really?

http://www.naaim.org...exposure-index/

Posted 08 June 2019 - 08:21 PM

For the first time this year I went 100% to cash. I have taken profits in Longs and sitting out for a bit. Though I’d been positioned for a relief rally, the trajectory surprised me. I sold most at 2830 and held a little into today, exited everything about 10 min before the close today.

From here I’m anticipating a high next week followed by a pullback of 50% of this rally. I’m looking for 3000-3100 either late July or early August. I’ll provide cycle dates in future posts, next one is June 14th.

With the Mexican tariff issue off the table I expect an initial rally then down. Could be an UP to FLAT week.

FED will not cut rates while markets are rallying towards record high but they may not wait until July to start the process, look forward to your cycle dates

Posted 09 June 2019 - 05:59 AM

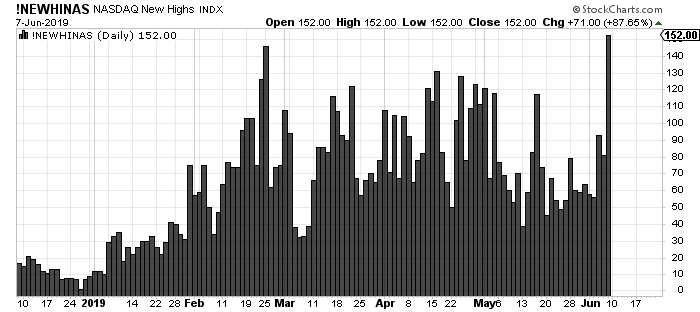

Most new highs for Naz since the December low.

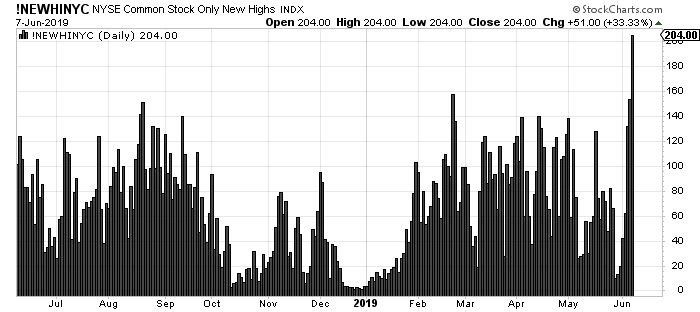

Even 'common stocks only' most new highs in a year.

Posted 09 June 2019 - 06:00 AM

McClellan Summation Index has turned up for the first time since early April. You might need a magnifying glass to see it

Posted 09 June 2019 - 06:01 AM

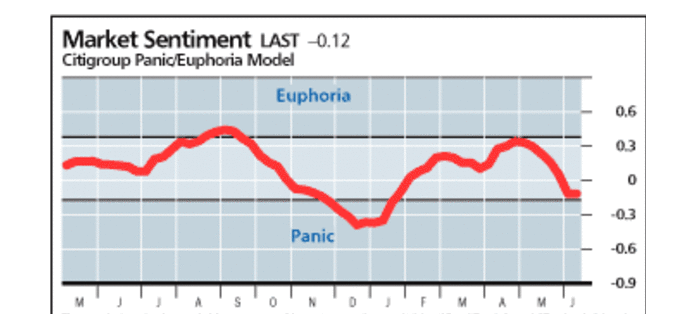

Early May Citi Panic/Euphoria ticked Euphoria. Now it it ticking Panic.

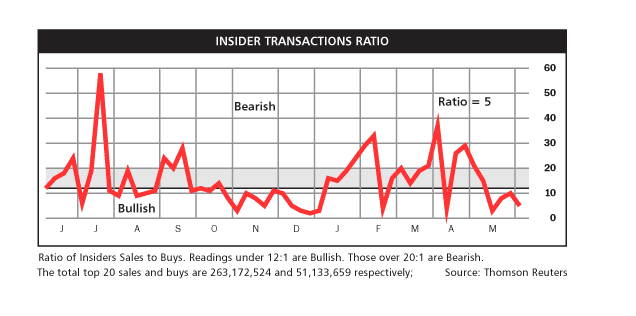

Insider Ratio

Posted 09 June 2019 - 07:27 AM

Very informative Twitter feed, You just need to look at the Data and Draw your own conclusions. https://twitter.com/ThinkTankCharts

Edited by opinionated, 09 June 2019 - 07:27 AM.

Posted 09 June 2019 - 08:05 AM

Very informative Twitter feed, You just need to look at the Data and Draw your own conclusions. https://twitter.com/ThinkTankCharts

Looks good. Bookmarked it in my FINTWEET folder

NYHL - this level is where you see reversals - it can go higher, so not necessarily a top, but a top watch for sure. May highs, October highs, all had the same reading. Problem is Monday the histogram may be a lot lower and your conclusion could be wrong ![]() Over 0 is a buy

Over 0 is a buy

Posted 10 June 2019 - 06:15 AM

Some of my best trades are between 6:30 to 9;30am

Chinese surplus increases....

#China imports tumble as growing tensions w/ US cloud trade. Imports plunge 8.5% in May YoY. Drop underscores the weakness of the domestic econ. On the other side, trade surplus rebounded to $41.7bn in May, from trivially revised $13.8bn in Apr, well above the consensus, $22.3bn.

Posted 10 June 2019 - 06:16 AM

Global markets rally but one gets the feeling that we are in the 8th to 9th inning on this rally, and no extra innings, regular and relief pitchers exhausted, batting line-ups almost totally used up;

Global mkts have started week in Risk-On mood after US shelved plans to impose tariffs on Mexico & as investors hoped for US rate cuts. Some believe that similar thing might happen w/China trade spat. Bond ylds jump w/US 10y at 2.13%. Yuan falters as China May imports disappoint.