Crafting the rhythms series 06/27

- Surprises & Volatilities That Lay Ahead in the Second Half of 2010

Near term:

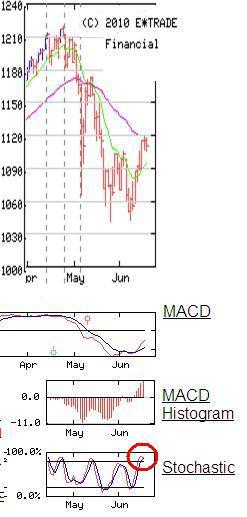

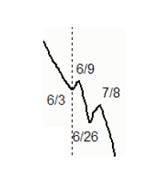

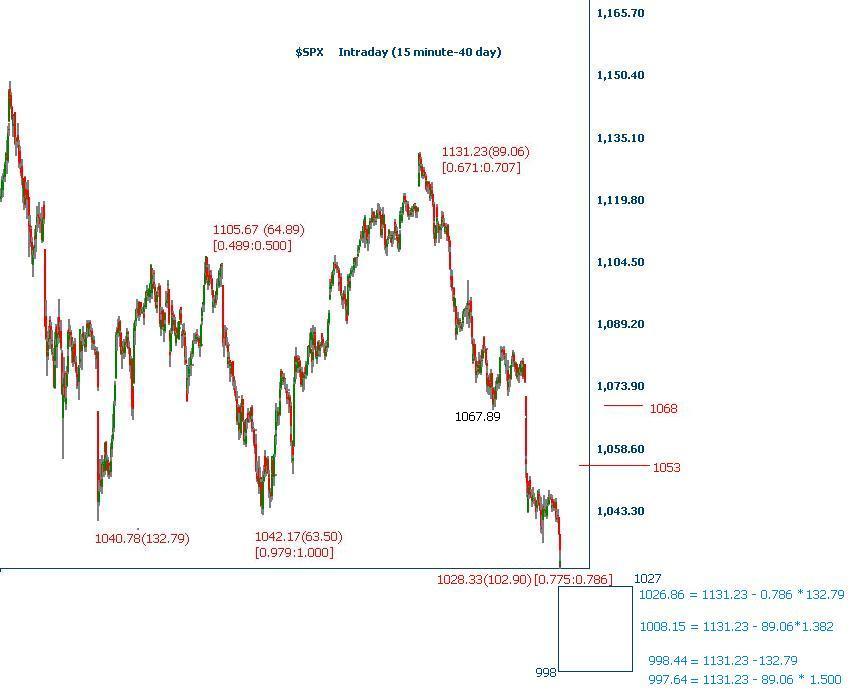

From the chart shown below, a seemingly rational trend line served as a support so the Index marked an Intraday low 1067.89 then bounced up. Not an unexpected skirmish. Counting from the recent high 1131.23 on 06/21, index deployed another ratio 0.707 ( 0.707 * 0.707 = 0.5), the third one that index has deployed recently. The same chart also labeled the nearby supports & resistances. these numbers were based on short term reference frame, will need to be adjusted accordingly. The short term bias is towards positive movement. Without a surprise, the cryptic

King Wen’s sequence (in this chart) probably had assigned 72 (actual 74) or 81 (actual 83) as the target. A secondary low is behind us. Use Time stamp 06/08, the next terminal Low is at least 54-63 trading days away. [54:08/24, 63:09/07, 72: 09/20, 81:10/01]. Apparently, such assessment is speculative and couples with contradiction, let’s move on ....

03/06/09 BASE 0666.79

07/08/09 85TD 0869.32

11/02/09 82TD 1019.95

02/05/10 64TD 1044.50

05/25/10 74TD 1040.78

06/08/10 83TD 1042.17

06/30/10 99TD ????.?? chance to see a secondary low in this time window is fading

To Probe Further:

To Probe Further:

-----------------------------------------

Oct 24 2009, 02:45 PM

link to post #19

The Grand Cross and An Alignment for Our Times

----- A T-Cross on July 30

----- The Grand Cross on August 6

----- The Saturn-Uranus opposition – 5 alignments in 2008-2010, No.5 07/26/10

(1) 11/04/08

(2) 02/05/09

(3) 09/15/09

(4) 04/26/10

(5) 07/26/10

Feb 6 2010, 04:48 PM

link

To explore the 2010 market trend, I divide the speculation focuses into two time zones. The first part is from 01/18 to 04/26. the second part is from 07/26 to 09/17. The month of May and June serves as a fulcrum that bridge the two time zones.

Jun 5 2010, 06:22 PM

This poster believes it is the market underlying intrinsic value determines the wave structure, ..... At this moment, the wave structure in the large scale time frame remains bullish. the intermediate frame wave structure does not manifest itself.

-----------------------------------------

The earnings announcement window is upon us, see if there is any warning or surprise in their outlooks. Bullish speculator can do the hype beforehand but reality authenticate the claim. The bet depends on how much realization a speculator has gained in the fundamental front.

Second half may be full of surprises & volatilities, not only due to geopolitical tensions but also some life time Astro events. You see the 4th Opposition between Saturn-Uranus on 04/26 marking the end of the Feb/March rally. The last such Opposition is due on 07/26. The chart I plotted (well, cut, edit, & paste)

in this link indicated the movement direction is against each other, the exact message is so indiscernible. I am not an astrologer but let me reiterate one more time that we need some entertainments in this

fascinating market. and “Technical analysis is a windsock, not a crystal ball” [Carl Swenlin]

Larger frame pullback targets:

Bull has gained “

enough” high terrain so that a regular 0.382 pullback from 1220

only can reach 1009 [frame 667:1221], 0.5 @944. 1K is a psycho mark, its nearby is a FIB cluster.

The middle term wave structure is ambiguous so it is premature to pick a number to gauge whether the rally since March 2009 is complete or not. The following chart embedded with quite a few scenarios. Any way, in between July/August, index will deploy enough trajectory for speculator to determine the status of the primary wave B. Be flexible, Wave count is subjective also evolves with time.

Archives:

-----------------------------------------

May 22 2010, 08:36 PM

Post #7 in this thread

After a few weeks respite period. market enters another chaos. Time window is around [07/30-08/10]–09/27. The possible upper rails: 1138-1157 or 1176-1186, possible lower rails: 1014 or 948.

Apr 13 2010, 10:58 AM

Post #1 in this thread

When index exceeds 1256.98 (refer to the chart shown below) the wave status since March 09 may “separate” from the prior one (1756-->667) and become an individual segment . When the wave is becoming a separate segment, it is capable of reaching 1300 level. The half power point 0.707 from 667 to 1576 is 1310, very close to the High 1313.15 marked on 08/11/08.

In late September, I picked two retracement references out of [667:1575] for speculation:

1122 is the 50% retracement, before index took out 1132 decisively, there was a month long tough fight in the zone 1086-1132. 1229 is the 61.8% retracements, Zone 1195 to 1229 should be another battle field.

-----------------------------------------