$SPX Hurst Analysis

#51

Posted 25 September 2009 - 11:28 PM

#52

Posted 30 September 2009 - 12:47 AM

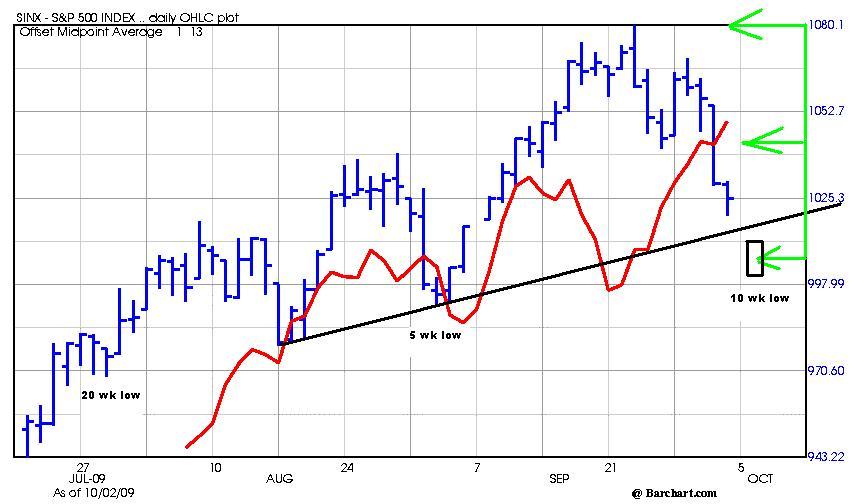

I am still uncomfortable in many ways with labeling July 10th as the 20wk low, even though from a bird's eye view, it sure looks like a slam dunk. I have been since July and I remain so to this day. I think we will know better once the 40wk low comes in. Too bad we need the past 20wk low to forecast the 40wk low, lol. Here is a post I put up just now on the main board, but I believe it belongs here too.

I've been laying low about the 20 and 10wk cycles as the July low really was 2.5wks early for the 20wk low. One way to deal with that is to accept that the 20wk low came early as John (Silent One) has. Clearly it seems evident on the price charts if you are simply looking for the price lows. But Hurst cycles don't work that way, at least not according to the course and not according to the way Airedale had interperted them. If I were to accept July 10 as the 20wk low, I would have to accept either a missing 2.5wk cycle or a sudden shortening of cycle length to squish in eight 2.5wk cycles into the 17.5wks from the March lows to July 10th. Both of these runs counter to Hurst principles. I also don't see a very good fit for the phasing of such eight 2.5wk cycles into that space. The one other possibility is the the 80 wk low was actually earlier than March 6th (recall it came in at 81wks post the Aug 07 Hurst 4.5yr low) and that the final price low was actually a small cycle straddle at the beginning of the new 80wk cycle. This would then allow for the July 10th 20wk low, but this phasing also seems to be a stretch.

I've been following the original phasing I had from the March 6th lows and still think it is tenable.

In that phasing, I see the 20wk low as coming in on July 29th.

The first 2.5wk low on August 17th.

The second 2.5wk low on Sept 3rd.

The third 2.5wk low was on Sept 21st.

We are now 6 days into the last 2.5wk cycle in the 10wk cycle

With this phasing, the 10wk low is due around Wed of next week or Oct 7th.

We've generated a 2.5wk FLD downside target of 1025 +/- 5.5 points on SPX cash, which in a bull market could be undershot.

To be complete, with Monday's huge rally, we've also generated a 6-7day FLD upside target of 1080, which is a retest of the local top. If we are indeed that close to a 10wk low, this target could be undershot as well.

Either way, the 80wk FLD target of 1200 or so is still in play or at least until we start breaking down some VTLs.

Echo/Doc

#53

Posted 01 October 2009 - 07:22 AM

Edited by SilentOne, 01 October 2009 - 07:23 AM.

#54

Posted 01 October 2009 - 08:15 AM

#55

Posted 01 October 2009 - 09:14 AM

whereas with your phasing, you'd be looking directly into the teeth of the 40wk low and expect a bearish bias the next few weeks.

That's pretty much where I am at. The $SPX is up 30 weeks into a top in Sept. Now we see how a 40 week low is made. I still believe the larger cycles (9, 18 year etc.) are pointing down so this market can top out in the current 18 month cycle at any time.

cheers,

john

#56

Posted 02 October 2009 - 09:20 AM

It looks like a 2.5 and 5 week low will arrive here today or Monday. Again, I have the early Sept. low as a 10 week low. Another good decline will start once the bounce is over and I am bearish until a 40 week low arrives. So my cycle view is a bit different than what is shown here, but a ST low should come in soon.

cheers,

john

Edited by SilentOne, 02 October 2009 - 09:26 AM.

#57

Posted 03 October 2009 - 11:43 PM

#58

Posted 07 October 2009 - 10:12 PM

#59

Posted 08 October 2009 - 08:56 AM

#60

Posted 20 October 2009 - 01:23 PM

Edited by SilentOne, 20 October 2009 - 01:26 PM.