Edited by pdx5, 08 September 2013 - 01:47 PM.

WEEKEND FORECAST

#21

Posted 08 September 2013 - 01:47 PM

#22

Posted 08 September 2013 - 01:51 PM

===========

Alright, keep an eye on the Yen and Treasuries futures tonight.

Meanwhile, gotta go stock up for the game - Packers @ 49ers.

Go 9ers!!!

#23

Posted 08 September 2013 - 01:54 PM

being bearish is easy...anybody can do it......if you want to compare check out the sp500 or the amex with 73 or 74.....everybody thinks that looking backwards is the answer to the future.....well if that were the case here we are making historic highs and all along the way everybody was looking back.....and now the markets are being labeled ....manipulate etc etc...lmao...watch the skyJust because there's a trendline around 16,000 on DJIA, it doesn't mean the market has to get there (or go through it). I would point out that the last major megaphone pattern was back in the 1966 to 1973 period. In the S&P, the market never made it to the upper trendline. After the 1973 peak, the market melted down into the 1974 low and took out prior swing lows of the pattern in the process.

Don can't make any guarantees and neither can I when forecasting market movements, but the weight of the evidence I'm looking at (and have posted about) suggests we follow the path after the 1966-73 megaphone pattern. This is purely technical based on historical comparisons and major pirce and time projections. If the DOW does push significantly above 16,000, that would invalidate what I'm looking at. BTW the Dow ETF did hit the upper line.

Kimston

#24

Posted 08 September 2013 - 02:30 PM

I am with you on this one. Both INDU & S&P look to have topped. NAsdaq and NDX maybe, maybe not. Should know more the next ten trading days. If we do see a 73-74 decline it's going to be a Dusey! Alan

Just because there's a trendline around 16,000 on DJIA, it doesn't mean the market has to get there (or go through it). I would point out that the last major megaphone pattern was back in the 1966 to 1973 period. In the S&P, the market never made it to the upper trendline. After the 1973 peak, the market melted down into the 1974 low and took out prior swing lows of the pattern in the process.

Don can't make any guarantees and neither can I when forecasting market movements, but the weight of the evidence I'm looking at (and have posted about) suggests we follow the path after the 1966-73 megaphone pattern. This is purely technical based on historical comparisons and major pirce and time projections. If the DOW does push significantly above 16,000, that would invalidate what I'm looking at. BTW the Dow ETF did hit the upper line.

Kimston

Edited by CRUISENAL, 08 September 2013 - 02:32 PM.

#25

Posted 08 September 2013 - 02:47 PM

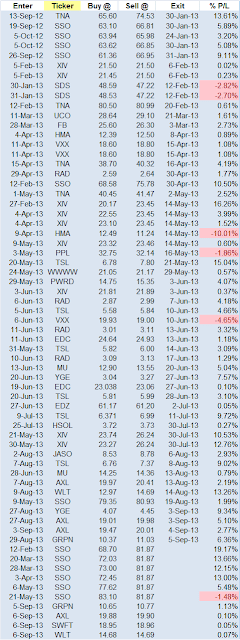

No matter what kind of system one uses, the fact remains that 95% of all TRADERS lose money, you can have a well tuned 80% system

but there is still only a 5% chance you will survive, most of those 5% likely represent Goldman elites and politicians that front run their

own decisions.

I am lucky to be in minority and I have no relationships with the Elites or.... In trend less markets stock picking and timing (along with good money management) pays off.

My comments are for entertainment/educational purpose only. All posted trades are fake (aka. paper) trades.

#26

Posted 08 September 2013 - 02:54 PM

being bearish is easy...anybody can do it......if you want to compare check out the sp500 or the amex with 73 or 74.....everybody thinks that looking backwards is the answer to the future.....well if that were the case here we are making historic highs and all along the way everybody was looking back.....and now the markets are being labeled ....manipulate etc etc...lmao...watch the skyJust because there's a trendline around 16,000 on DJIA, it doesn't mean the market has to get there (or go through it). I would point out that the last major megaphone pattern was back in the 1966 to 1973 period. In the S&P, the market never made it to the upper trendline. After the 1973 peak, the market melted down into the 1974 low and took out prior swing lows of the pattern in the process.

Don can't make any guarantees and neither can I when forecasting market movements, but the weight of the evidence I'm looking at (and have posted about) suggests we follow the path after the 1966-73 megaphone pattern. This is purely technical based on historical comparisons and major pirce and time projections. If the DOW does push significantly above 16,000, that would invalidate what I'm looking at. BTW the Dow ETF did hit the upper line.

Kimston

Unfortunately, looking at history is all us mere mortals can do. Being bullish has been the correct posture since the 7/8/32 low, but that move is getting a bit long in the tooth.

#27

Posted 08 September 2013 - 03:01 PM

No matter what kind of system one uses, the fact remains that 95% of all TRADERS lose money, you can have a well tuned 80% system

but there is still only a 5% chance you will survive, most of those 5% likely represent Goldman elites and politicians that front run their

own decisions.

I am lucky to be in minority and I have no relationships with the Elites or.... In trend less markets stock picking and timing (along with good money management) pays off.

trendless markets ...lol

#28

Posted 08 September 2013 - 03:04 PM

>. Both INDU & S&P look to have topped. < oh really......since when does the market top with less tham 40% in the marketKim,

I am with you on this one. Both INDU & S&P look to have topped. NAsdaq and NDX maybe, maybe not. Should know more the next ten trading days. If we do see a 73-74 decline it's going to be a Dusey! Alan

Just because there's a trendline around 16,000 on DJIA, it doesn't mean the market has to get there (or go through it). I would point out that the last major megaphone pattern was back in the 1966 to 1973 period. In the S&P, the market never made it to the upper trendline. After the 1973 peak, the market melted down into the 1974 low and took out prior swing lows of the pattern in the process.

Don can't make any guarantees and neither can I when forecasting market movements, but the weight of the evidence I'm looking at (and have posted about) suggests we follow the path after the 1966-73 megaphone pattern. This is purely technical based on historical comparisons and major pirce and time projections. If the DOW does push significantly above 16,000, that would invalidate what I'm looking at. BTW the Dow ETF did hit the upper line.

Kimston

#29

Posted 08 September 2013 - 03:12 PM

On May 21st, 2013 SPY was at the ~same price as it was 75 days later (on September 6th, 2013) .No matter what kind of system one uses, the fact remains that 95% of all TRADERS lose money, you can have a well tuned 80% system

but there is still only a 5% chance you will survive, most of those 5% likely represent Goldman elites and politicians that front run their

own decisions.

I am lucky to be in minority and I have no relationships with the Elites or.... In trend less markets stock picking and timing (along with good money management) pays off.

trendless markets ...lol

Edited by Harapa, 08 September 2013 - 03:14 PM.

My comments are for entertainment/educational purpose only. All posted trades are fake (aka. paper) trades.

#30

Posted 08 September 2013 - 03:17 PM

so.....??? u in a hurry???? ive heard all these argurments for decades....the end result was ....wellOn May 21st, 2013 SPY was at the ~same price as it was 75 days later (on September 6th, 2013) .No mgatter what kind of system one uses, the fact remains that 95% of all TRADERS lose money, you can have a well tuned 80% system

but there is still only a 5% chance you will survive, most of those 5% likely represent Goldman elites and politicians that front run their

own decisions.

I am lucky to be in minority and I have no relationships with the Elites or.... In trend less markets stock picking and timing (along with good money management) pays off.

trendless markets ...lol

here we are http://finance.yahoo...urce=undefined;