...but the inventor of McOSc and similar tools is still bullish:

first, did you see this? Hope it does not radically change the daytrading strategies some of us use....

High-frequency algo traders spent all that money, locating their offices closer to ICE server farms and buying high-speed fiber connections to get an edge on trading, and now ICE is introducing a 3-millisecond delay trying to level the playing field.

I discussed this chart in my Daily Edition on Wednesday, and introduced it 2 weeks ago at https://www.mcoscillator.com/learning_center/weekly_chart/a_new_vix_indicator_thats_really_not_all_that_new/ …. The VIX Index needed to close today below 15.74 to turn down this indicator, and it closed at 15.29. So a bullish signal.

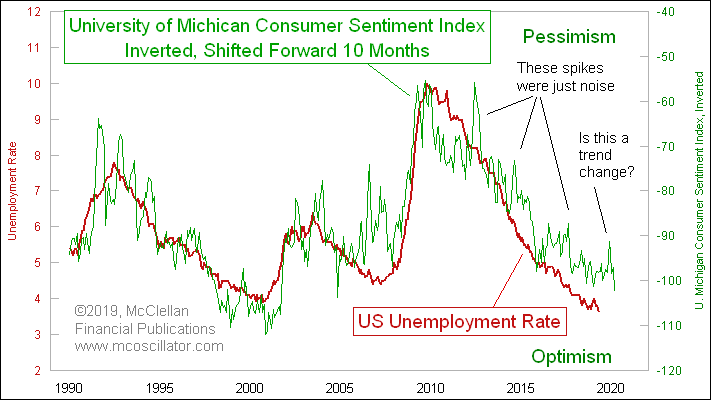

Here is why today's posting in the UMich Consumer Sentiment Index is important. It shows that the Jan. 2019 dip (upward thrust on the inverted scale) over Trump's government shutdown has now been made up. Good news for continued low unemployment rate.