Finally, this laptop WINDOWS update is done, hope it does not fail again during real-time cash session.

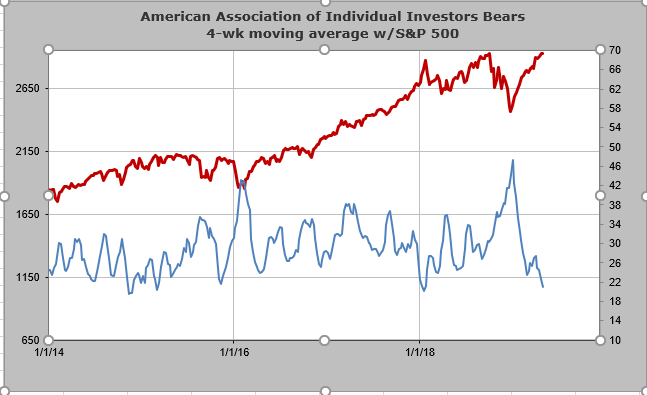

Some informative stuff here from Sentiment Trader

The S&P hit new highs for 3 straight days, with a negative McClellan Oscillator each day. That triggered in October ’17, with no problem, but prior to that was an issue over the next 30 days.

https://www.sentimen...ring-financials