Edited by SilentOne, 12 March 2009 - 11:50 AM.

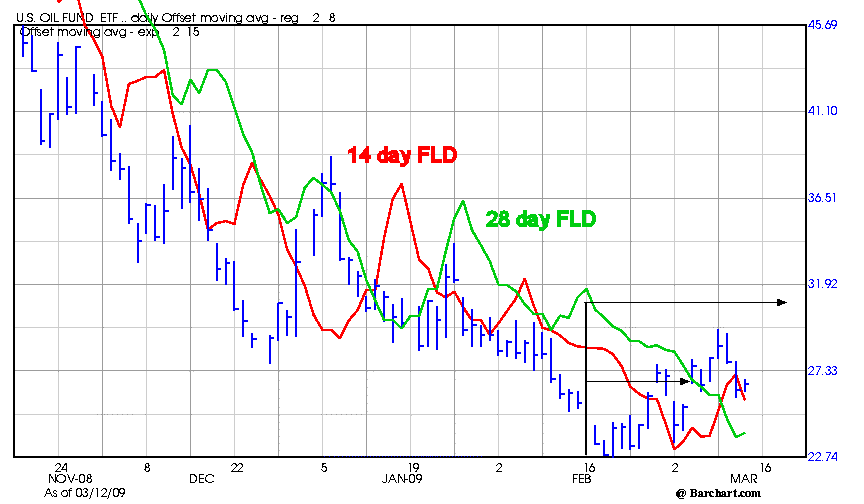

Crude Oil Hurst Cycles

#11

Posted 12 March 2009 - 11:46 AM

#12

Posted 14 March 2009 - 03:42 PM

Major mea culpa! It's time for me to bone up on my Hurst and reread some of the course notes.

I actually thought Hurst used calendar days in his charts. That's the way they appear anyway with the gaps between bars that I thought he counted. I use trading days too so it's not a huge deal, but just wanted to check.

I have been so focused on counting cycles for crude oil, gold etc., I forgot that in fact Hurst did use a calendar count in his cycles work. I have been using thinkorswim charts which show trading days of course and not calendar days. It saves a lot of time not having to count manually. I derived the cycles for oil for example by tracking trading days (eg. 7, 14 and 28 day TD cycles for crude) and when I have shown these cycles in terms of weeks, I was dividing by five (5 TDs/ week). Doh!!

So nothing changes per my cycle periods for oil, I just have to work out the expression of these daily cycle periods in terms of Hursts original framework.

Sorry about the confusion I may have caused.

So to summarize crude oil cycles that I track:

88/90 week

44/45 week

22/23 week

11/11.5 week which in fact was derived from (56 TD cycle, but actually 79 - 80 calendar days)

5/5.5 week which in fact was derived from (28 TD cycle, but actually 39 - 40 calendar days)

2.5/2.75 week which in fact was derived from (14 TD cycle, but actually 19 - 20 calendar days)

1.25 week which in fact was derived from (7 TD cycle, but actually 10 calendar days)

I'm very sorry for any confusion. And hey other than LeroyB3, where were the Hurst enthusiasts out there to correct my faux pas!

cheers,

john

Edited by SilentOne, 14 March 2009 - 03:46 PM.

#13

Posted 14 March 2009 - 03:56 PM

And as I have been explaining in recent days, if the cycles for crude have turned bullish, then crude has seen a major nest of lows here late Feb. The larger cycles 2.5 on up to the 88/90 week cycles are pointing hard up. THAT's why I have to be bullish here.

cheers,

john

Edited by SilentOne, 14 March 2009 - 04:00 PM.

#14

Posted 14 March 2009 - 04:18 PM

#15

Posted 14 March 2009 - 06:51 PM

#16

Posted 15 March 2009 - 09:55 AM

I don't plan to change the way I am doing the crude oil Hurst cycles. But I will make the distinction in daily counts.

Next week is the big test for this crude oil phasing.

cheers,

john

Edited by SilentOne, 15 March 2009 - 09:56 AM.

#17

Posted 15 March 2009 - 03:52 PM

#18

Posted 19 March 2009 - 07:55 AM

#19

Posted 19 March 2009 - 09:19 PM

#20

Posted 19 March 2009 - 11:38 PM