Count the hours until half to 2/3s of Fridays gains are vaporized......

Finally, the POWELL PUT comes, BULLS on the rampage!

#11

Posted 05 January 2019 - 02:58 PM

#12

Posted 05 January 2019 - 02:59 PM

BOWLEY predicts cyclical BEAR within secular BULL market:

Here are specific "big picture" predictions for 2019:

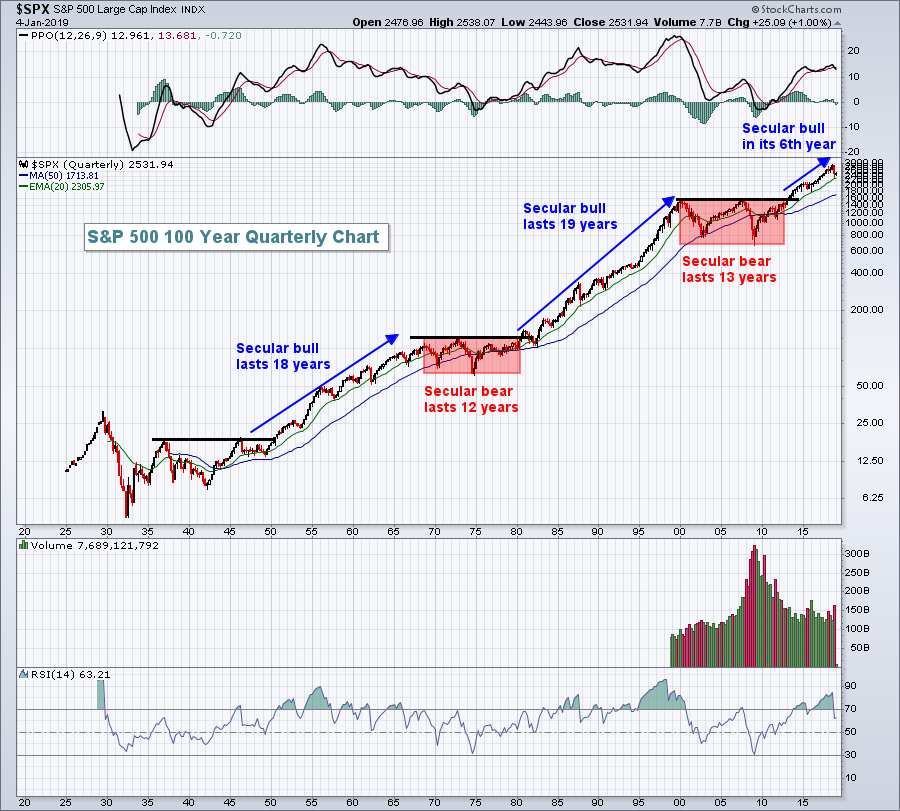

(1) We have entered a cyclical bear market within a secular bull market. I believe we will experience tremendously higher equity prices over the next decade, but there will be hiccups along the way. One look at the following chart will help to illustrate why I believe the future remains very exciting for stock traders and investors:

Do not ever lose sight of the above chart and the secular bull market that we're in (my opinion). Why? Because cyclical bear markets can be very fast and to a much lesser degree than secular bear markets. It's entirely possible that we quickly resume the overall secular bull market uptrend much faster than many believe possible.

Do not ever lose sight of the above chart and the secular bull market that we're in (my opinion). Why? Because cyclical bear markets can be very fast and to a much lesser degree than secular bear markets. It's entirely possible that we quickly resume the overall secular bull market uptrend much faster than many believe possible.

(2) This bear market will be short-lived. Cyclical bear markets tend to end quickly and they're not nearly as deep as their secular bear market counterparts. Since 1945, bear markets within secular bears have on average lasted 632 days, or roughly 21 months, dropping 43.92%. Bear markets within secular bulls have on average lasted just 284 days, or 9-10 months, less than half that of a bear market within a secular bear and have fallen 25.73% on average. Knowing the difference clearly can pay huge dividends. I will be looking for a cyclical bear market bottom to form in the June-September timeframe and an explosive Q4 rally to follow. I do not believe we'll see a low beneath 2100 on the S&P 500. 2200 could mark the bottom.

(3) Sentiment will help to guide us in 2019. Bear markets are emotional and many times pay little attention to price, trendline and moving average support. The last two bear markets never saw a VIX reading move below 16. Therefore, if the VIX drops beneath 16 during 2019, at least consider the possibility the bear market has ended. A bear market requires fear. If fear dissolves, so too will the bear market.

https://stockcharts....8-forecast.html

#13

Posted 05 January 2019 - 03:01 PM

This guy has been right for months!

