Two different opinions about the same market

The End is Nigh

Posted

October 3, 2018

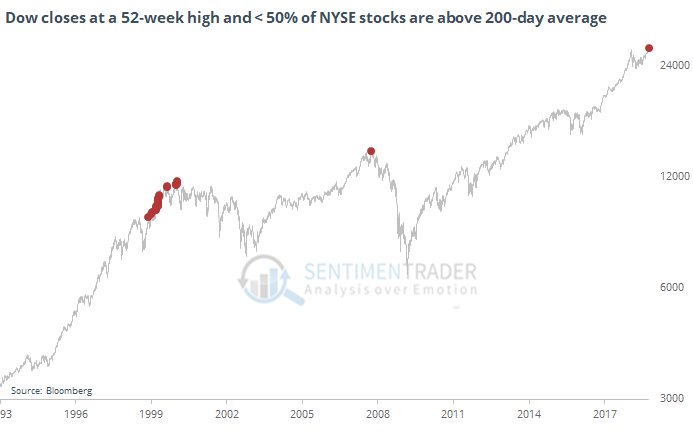

Two tweets from SentimenTrader paint a scary picture of current stock market breadth. Yesterday, he wrote:

“The Dow is on track to close at a new 52-week (and all-time) high. Yet, there are 3 times as many 52-week lows as 52-week highs on the NYSE. Since 1965, that has happened on exactly one* other day.

*December 28, 1999

This morning he dropped another stat with a powerful visual.

https://theirrelevan...he-end-is-nigh/

The Dirty Little Stock Market Secret

Shhhh…don’t tell anyone, I have a dirty little secret. Are you ready? Are you sure? The world is not going to end…really.

Despite lingering trade concerns (see Trump Hits China with Tariffs on $200 Billion in Goods), Elon Musk being sued by the Securities and Exchange Commission (SEC) for tweeting his controversial intentions to take Tesla Inc. (TSLA) private, and Supreme Court nominee, Brett Kavanaugh, facing scandalous sexual assault allegations when he was in high school, life goes on. In the face of these heated headlines, stocks still managed to rise to another record in September (see Another Month, Another Record). For the month, the Dow Jones Industrial Average climbed +1.9% (+7.0% for 2018), the S&P 500 notched a +0.4% gain (+9.0% for 2018), while the hot, tech-laden NASDAQ index cooled modestly by -0.8% after a scorching +17.5% gain for the year.

If the world were indeed in the process of ending and we were looking down into the abyss of another severe recession, we most likely would not see the following tangible and objective facts occurring in our economy.

Doom-and-gloom, in conjunction with toxic politics, continue to reign supreme over the airwaves. If you want in on a beneficial dirty little secret, you and your investments would be best served by ignoring all of the media noise and realizing the world is not going to end any time soon.

https://www.philstoc...k-market-secret