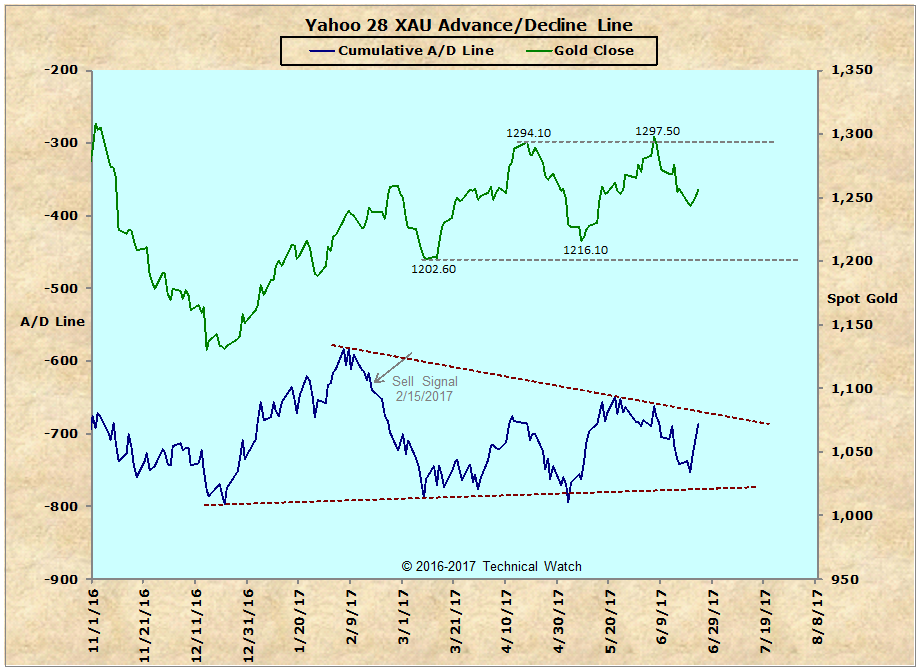

Though the May rally in the precious metals was constructive, we continued to see a lack of underlying internal trend support by the XAU/Yahoo advance/decline line, and with the price of silver failing to match the amplitude in the run up in gold, the best interpretation for now is that gold has morphed into a trading range between $1200 and $1300 an ounce.

This month's precious metals update shows that after the price of gold rallied to challenge the highs of April on June 6th, breadth of market in the precious metals stocks weakened again, and this has left us with the upper end of our expected trading range. However, with both the CRB and DBC commodity indexes continuing to decline sharply over the last couple of months, this is something that is becoming more and more worrisome toward any future inflationary expectations as even the trend of lower interest rates (cheaper money) has yet to help in providing enough monetary excesses to support the precious metals group as a whole. Taken together, this would strongly suggest that with the end of the Fed's Quantitative Easing policy that the asset classes are now showing a real need for another QE type fix, as the last traces of the drug leave the financial system, to keep things from collapsing altogether in what has now become a period of disinflation.

In any event, current conditions suggest that we should look for the trading range in gold to continue over the next couple of weeks with the still ongoing expectation of a tradable bottom for the metals still scheduled for the early part of August. That said, we also have to be acutely aware of the fact that the longer term gold chart shown earlier in another thread might also be indicating that a period of all out deflation might also be upon us which would lead to an all out collapse in this asset group along with everything else Dollar denominated (at least that's the theory). That is, of course, unless the Fed stops looking left (tightening) when it should be looking right (easing) and gives the markets what it desperately needs to "maintain" stability.

We'll see how it goes.

The next update will be on the weekend of July 28th....good trading.

Fib