Yes the derivatives industry has grown HUGE. But those guys who sell you insurance don't like to take risks. They like to collect the premium. So far, premium has been very low. Their profits are going down.

Since this industry has grown to be monstrous, to show continued profits, they need to make sure their customers pay more premium, not less premium. They're not bullish or bearish, they just want more premium.

Right now, the best way to spike the VIX is on the downside. Can VIX increase with price? Certainly. That may come later. This is the ONLY business where the banks, who make their $ on derivative premiums, can control the high sigma events. Yes, they can manufacture their own Katrina, then sell higher insurance premiums.

Will they do that? Well, VIX is so darn low, they need to sell far more insurance at these prices. I don't see volume increasing on options too much, so my guess is they wanna collect more premium on the existing volume. How else are they gonna pay for the rolex and home in the hamptons?

Why I think VIX will soon increase

Started by

dcengr

, Feb 20 2007 01:24 PM

2 replies to this topic

#1

Posted 20 February 2007 - 01:24 PM

Qui custodiet ipsos custodes?

#2

Posted 20 February 2007 - 02:03 PM

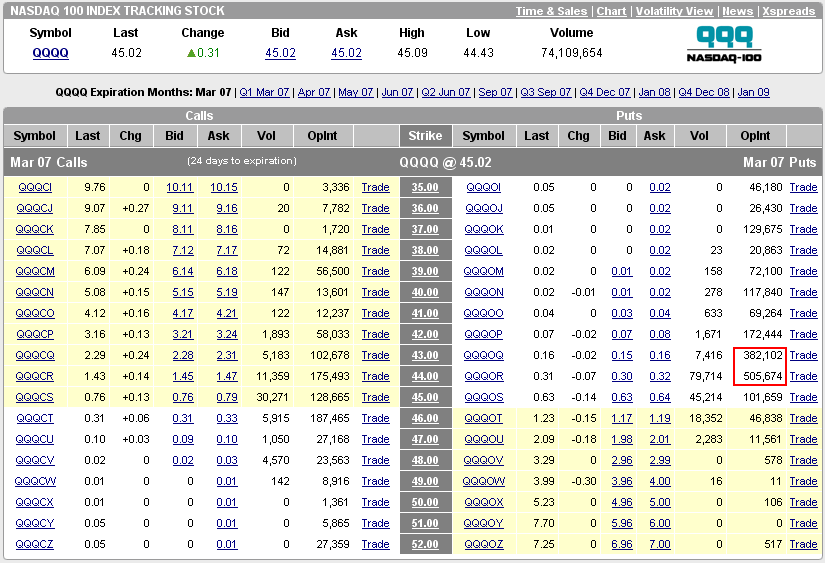

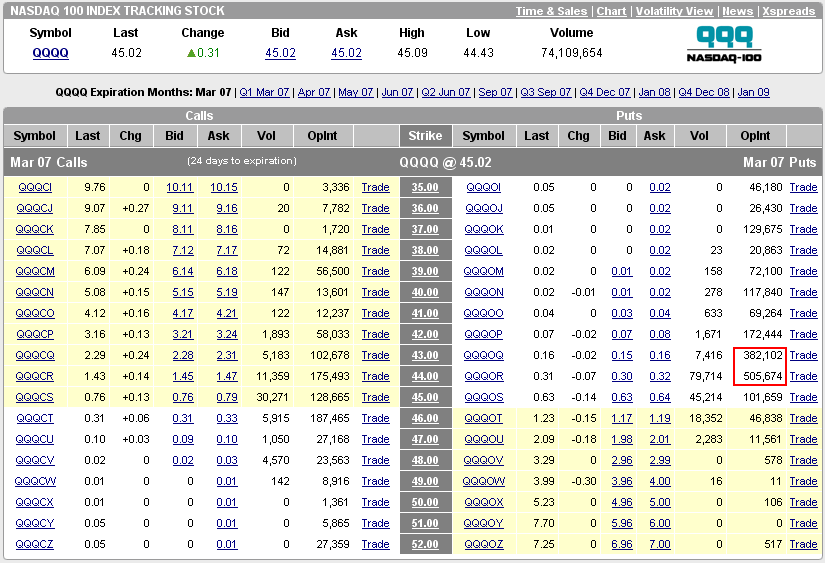

That being said, there's a GIGANTIC jump in put buying for march in Qs..

I'm first to interpret this as bullish because it is GIGANTIC compared to few months ago. Then again, it came suddenly out of the blue.

I'm not seeing a whole lot of general public burst in skepticism.. rather there's some slight increase in bullishness the past week or so.

So I'm not sure who bought all this stuff, but right now its underwater by a lot, and it is a gigantic position. It could be hedging, but why now, I dunno.

I'm first to interpret this as bullish because it is GIGANTIC compared to few months ago. Then again, it came suddenly out of the blue.

I'm not seeing a whole lot of general public burst in skepticism.. rather there's some slight increase in bullishness the past week or so.

So I'm not sure who bought all this stuff, but right now its underwater by a lot, and it is a gigantic position. It could be hedging, but why now, I dunno.

Qui custodiet ipsos custodes?

#3

Posted 20 February 2007 - 02:44 PM

Having said this, the frequency of the CPCE readings below 0.5 were much higher in 2004 than now. However, I know from the OCC stats that the cost of the readings during the 2006 spikes below the 0.5 or the open call buys were much larger than the 2004's. So, my guess is there has been a few huge capitulation moments that were heavily capitalized by the firms immediately and although there might be still some more money left for now since the liquidity has been huge on this run up...

- kisa