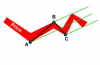

SPX weekly

#1

Posted 27 January 2012 - 05:37 PM

http://www.motherboa...e-thorium-dream

http://energyfromthorium.com/ http://maps.thefullw...en_salt_reactor

#2

Posted 27 January 2012 - 06:04 PM

#3

Posted 27 January 2012 - 06:44 PM

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#4

Posted 27 January 2012 - 07:33 PM

But with FED bubbling the only thing left which they can bubble...who knows?

Americanbulls.com:

Candlestick Analysis This week a Doji was formed.

This shows indecision about the direction of the market and it represents a tug-of-war between buyers and sellers.

Edited by Rogerdodger, 27 January 2012 - 07:35 PM.

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#5

Posted 27 January 2012 - 07:54 PM

Love, be kind to one another, seek the truth, walk the narrow path between the ying and the yang.

#6

Posted 27 January 2012 - 08:16 PM

BIGGEST SCIENCE SCANDAL EVER...Official records systematically 'adjusted'.

#7

Posted 27 January 2012 - 08:28 PM

The point however, is that we have a break & probable new trend which has a certain rising wedge flavour about it

http://www.motherboa...e-thorium-dream

http://energyfromthorium.com/ http://maps.thefullw...en_salt_reactor

#8

Posted 27 January 2012 - 08:39 PM

What happens if we draw the trendline from the 2007 high to the May 2011 high?

http://www.motherboa...e-thorium-dream

http://energyfromthorium.com/ http://maps.thefullw...en_salt_reactor

#9

Posted 27 January 2012 - 09:33 PM

What happens if we draw the trendline from the 2007 high to the May 2011 high?

http://www.motherboa...e-thorium-dream

http://energyfromthorium.com/ http://maps.thefullw...en_salt_reactor