Options Show Investors Aren't Panicking Yet

Panic in Stocks? Options Signal No

By Gunjan Banerji, options reporter

An unusual dynamic in options markets is signaling that investors aren’t panicking despite October’s stock-market drubbing: Expectations for volatility are greater in individual companies than the broader market.

This earnings season, options investors are pricing in some of the biggest swings from specific stocks since 2015, according to Credit Suisse Group. They have been singling out names like Facebook and General Electric in expectation of outsize moves after earnings reports.

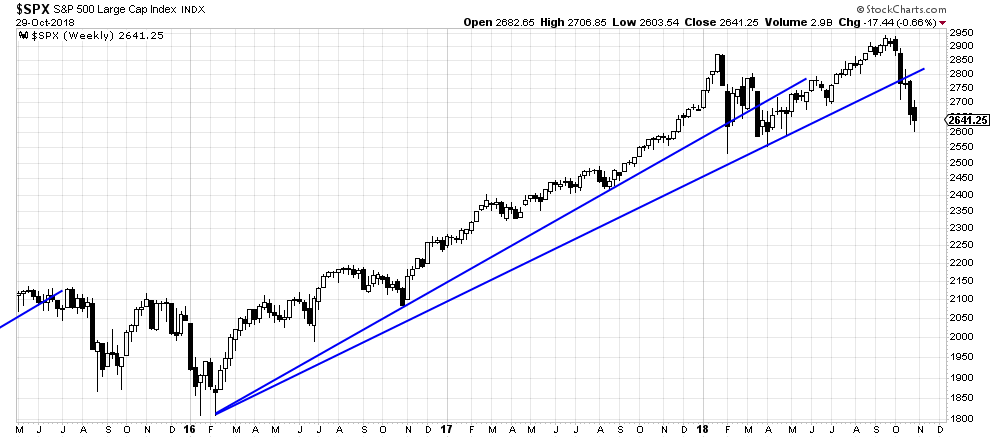

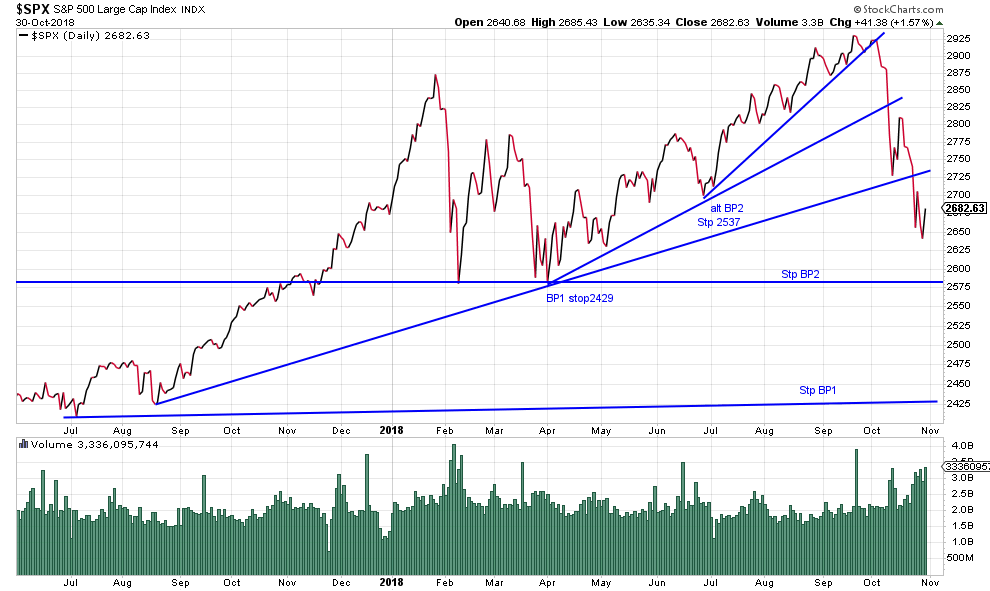

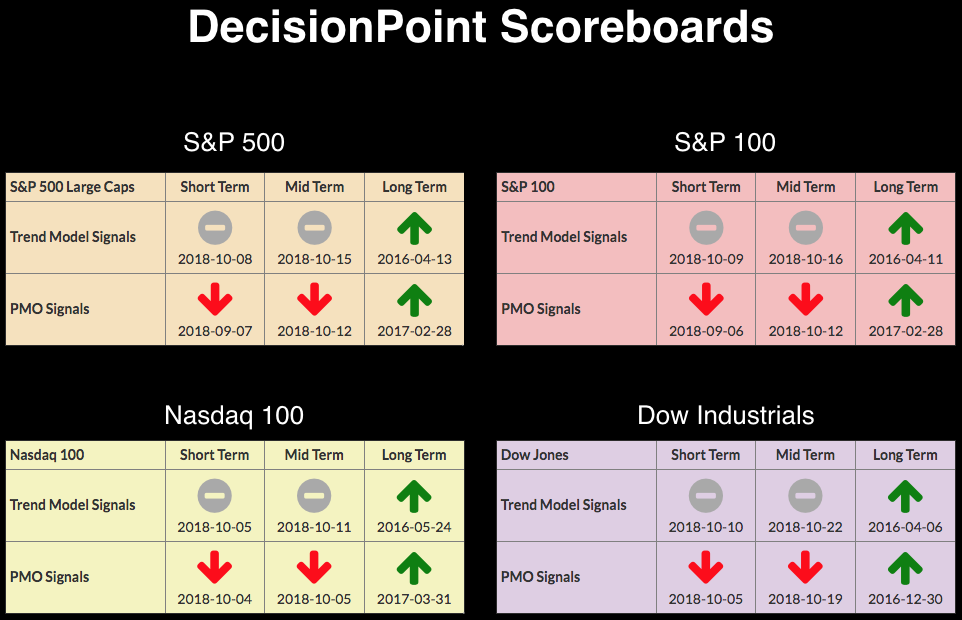

Meanwhile, the S&P 500 is on track for its worst month since May 2010. Historically, when the market is in such turmoil, moves by stocks and sectors become tightly correlated. That, in turn, tends to spur investors to use bearish options on major indexes for protection from further losses.

Lately, though, investors haven’t been doing that, a potentially positive sign, analysts say.

“There’s not a lot of broad-based panic,” said Joanne Hill, chief advisor for research and strategy at Cboe Vest Financial. “People aren’t as nervous about holding [the S&P 500] than they are an overweight position in Facebook.”

It’s an indication that the October stock swoon has been driven more by idiosyncratic concerns related to specific company earnings than widespread worries about the economy, according to Mandy Xu, a derivatives strategist at Credit Suisse.

Of course, some investors are worried about global growth and are selling shares because of these concerns. And it can take time for economic headwinds to trickle into company earnings and depress the outlook of investors.

But in options markets, at least, there hasn’t been a stampede into benchmark protection.

Ms. Hill said the recent market volatility appears to be driven by investors rotating out of companies dependent on high growth like technology stocks. For example, a greater number of stocks actually advanced than declined on Monday. A few heavyweights like Amazon.com, Microsoft, Apple and Alphabet made up the bulk of losses in the S&P 500, according to Wells Fargo Securities.

Meanwhile, moves in the Cboe Volatility Index have been relatively muted compared to the stock fall, analysts say. The measure called the VIX tracks expected swings in the S&P 500 and is known as Wall Street’s fear gauge.

Measures of expected volatility in oil, currencies and U.S. interest rates also remain relatively low—another sign investors aren’t as fearful as this month’s declines might indicate.