Alistair, Alistair, ... one may believe it will happen, but for God's sake don't admit it publicly.

Recession fears: Markets reel from Darling downturn talkAgainst the dollar, sterling fell more than 1% to its lowest level since April 2006

Julia Kollewe guardian.co.uk, Monday September 01 2008 09:30 BST

The pound hit a record low against the euro this morning and stocks also fell in London after a stark warning from Alistair Darling, the chancellor, that the economic downturn would be worse and longer than expected.

Measured against a basket of trade-weighted currencies, the pound is now at a 12-year low. The FTSE 100 index dropped 42.9 points to 5593.7 points in early trading, down 0.76%.

"Most people believed that things were probably deteriorating faster in the UK than the government was admitting, but the fact that we've seen the chancellor come out and admit that things are far worse have put sterling under pressure," said Ian Stannard, senior currency strategist at BNP Paribas.

In an interview with the Guardian, the chancellor said Britain is facing "arguably the worst" economic downturn in 60 years and predicted it would be "more profound and long-lasting" than people had expected.

Adding to the gloomy picture, a CIPS survey showed today that the manufacturing sector shrank for the fourth month in a row.

Mortgage approvals fell to 33,000 in July, the lowest since the data series began in 1993, according to Bank of England figures released this morning. House prices fell in August for the eleventh consecutive month, according to a separate report from property consultants Hometrack.

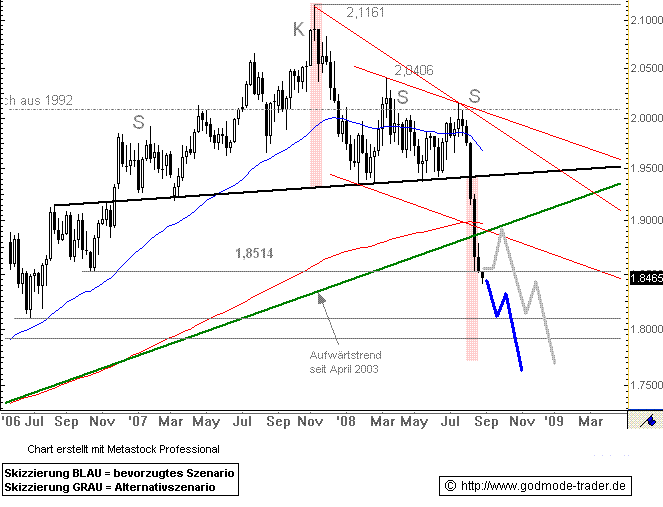

The pound slid to 81.39p against the euro, its lowest point since the single European currency was launched in 1999. Against the dollar, sterling fell more than 1% this morning to $1.8005, its lowest level since April 2006. The pound also hit a five-month low against the yen, of ¥195.15. Gilts and short sterling futures rose sharply, pushing down yields.

"The market is clearly worried by what Darling has said," said David Page, an economist at Investec. "His views aren't a million miles away from the Bank of England's."

The Bank of England's deputy governor, Charles Bean, last week warned that the economy is facing a period "at least as challenging" as the 1970s when Britain sank into a deep recession.

Darling said at the weekend that the economic backdrop presents Labour with its toughest challenge since the 1980s. "We've got our work cut out. This coming 12 months will be the most difficult 12 months the Labour party has had in a generation."

His comments came after a Bank of England policymaker, David Blanchflower, warned of 2 million unemployed by Christmas.

Investec's Page predicted that worries about the health of the public finances and the economy overall would put the pound under further pressure over the next month, when the political party season gets under way and ahead of the chancellor's pre-budget report. But looking further out, the City's view that the Bank will probably hold off cutting interest rates until next year - because of soaring inflation - "should provide a floor to sterling", he said.

"By the Law of Periodical Repetition, everything which has happened once must happen again and again and again-and not capriciously, but at regular periods, and each thing in its own period, not another's, and each obeying its own law ..." - Mark Twain