09/27/2009 - Stanley

Last month Vivid September

Recap:

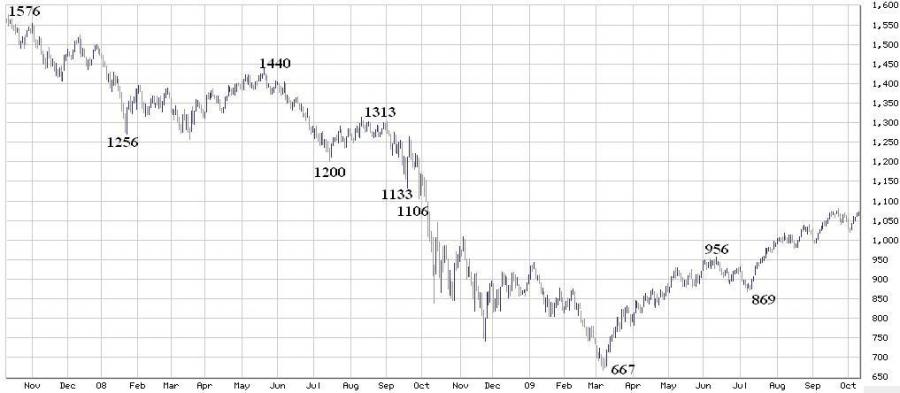

Sep 26, 11:29 AM - I consider 1080 was an aberration when index attempted breaking the half power zone 1070-1074. Without sizeable pullback, even though index made a seemingly failed attempt on the upper zone. The chance to greet 1122 still cannot be ruled out.

[url="http://<a%20href="http://scienceworld.wolfram.com/astronomy/AutumnalEquinox.html"%20target="_blank">http://scienceworld....quinox.html</a>"]Autumnal Equinox[/url]: a Day to Fall For Autumn Begins, Date 09-22-2009, UT 21:28

Profound autumnal colors:

[Five-color mountains, China] http://z.abang.com/d.../-/-/yc0002.jpg

[Kunlun Mountains, China] http://static.panora...nal/6594166.jpg

Summary outlook for October:

In a succinct way, the September movements did not produce any surprises. the trend was neither regressive nor inceptive. Therefore, the ambiguity extends into October; I speculate index may have a milder lower bound attempt and there may be another attempt on the higher bound. The outcome from these attempts set the middle term tone. A decisive breakdown in the lower bound leads to the long awaited red October.

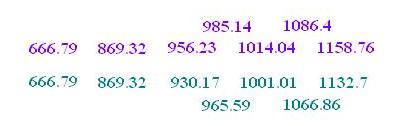

Fibonacci:

For near term, the support remains in 1040-1045, resistant 1065-1074; The early sign for a reversal is to see index dive below 1000-1014. further confirmation is to see index dive below 950-975, better confirmation is to see index drop below 900-915. The more time the index flirts with these confirmation levels, the more the underlying economy will decay. But, ironically, the higher the possibility to see a rampant overshoot that jumps over 1100 mark. Resistance zone are 1065-1074, 1086-1090. This chart (09/19) indicates a few key support/resistance clusters. Coincidently, the middle point between 1086 & 1158 is 1122.

May 10, 10:07 AM

Sometimes, a lesser suspected point becomes retracement reference pivotal point. Here is an example:

Sep 26, 9:29 PM

The steep slope follows the right "head" implies some consolidation period.

Apr 19 2009, 07:54 PM

Astro:

The Saturn-Uranus opposition – 5 alignments in 2008-2010.

(1) 11/04/08 (11/21/08, lagging, low 741.02)

(2) 02/05/09 (03/06/09, lagging, low 666.79)

(3) 09/15/09 (impetus to be observed)

