seeking a bottom!

#11

Posted 20 December 2011 - 02:48 PM

apparently the far east is willing to pay more to actually get the physical

dharma

#12

Posted 21 December 2011 - 08:18 AM

THE MESSENGER OF CHANGING TIMESÖ

20 December 2011 by Cullen Roche

Here are some deep thoughts from the great Richard Russell that will give the bears something to chew on for a while:

ďI talked with my good friend, Joe Granville, over the weekend, and Joe is as bearish as Iíve ever seen or heard him, based on his OBV volume figures. This checks with my own work and studies.

While fundamentalists scour the news for indications of bullish news, the internals of the stock market continue to deteriorate. Even the action of the stock market is bearish as the market rallies on dull volume but declines on higher volume. Furthermore, rising breadth is narrow on rallies while declining breadth is broad when the market heads down.

I donít know what more I can do or say to convinced subscribers that we are seeing the resumption of the bear market. This means that we should be OUT of all stocks. As for gold mining stocks, this is a personal choice. In due time, I expect gold to fully express itself with a huge upside blow-off. At that time I expect gold mining stocks to follow, but between now and then gold mining shares will probably be hit like every thing else by the fury of the bear market.

I should add that I am expecting this bear market to be far worse than most people expect or are prepared for. The fact is that I donít believe that Americans expect any thing more than a temporary spate of difficult times, an annoying patch that should be over in a year or so. This is not what I am expecting or predicting.

Once the Dow breaks under 10,000, I believe that the analysts and the PUBLIC will become frightened and start to cut back on their buying. The newspapers will halt their bullish stance, and a great stillness will envelope that land. That stillness will be the result of shock as it dawns on Americans that they are seeing something far different than what they were expecting.

By the way, the Dow is now trading below its 200-day moving average, which stands at 11,938. The 50-day MA is bearishly below the 200-day MA (50-day is 11,811).

Spiritual ó While in rehab and after my hip operation I had a lot of time to think. And I wondered why I was still alive. I had survived combat in World War II. I had survived two heart attacks and a stroke. I had survived a mastoid infection and operation. I had survived 50 years of riding motorcycles with one dangerous crash. I had survived two divorces. I have survived (and believe me it was survival) a severely autistic daughter who almost drove me mad. I have survived the years, since I will be 88 (the Chinese lucky number is 8).

So why, I ask myself, am I still here with my brain still functioning. My conclusion, arrived at after a lot of hard thinking, is that Iím supposed to be the messenger of changing times. I have 8,034 subscribers. What percentage of these ladies and gentlemen take me seriously and follow my advice, and what percentage of this group think I am a self-opinionated loonie I donít know.

In other words, some body wants me to hang around. I know this based on e-mails and kind letters I have received from many subscribers. My advice over the years on gold and various bull and bear markets has resulted in changing some lives for the better. Which is a source of great satisfaction to me.

So thatís my story. Iím afraid it may sound prideful or mystical, but it is what I think, and when a man is 87 years old, heís long past the need or the desire to lie. ď

Messenger of changing times sounds more like the messenger of doomÖ.Letís hope Richard Russell is wrong. Unfortunately, itís hard to ignore a man with more market cycles under his belt than just about anyone aroundÖ.

Source: Dow Theory Letters

johngeorge

#13

Posted 21 December 2011 - 10:25 AM

#14

Posted 21 December 2011 - 10:36 AM

#15

Posted 21 December 2011 - 11:07 AM

Edited by stubaby, 21 December 2011 - 11:11 AM.

#16

Posted 21 December 2011 - 11:09 AM

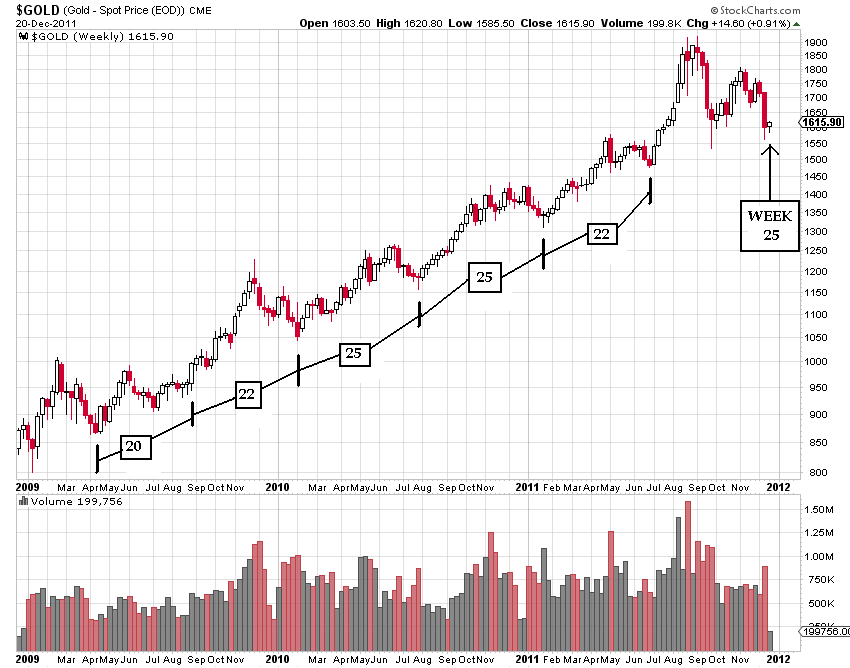

IF this is a Wave © Up we should see a move past 1,667 and even above 1,700 over the next 3-4 days.

Based on the inversion to a "top" around the 9th - this count is looking better to me:

http://stockcharts.com/c-sc/sc?s=$GOLD&p=D&yr=1&mn=0&dy=0&i=p75242258115&a=251439079&r=3898.png

stubaby

#17

Posted 21 December 2011 - 11:37 AM

interesting possibility! i have a different count, but we end up in the same placedharma:

IF this is a Wave © Up we should see a move past 1,667 and even above 1,700 over the next 3-4 days.

Based on the inversion to a "top" around the 9th - this count is looking better to me:

http://stockcharts.com/c-sc/sc?s=$GOLD&p=D&yr=1&mn=0&dy=0&i=p75242258115&a=251439079&r=3898.png

stubaby

dharma

this piece if it is true, is a real game changer. buying forward supplies before the banksters can get it takes supply off the market

http://kingworldnews...om_in_Gold.html

#18

Posted 21 December 2011 - 12:15 PM

#19

Posted 21 December 2011 - 01:31 PM

#20

Posted 21 December 2011 - 01:47 PM

Anyone buying here? - or are the "headlights too bright" - I am adding strategically TODAY!

IMHO - this is the BUY point for the move up into January - then we'll see.

stubaby

Bought last week Stu...