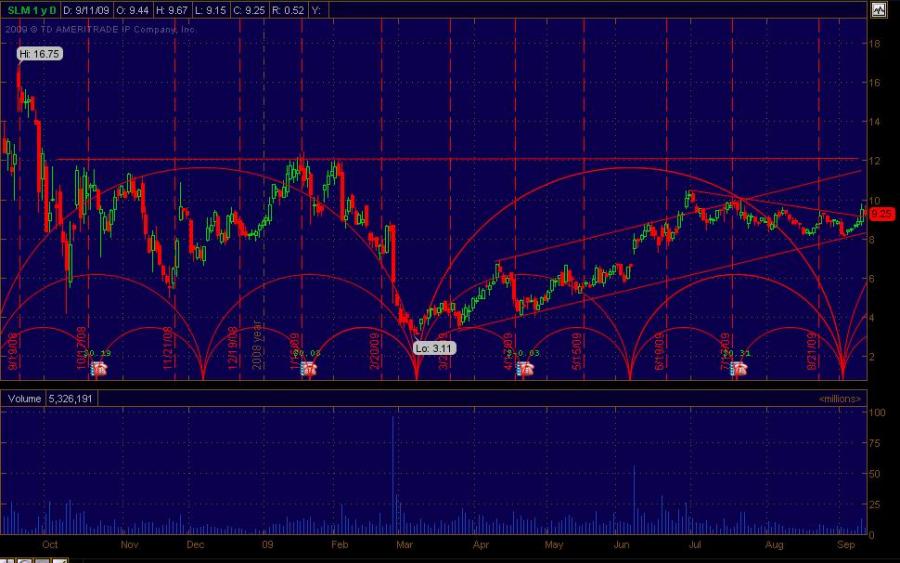

Hurst for SLM, critique my chart

#1

Posted 13 September 2009 - 04:06 PM

#2

Posted 13 September 2009 - 09:24 PM

Edited by SilentOne, 13 September 2009 - 09:28 PM.

#3

Posted 14 September 2009 - 10:51 PM

hi athlonmank8,

My initial thoughts on this stock per Hurst:

1. The 20 week lows are lengthy into the March 2009 low and not easily identified. Given the very bearish market of the last 2 years, you'd have to look back several cycle periods to get a fix on the true duration of the 20 week Hurst cycle for SLM.

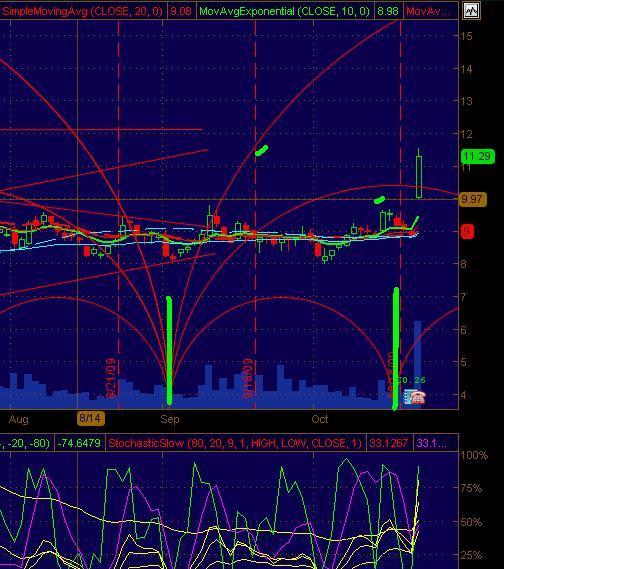

2. The last known 80 week low in March 2009 for the general market likely marked an 80 week low for SLM. Now count forward to see if an identifiable 20 week low arrived this summer. It may have arrived with the $SPX 20 week low mid-july.

3. Notice that the last 20 week low for SLM may have already been breached in the larger 40 week cycle period. That is bearish and a sign of weakness for the stock. The 20 week low looks to have arrived for SLM and may have now failed. I'd wait to see now if a 10 week low materializes.

4. Once a 10 week low is identified, the next time frame to watch is when we can expect a 40 week low to arrive this fall.

I don't have more time right now to add anything more. Make sure you understand how various cycles and their possible status will affect cyclic price action (ie. per J.M. Hurst's course).

cheers,

john

Thanks for the help. I see I'm definitely doing this incorrectly.

1. Need to do that

2. I didn't notice a 20 wk low in July, but if there was one it was definitely violated.

3. I'm not sure if I understand where the 40 wk is being drawn. I actually am not sure if I understand this at all lol. (i'm still a beginner)

4. Sound good. I'll be watching for the new 5/10 week lows to arrive to see if this chart has any validity whatsoever.

The question is how do you usually determine if it's a 40 week cycle or a 56 week cycle? That's typically through trial and error unless I missed something.

I'm working on the FLD's now, and I realize the book is only going to take me so far. I need the course if I want to make any worthwhile advances in this it seems.

Unfortunately this analysis is time consuming it's difficult to apply to a large basket of stocks. I do some intra-day trading and that's a mess of other issues.

With that said i'm leaving it to a pro lol. I respect your work a lot. Thanks again for the help.

#4

Posted 15 September 2009 - 03:51 PM

"If you've heard this story before, don't stop me because I'd like to hear it again," Groucho Marx (on market history?).

“I've learned in options trading simple is best and the obvious is often the most elusive to recognize.”

"The god of trading rewards persistence, experience and discipline, and absolutely nothing else."