(4) 04/26/10

(5) 07/26/10

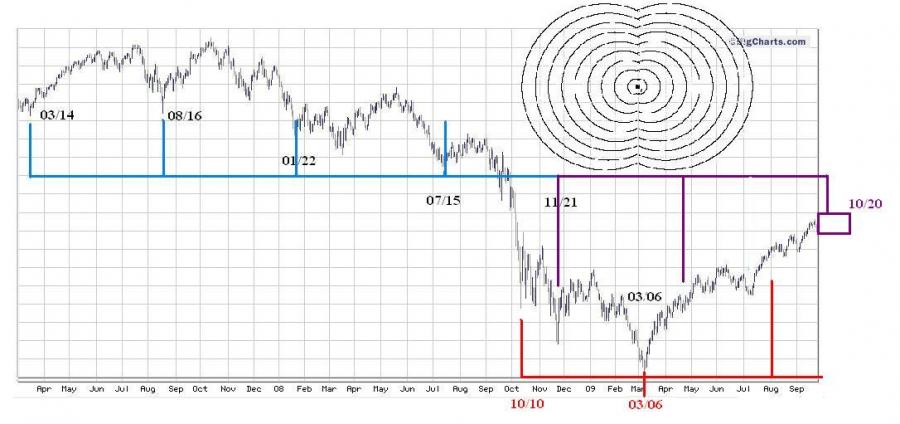

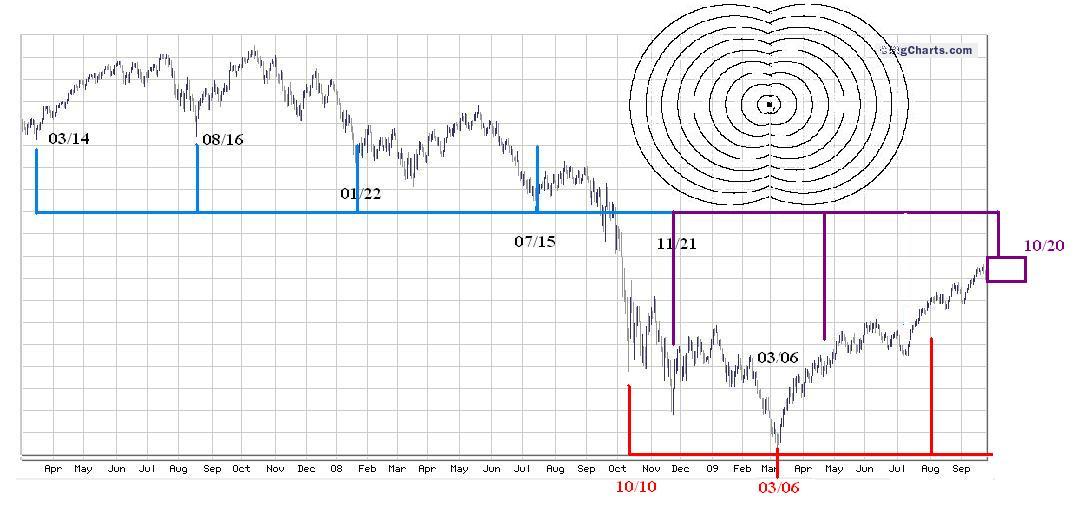

The 109 trading day cycle:

There are two 109 trading day cycles interleaves each other. So far, there is no comfortable assessment can be made. Which cycle caused the low on 11/21/08 is hard to reconcile. Perhpas, the ambiguity is due to the folding of the harmonics. In my entertainment work, I applied 109 trading day cycle. In technical term, these cycles (30, 54, 74,109) are harmonics. In the resonant conditions, a particular resonant frequency ( inverse of cycle ) can persist. In the non-linear stock market, I guess the resonant oscillation may repeat only a few cycles, then, it will either dampen out or merge with other harmonics. Once the overall market provides the same rhythms conditions, the resonant harmonics recurs.

Dec 6 2008, 05:02 PM

The cycle with root on 10/10/08 “supposed” to be a secondary event in late March, but, it became dominant and marked the March’s low. Its cycle length is 4-6 days shorter than the “nominal” length.

10/10/08-100-03/06-100 (significant)

03/06/09-106-08/06-106 (insignificant)

Conversely, the cycle with root on 11/21 “supposed” to be a dominant cycle, it became insignificant in April. If there is an “alternation” action between this two cycles, the time window to be observed can reach October 20. If the low recurs, it is probably a secondary event.

11/21/08-106-04/28/09 (insignificant)

04/28/09-106-09/28-09, 110-10/02/09,120-10/20/09 (could be a secondary event)