38.3 billion -- you do the math. Not even with IT's money . . .

#5

Posted 30 January 2007 - 10:17 AM

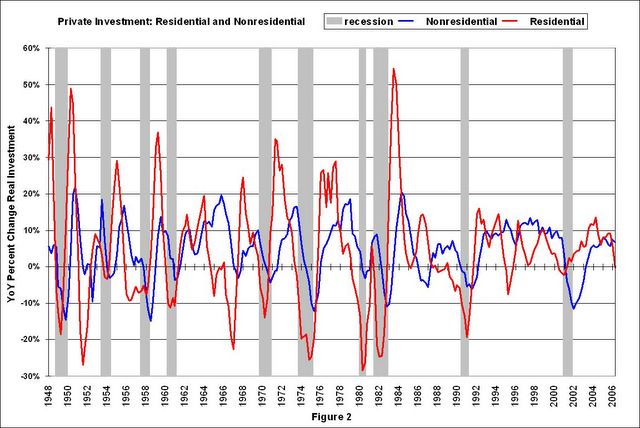

Residential investment leads, nonresidential follows:

Are you short something in the REIT area?

IT

#6

Posted 30 January 2007 - 10:36 AM

NDEResidential investment leads, nonresidential follows:

Are you short something in the REIT area?

IT

#7

Posted 30 January 2007 - 10:48 AM

The figures aren't adjusted for cancellations

http://www.census.go...cellations.html

Jan. 9 (Bloomberg) -- D.R. Horton Inc., the largest U.S. homebuilder. Order cancellations fell to 33 percent from 40 percent in the fourth quarter

http://www.bloomberg...id=alZi3a_wcafo

.

#8

Posted 30 January 2007 - 11:04 AM

Also consider vacancy rates, up 34% from Q405 to Q406:New Home Sales adjusted for 30% cancellations

The figures aren't adjusted for cancellations

http://www.census.go...cellations.html

Jan. 9 (Bloomberg) -- D.R. Horton Inc., the largest U.S. homebuilder. Order cancellations fell to 33 percent from 40 percent in the fourth quarter

http://www.bloomberg...id=alZi3a_wcafo

.

Census data

#9

Posted 30 January 2007 - 11:34 AM

if the housing market is still weak in the summertime, I guess we'll all be worried

.

#10

Posted 30 January 2007 - 11:49 AM