Sorry Gold Bugs, I have more BAD NEWS

#1

Posted 15 March 2012 - 12:17 AM

Richard Wyckoff - "Whenever you find hope or fear warping judgment, close out your position"

Volume is the only vote that matters... the ultimate sentiment poll.

http://twitter.com/VolumeDynamics http://parler.com/Volumedynamics

#2

Posted 15 March 2012 - 12:57 AM

#3

Posted 15 March 2012 - 04:46 AM

We're also within the window of the next nesting of the 3 month cycle.The 2012 low was made on the STRONGEST VOLUME of the year as well.

Climactic behavior?

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#4

Posted 15 March 2012 - 06:42 AM

Dave,We're also within the window of the next nesting of the 3 month cycle.The 2012 low was made on the STRONGEST VOLUME of the year as well.

Climactic behavior?

Fib

You mentioned elsewhere that the effects of QE2, the liquidity are actually seen in the markets some months atferwards, I think you said something like 8-12 months.

What are you basing this on, and what information and references do you have to support such a claim? I cant seen anything to support it.

I thank you in advance for any such information.

Also, do you by any chance know where I can get a chart on the eurodollar commercial interest as a persentage of open interest (OI)?

Thanks,

#5

Posted 15 March 2012 - 08:15 AM

Well, there's probably not too much out there because it doesn't jive with general Ivy League thinking, plus I haven't written a book on liquidity waves as yet!What are you basing this on, and what information and references do you have to support such a claim?

This is something though that we do discuss a lot in our chat sessions as you already know.

There are free charts of the Eurodollar futures such as this one.Also, do you by any chance know where I can get a chart on the Eurodollar commercial interest as a percentage of open interest (OI)?

Once you have that, you should probably go to Commitment of Traders where you can then figure out the percentage yourself.

Fib

Better to ignore me than abhor me.

“Wise men don't need advice. Fools won't take it” - Benjamin Franklin

"Beware of false knowledge; it is more dangerous than ignorance" - George Bernard Shaw

Demagogue: A leader who makes use of popular prejudices, false claims and promises in order to gain power.

Technical Watch Subscriptions

#6

Posted 15 March 2012 - 10:25 AM

#7

Posted 16 March 2012 - 07:54 PM

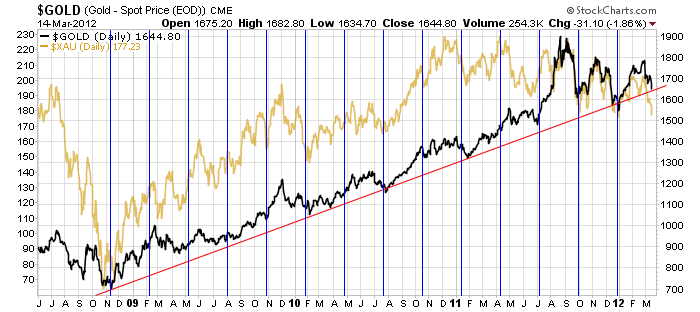

http://stockcharts.c...c/1178409/tenpp