Rather lonely in this corner:

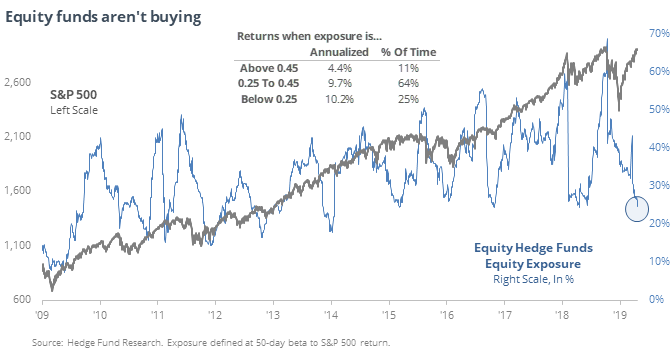

"The final phase of a bull cycle is the most deceiving. It is the time when things are at their best, optimism runs wild, equities can do no wrong and any warning signs are dismissed as equity price action valiantly defies the reality that is to come.

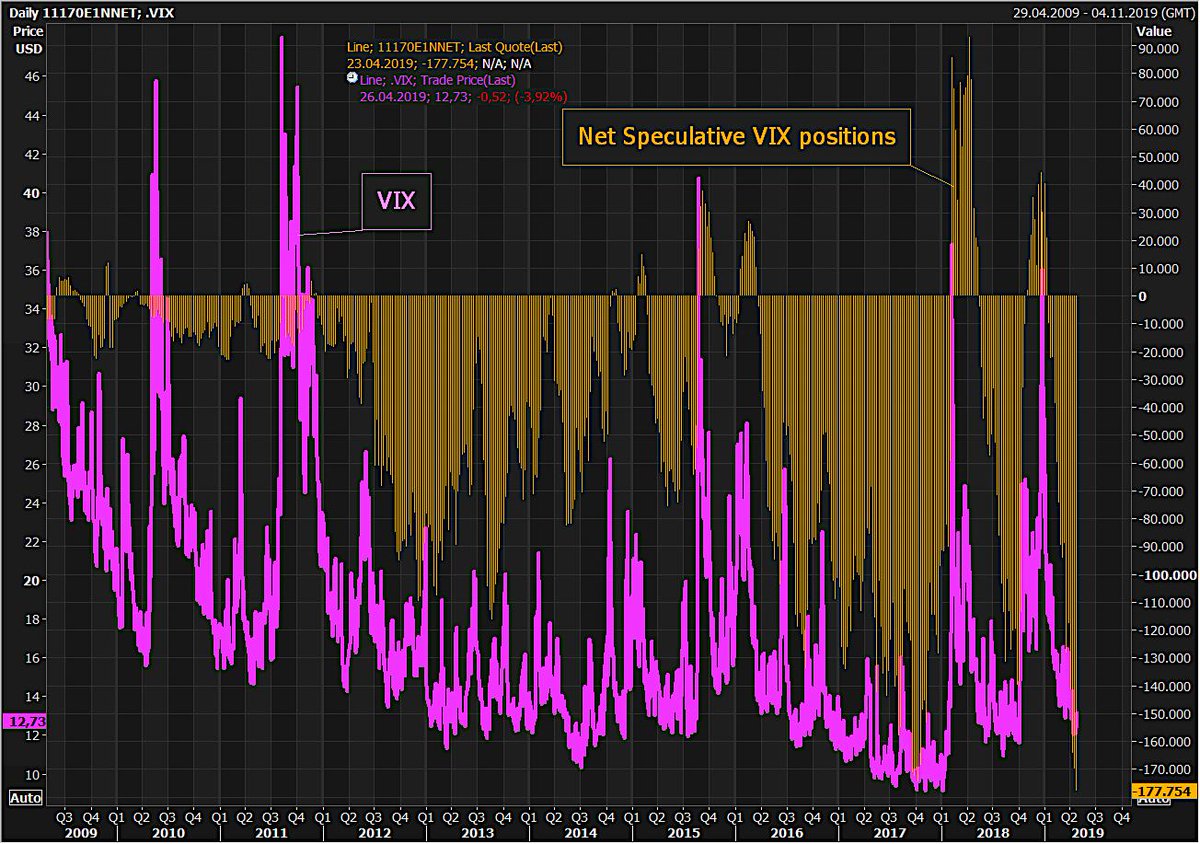

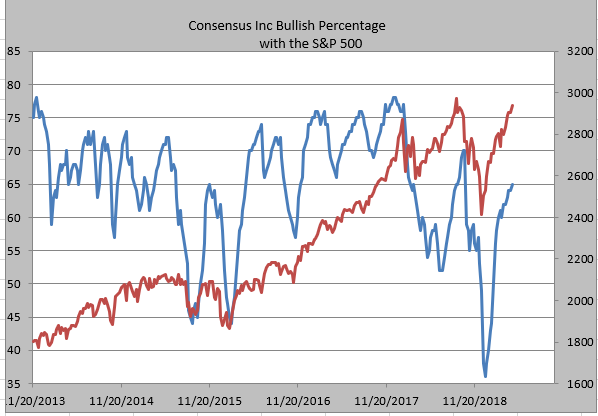

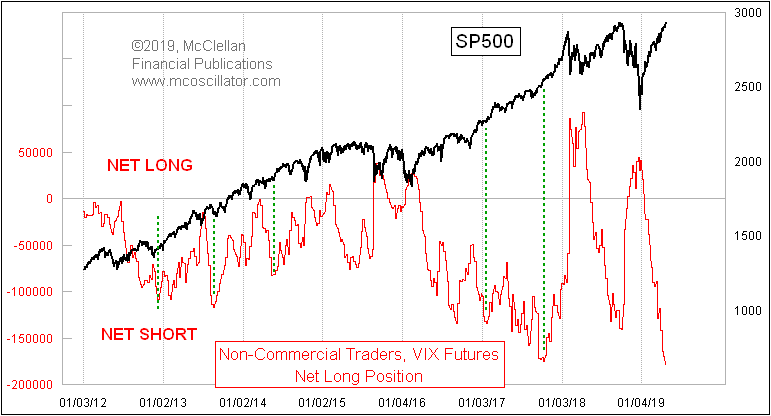

It is also a time when complacency makes a comeback as big rallies emerge following initial larger corrections. 2018 was a year of big corrections. 10% in February, 20% in Q4. Now a 25% rally. Not signs of a stable bull market. It is precisely the aggressive counter rallies near the end of cycles that can be the most awe-inspiring and reason defying, yet they can also be the most dangerous while being the best opportunities to sell at the same time.

Let’s get real: The liquidity machine can hide reality only for so long and that is: Things keep slowing down. Cycles don’t turn on a dime, they take time and that is what we are seeing unfold and the signs are plentiful. From Japanese industrial production going negative the past 3 months to home sales in the Hamptons slowing to the slowest level in 7 years. I’m using these couple rather random examples to illustrate a point: The slowdown is as broad as it global:"

https://northmantrad...04/28/get-real/