Your guide for the next 5 years

#11

Posted 18 May 2008 - 01:11 AM

http://www.zimbio.co...Veyron Crashing

#12

Posted 18 May 2008 - 01:58 AM

#13

Posted 18 May 2008 - 02:01 AM

#15

Posted 18 May 2008 - 09:57 AM

#16

Posted 18 May 2008 - 11:37 AM

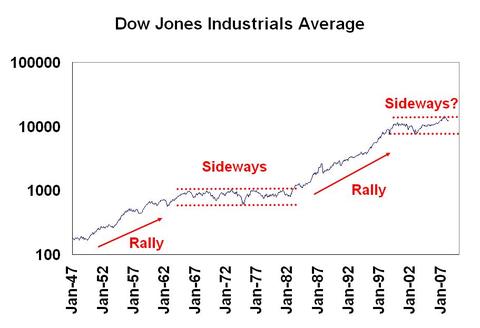

Take a good look at the GS chart...

I have it going to 77 LT.

Wyckoff Wave Chart

Edited by SemiBizz, 18 May 2008 - 11:54 AM.

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#17

Posted 18 May 2008 - 11:46 AM

#18

Posted 18 May 2008 - 03:27 PM

Also, AJTJ from another board likes to use the 180,68 Sto. He notes that tops occur around 80-90. I plotted it here, zooming in more on the handle area. You can see it's nowhere near 80-90. Also note the generally declining volume in the handle.

It all looks bullish to me. But I'm sure Tea can come up with a bearish count.

#19

Posted 18 May 2008 - 04:46 PM

HeyTeapartyThe balance of the triangle...consolidation while the consumer tucks some possible savings away while paying off his debt.....and financials take the time to repair the damage after coming completely clean soon.

http://stockcharts.com/c-sc/sc?s=$OEX&p=W&yr=9&mn=6&dy=0&i=p57106758944&a=106691891&r=3882.png

It is courageous of you to stick your neck out with such a long range projection, I compliment you for this.

I usually do not get into the fray, but I would like to add a little bit of market history.According to Stock Traders Almanac the market usually prognosticates who will win the election.If the incumbent party wins the average gain is 18% this is unlikely IMHO,if the challenging party wins the market may end up the year about 4%.Your scheme in general configuration could be correct, but the level at the outcome would need an adjustment.

Cheers

#20

Posted 18 May 2008 - 05:27 PM