hey stubaby good to see you, maybe now we will hear from you more often. must be hot in your neck of the woods. hopefully the monsoon has started here. got 3 hours of rain yesterday, cooled it down

the thing is

for one its inflation, and the metrics there are always changing to suit the views of the present administration. you have to love figures that take food and energy out of the #s . give me a break . food and energy are essential

then for me its money velocity now alot of folks are talking about that. and that in essence is when the money velocity topped in 96 it was a 20year bear market vs gold for miners. when that # turns its game on for the sector

i firmly believe that we are rapidly approaching the gold bull era w/price appreciation. the infrastructure world wide has been put in place the center of gold trading will shift from lbma and comex to shanghai, dubai, and of course india. as will the economic power. i dont know how this end bit plays out here. but i think this chop will end w/in the next 6 months. i dont want to speculate how it ends, i want to prepared to act when i think it does.

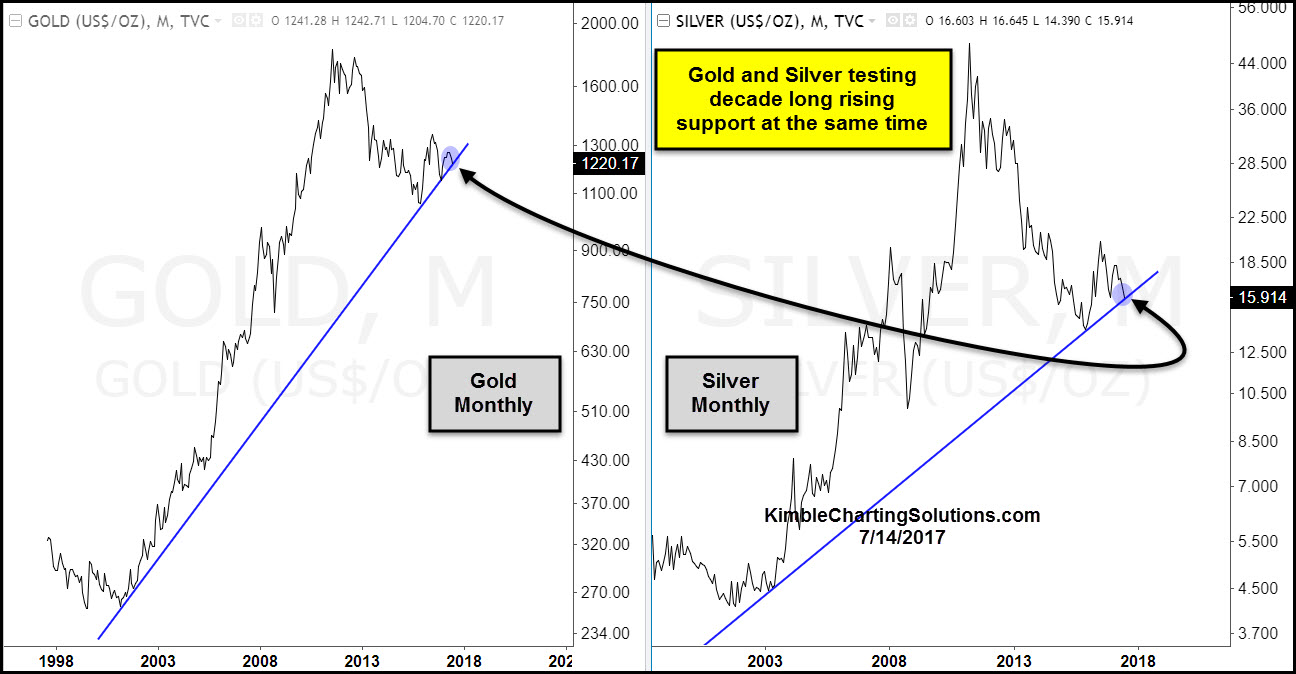

my contention is the 70s bull is the model for this bulls fractal. we are in stagflation. i dont need stats to tell me that , every thing is more expensive today. in 78 the low was made in sept the bulls loaded up , then in november there was a lower low causing the bulls to stop out and trapping the bears. then the big rally got underway leading eventually to the parabolic. well here we had the may lows, which the bulls bought and were now stopped out and terrified by the lower lows in july. also the gdx gdxj did not confirm the lower lows here in july. i want to see evidence of a good bottom. 1229 breaks into the next higher price cycle. i want to see a couple of closes over that # to give me confidence. today being friday , would be strong to see a close above 1229.

every one has theories how this will end. what i do know is the bull will take as few riders as possible and that 10dsi on monday is an indication of that hulbert wants negative #s on his hgnsi # . we all have different ideas of what is needed. i believe the market could be saying something here. gotta get quiet to hear it cut out all the chatter

dharma