Price action is not consistent with an 80 week low. Thus I have to assume it has not arrived yet. The $SPX failed miserably as it rolled off its FLDs (2.5, 5, 10, and 20 week). So this market is headed for its lows no doubt. The more difficult question is when will an 80 week low make its turn. And when it occurs you'll know, trust me.

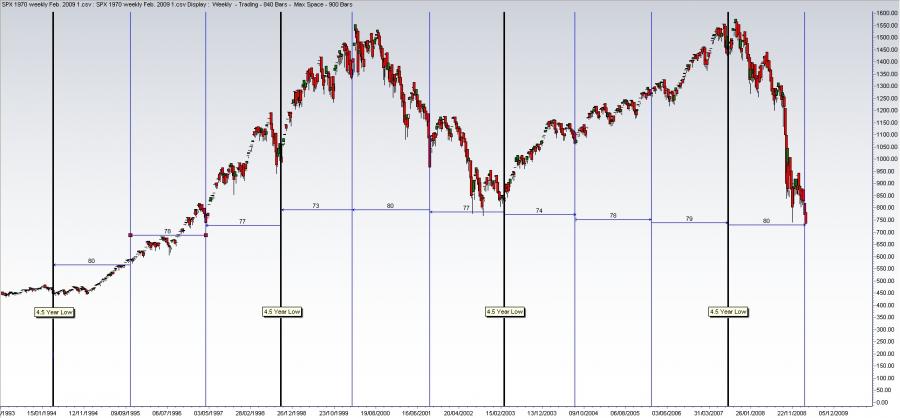

This is Bob's original phasing for the 80 week cycle (18 month) and points to a low possibly late Feb./early March. There are some other aspects that point to March 6th at the moment, but that is merely a guess at this point. The 80 week will be good to what +/- 4 weeks but will extend in time due to the very large cycles involved? So could extend to mid-April. Avg. cycle length is 79 weeks for the last 13 counted here (assuming the cycles are accurately counted of course).

What bugs me is the "extra" 80 week cycle we seem to be looking at here for 1987. And I just can't see how a market can top virtually at a 4.5 year low (ie. black vertical lines are 4.5 year cycle lows). From 10,000 feet that is what it looks like. AND if that is correct that the 4.5 year low came in Aug., 2007 near the all-time high, then timewise this bear is going to be really painful, never mind price. I think I have repeated myself more than once on this, but those are the facts.

Once the 80 week low is in we will see a terrific rally, probably one of the best of this bear market.

cheers,

john

Edited by SilentOne, 02 February 2009 - 09:17 AM.

"By the Law of Periodical Repetition, everything which has happened once must happen again and again and again-and not capriciously, but at regular periods, and each thing in its own period, not another's, and each obeying its own law ..." - Mark Twain