“The Nasdaq was down -20.3% from where it was in August when the U.S. economic cycle and corporate profit cycle peaked,” explains CEO Keith McCullough in a recent edition of The Macro Show. “You’ll see countertrend bounces like this because everyone that missed it is going to say it’s over. These investors are confusing dips with disasters."

We protected our subscribers’ portfolios in 2018—particularly in Q4, when most investors got hit hard—and helped lots of people make money during this market hurricane.

Below is some smart Weekend Reading to keep you proactively prepared for the next big market move.

- [PREMIUM MACRO INSIGHT] Real-Time Macro: Does Hawkish Jobs Report = Fed Tightens Into Slowdown?

- [RISK MANAGEMENT VIDEO] The Macro Show with Keith McCullough: Prepare Your Portfolio For the Year Ahead

- [MACRO INSIGHT] Early Look: Winning Year-End #Quad4

- [RISK MANAGEMENT LEVELS] Risk Ranges: Friday, January 4th

- [MACRO INSIGHT] Market Edges: Week of 12/30/2018

#14

Posted 05 January 2019 - 03:03 PM

CARL's very insightful analysis:

CONCLUSION: The S&P 500 is back in the normal value range, but is still overvalued. Historically, overvalued conditions leave the market vulnerable for a large correction or bear market, and that seems to be what we are currently experiencing. These earnings charts are intended to provide an historical context for current earnings, and to demonstrate that overvaluation is not your friend.

https://stockcharts....rmal-range.html

The Market Eats the Shorts Again, but Context Helps Preserve Sanity

https://stockcharts....rve-sanity.html

Edited by dTraderB, 05 January 2019 - 03:06 PM.

#15

Posted 05 January 2019 - 03:05 PM

I admit I have failed to understand the wave thing but I still try:

That being said, the main question the market will have to answer in the coming week is if we will see a lower low before we begin the rally to 2800SPX in the b-wave shown on our charts. Based upon the reasons I have outlined over the prior week, I have to maintain the primary count that this rally is a smaller degree 4th wave within the © wave of the a-wave. That leaves us looking for a lower low in the coming week or two.

https://www.elliottw...2295064943.html

#16

Posted 05 January 2019 - 03:10 PM

DOW 19K?

At worst, rather ominously, we might be looking at a historic massive year-long top. And why not, considering the historic bull market since March 2009? It is quite possible that we are looking at a truly historic double top. We would not call it a classic double top, but in these mad and bizarre times classic paradigms of any kind will shortly be tweeted to death -- or foolishly debunked as fake news.

The depth of this formation is approximately 3500 points. That would compute to a downside target of 19440.

Remember: we don't do prophecy here. We just analyze the charts operating from classic principles and report what they imply. Here, the implications are obvious: beware the bear and be aware that the risk is on the downside. Possible rewards are slim to non-existent for bulls.

https://stockcharts....he-ominous.html

#17

Posted 05 January 2019 - 03:13 PM

We highlighted the potential risk in our post yesterday,

Druckenmiller On Bonds

If you listened to the Druckenmiller interview we posted on New Year’s Day, he thrives in bear markets, not by shorting stocks but being long bonds. Shorting stocks in a bear market, though more profitable, he has learned is riskier due to the higher propensity for nutcracking short squeezes. Druck also worries about the level he is buying at.

Nevertheless, this confirms our suspicion the bond market has been hijacked by stock bears and short sellers. How far they push down yields is anyone’s guess. We just wonder who they are going to sell to when its time to get out. They couldn’t be betting on a central bank takeout in a new round of QE?

Unexpected bond market volatility could be the Black Swan of 2019. We will flesh out our thoughts in a later post. - GMM, Jan 3rd

U.S. 10-year yields are climbing the most in a year after a blowout jobs report and as Fed Chair Powell said he's willing to reconsider the balance-sheet run-off plan if necessary. pic.twitter.com/m1gZwtXDLT

— Lisa Abramowicz (@lisaabramowicz1) January 4, 2019

#18

Posted 05 January 2019 - 03:15 PM

Late Friday:

International-Sacramento Bee-19 hours ago

Highly Cited-NPR-22 hours ago

Business Insider-15 hours ago

#19

Posted 05 January 2019 - 03:26 PM

It was last month where I was reading about PG&E asking for something like $2 billion in rate hikes to cover everything.....their service coverage map in CA is not the place to be right now.

#20

Posted 05 January 2019 - 06:17 PM

Don't want to burst high hopes but...When this bear ends it is likely to visit near 1000 +-200. We completed a 5th from the start of the fed near 1920.

W1 1929

W2 1932

W3 2007

W4 2009

W5 2018

Your chart above shows most of it.

Love, be kind to one another, seek the truth, walk the narrow path between the ying and the yang.